Please answer all parts.

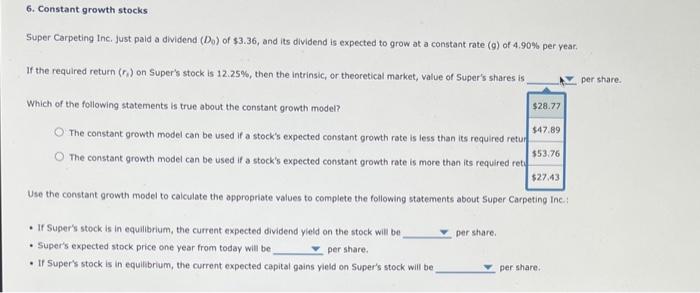

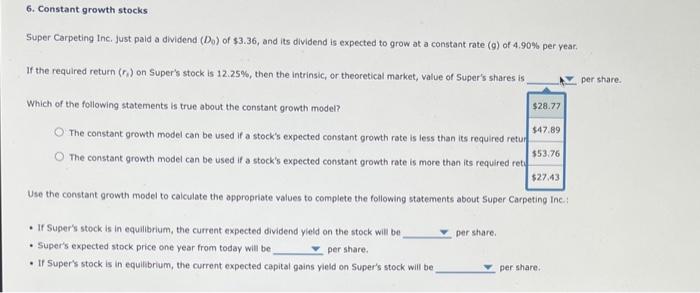

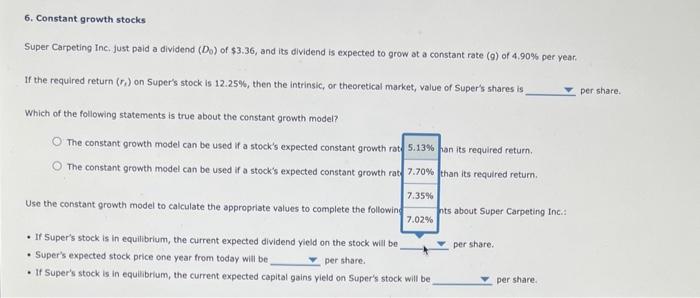

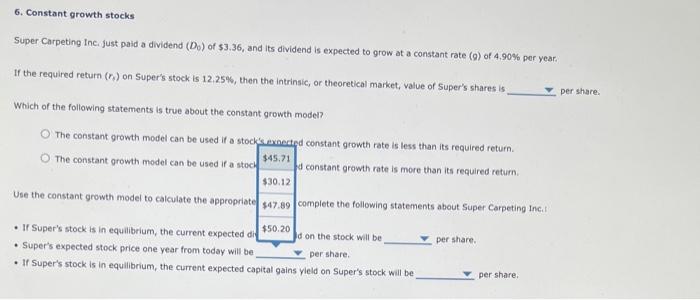

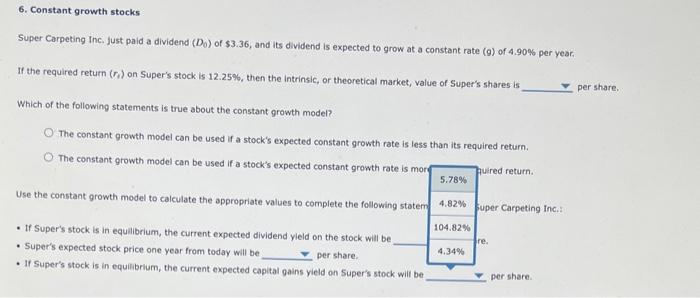

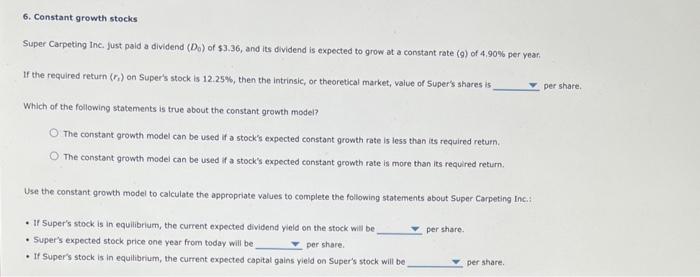

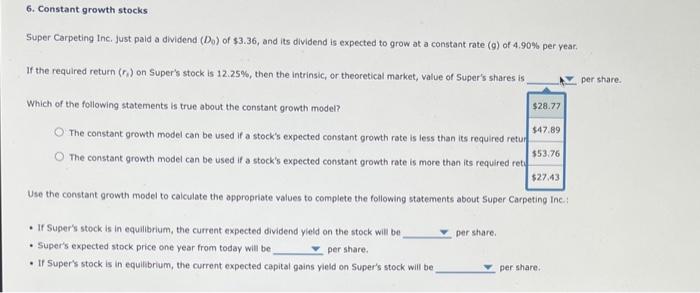

Super Carpeting Inc. Just paid a dividend (D0) of $3.36, and its dividend is expected to grow at a constant rate (9) of 4.90% per year. If the required return (ri) on Super's stock is 12.25%, then the intrinsic, or theoretical market, value of Super's shares is per share. Which of the following statements is true about the constant growth model? The constant growth model can be used if a stock's expected constant growth rate is less than its required retur The constant growth model can be used if a stock's expected constant growth rate is more than its required reth Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc: - If Super's stock is in equilibrium, the current expected dividend yleld on the stock will be per share. - Super's expected stock price one year from today will be per share. - If Super's stock is in equilibrium, the current expected capital gains vield on Super's stock will be per share. 6. Constant growth stocks Super Carpeting inc, just paid a dividend (D0) of $3.36, and its dividend is expected to grow at a constant rate ( 9 ) of 4.90% per year. If the required return (r2) on Super's stock is 12.25%, then the intrinsic, or theoretical market, value of Super's shares is per share. Which of the following statements is true about the constant growth model? The constant growth model can be used if a stock's expected constant growth rat 5.13% ian its required return. The constant growth model can be used if a stock's expected constant growth rat 7.70% than its required return. Use the constant growth model to calculate the appropriate values to complete the following 7.02%7.35% - If Super's stock is in equilibrium, the current expected dividend yield on the stock will be pershare. - Super's expected stock price one year from today will be - If Super's stock is in equilibrlum, the current expected capital gains yield on Super's stock will be per share. 