please answer all parts of the question and round the answer to the correct decimal places for a thumbs up Thank you

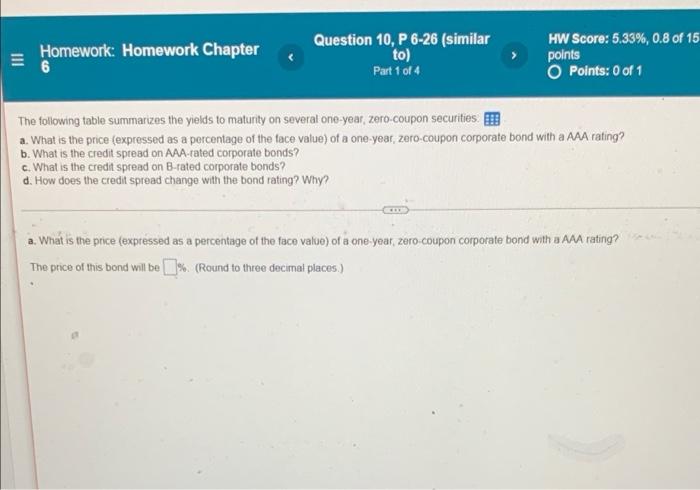

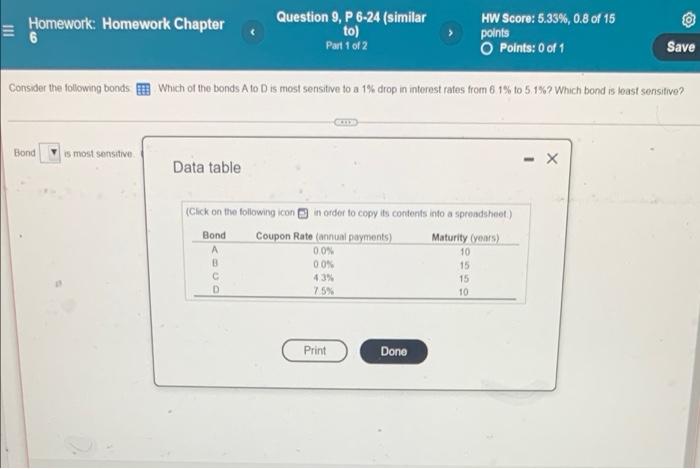

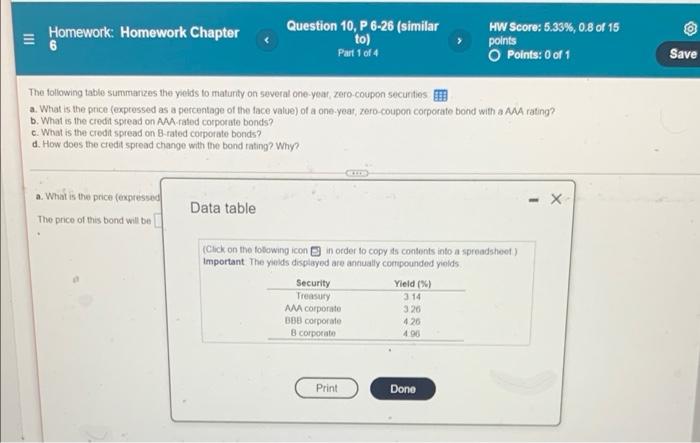

Homework: Homework Chapter Question 9, P 6-24 (similar to) Part 1 of 2 HW Score: 5.33%, 0.8 of 15 points Points: 0 of 1 Save Consider the following bonds Which of the bonds A to Dis most sensitive to a 1 drop in interest rates from 61% to 51% which borld is least sensitive? Bond s most sensitive (Select from the drop down menu) Homework: Homework Chapter 6 Question 10, P 6-26 (similar to) Part 1 of 4 HW Score: 5.33%, 0.8 of 15 points O Points: 0 of 1 The following table summarizes the yields to maturity on several one-year, zero-coupon securities ! a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one year, zero-coupon corporate bond with a AAA ratinig? The price of this bond will be % (Round to three decimal places.) @ III Homework: Homework Chapter 6 Question 9, P 6-24 (similar to) Part 1 of 2 HW Score: 5.33%, 0.8 of 15 Points: 0 of 1 points Save Consider the following bonds which of the bonds A to D is most sensitive to a 1% drop in interest rates from 61% to 5.1%? Which bond is toast sensitivo? Bond is most sensitive - X Data table (Click on the following icon in order to copy its contents into a spondheet) Bond Coupon Rate (annual payments) Maturity (vers 00% 10 B 00% 15 15 D 10 7.5% Print Done III Homework: Homework Chapter 6 Question 10, P6-26 (similar to) Part 1 of 4 HW Score: 5.33%, 0.8 of 15 points Points: 0 of 1 Save The following table summarizes the yields to maturity on several one-year, zero-coupon securities a. What is the price (expressed as a percentage of the face value) of a one-year, zoro coupon corporate bond with a AAA rating? b. What is the credit spread on MA rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? - X a. Wrint is the price (expressed The price of this bond will be Data table (Click on the following icon in order to copy its contents into a spreadsheet Important The yields displayed are annually compounded yields Security Yield (%) Treasury 3 14 MM corporate 326 BB corporate 420 8 corporate 490 Print Done