Answered step by step

Verified Expert Solution

Question

1 Approved Answer

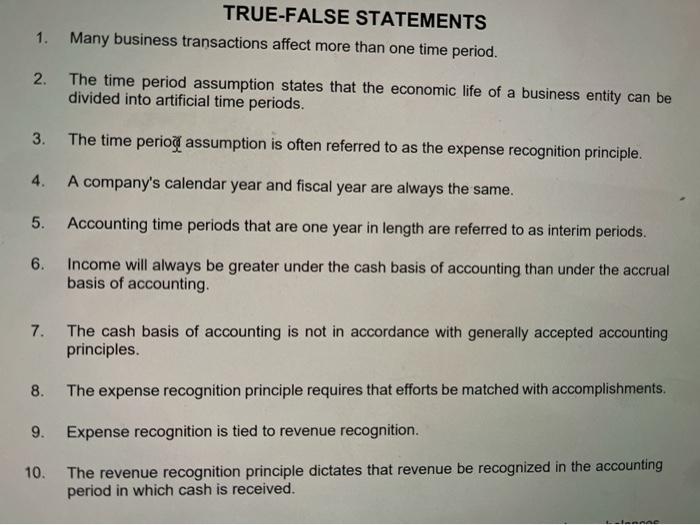

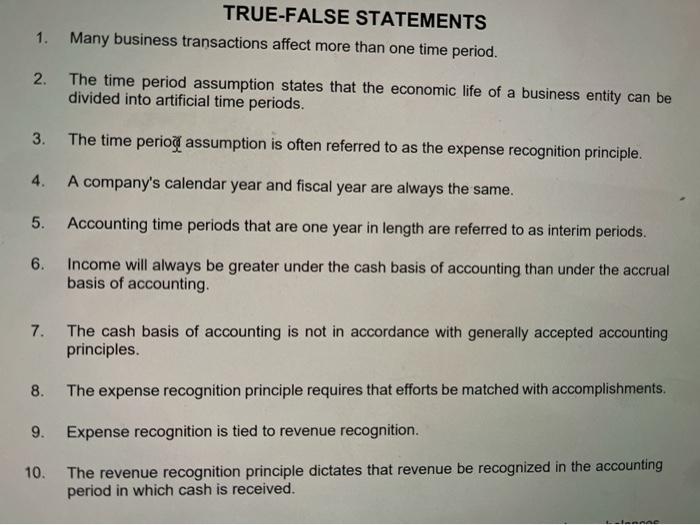

Please answer all parts of the question for a good rating and a good thumbs up. Thank you. TRUE-FALSE STATEMENTS 1. Many business transactions affect

Please answer all parts of the question for a good rating and a good thumbs up.

TRUE-FALSE STATEMENTS 1. Many business transactions affect more than one time period. 2. The time period assumption states that the economic life of a business entity can be divided into artificial time periods. 3. The time period assumption is often referred to as the expense recognition principle. 4. A company's calendar year and fiscal year are always the same. 5. Accounting time periods that are one year in length are referred to as interim periods. 6. Income will always be greater under the cash basis of accounting than under the accrual basis of accounting. 7. The cash basis of accounting is not in accordance with generally accepted accounting principles. 8. The expense recognition principle requires that efforts be matched with accomplishments. 9. Expense recognition is tied to revenue recognition. 10. The revenue recognition principle dictates that revenue be recognized in the accounting period in which cash is received. NE

Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started