Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts of the question for a big thumbs up and a good rating. Thank you. 16. Which one of the following payroll

Please answer all parts of the question for a big thumbs up and a good rating.

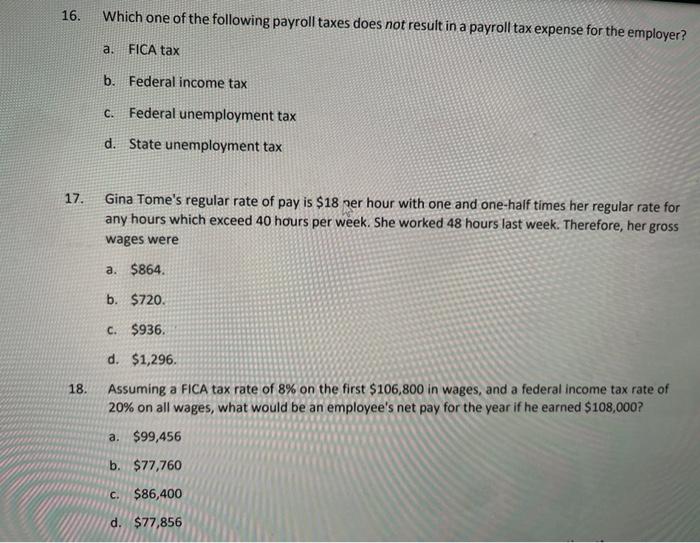

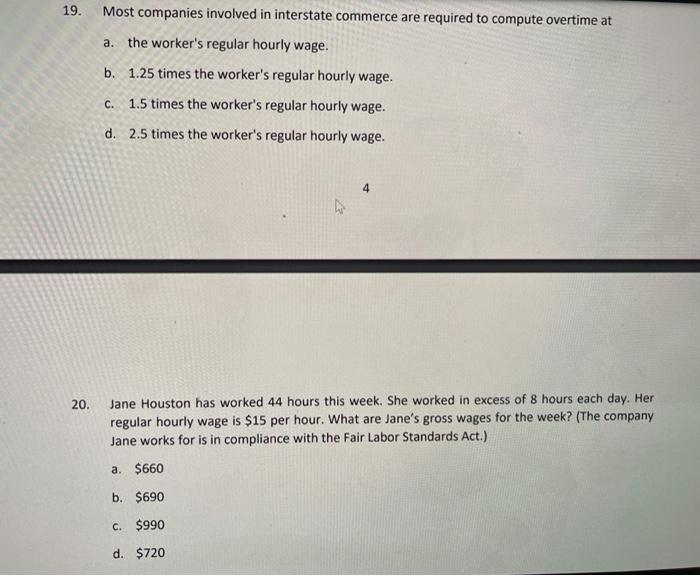

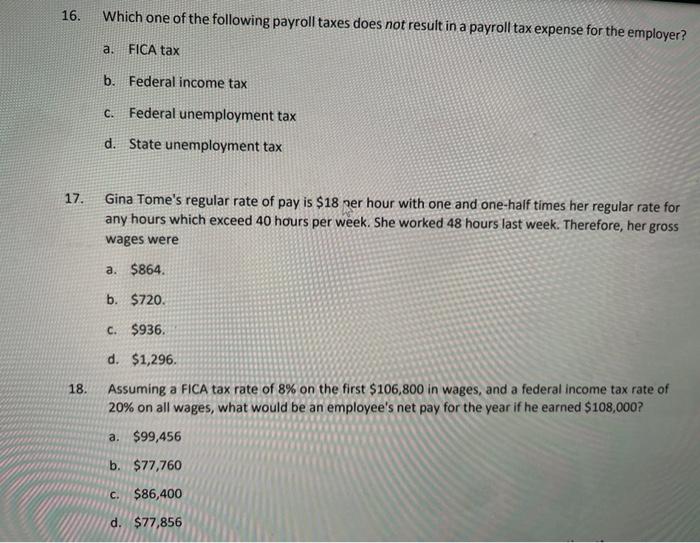

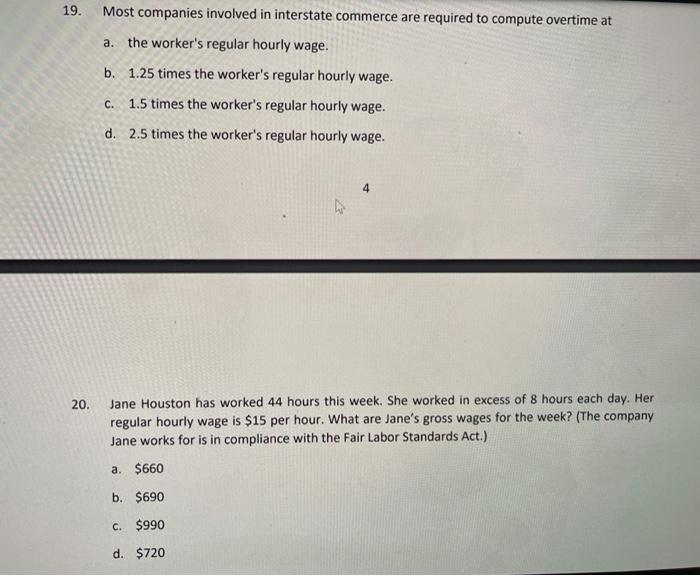

16. Which one of the following payroll taxes does not result in a payroll tax expense for the employer? a. FICA tax b. Federal income tax C. Federal unemployment tax d. State unemployment tax 17. Gina Tome's regular rate of pay is $18 per hour with one and one-half times her regular rate for any hours which exceed 40 hours per week. She worked 48 hours last week. Therefore, her gross wages were a. $864. b. $720. C. $936. d. $1,296. 18. Assuming a FICA tax rate of 8% on the first $106,800 in wages, and a federal income tax rate of 20% on all wages, what would be an employee's net pay for the year if he earned $108,000? a. $99,456 b. $77,760 C. $86,400 d. $77,856 19. Most companies involved in interstate commerce are required to compute overtime at a. the worker's regular hourly wage. b. 1.25 times the worker's regular hourly wage. C. 1.5 times the worker's regular hourly wage. d. 2.5 times the worker's regular hourly wage. 4 20. Jane Houston has worked 44 hours this week. She worked in excess of 8 hours each day. Her regular hourly wage is $15 per hour. What are Jane's gross wages for the week? (The company Jane works for is in compliance with the Fair Labor Standards Act.) a. $660 b. $690 C. $990 d. $720

Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started