6. Constant growth stocks Super Carpeting Inci just paid a dividend (D0) of $3.36, and its dividend is expected to 9 row at a constant rate (9) of 4.90% per year. If the required return (rn) on Super's stock is 12.25%, then the intrinsic, or theoretical market, value of Super's shares is per share. Which of the following statements is true about the constant growth model? The constant growth model can be used if a stockis axnected constant growth rate is less than its required return. The constant growth model can be used if a stocl $45.71 d constant growth rate is more than its required return. Use the constant growth model to calculate the appropriate $47.89 complete the following statements about Super Carpeting Inc. $30.12 - If Super's stock is in equilibrium, the current expected di $50.20 de on the stock will be Super Carpeting Inc. Just paid a dividend (D0) of $3.36, and its dividend is expected to grow at a constant rate ( 9 ) of 4.90% per year. If the required return (ri) on Super's stock is 12.25%, then the intrinsic, or theoretical market, value of Super's shares is Which of the following statements is true about the constant growth model? The constant growth model can be used if a stock's expected constant growth rate is less than its required return. The constant growth model can be used if a stock's expected constant growth rate is mor? Use the constant growth model to calculate the appropriate values to complete the following - Super's expected stock price one year from today will be - If Super's stock is in equilibrium, the current expected capital gains yield on 5uper 's stock wiil be per share. 6. Constant growth stocks Super Carpeting Inc. Just paid a dividend (D0) of 53.36, and its dividend is expected to grow at a constant rate (g) of 4,90% per year. If the required return (rx) on Super's stock is 12.25%, then the intrinsic, or theoretical market, value of super's shares is per share. Which of the following statements is true about the constant growth model? The constant growth model can be used if a stock's expected constant growth rate is less than its required return. The constant growth model can be used if a stock's expected constant growth rate is more than its required return. Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc: - Ir Super's stock is in equilibrium, the current expected dividend yield on the stock will be per share. - Super's expected stock price one year from today will be - If Super's stock is in equilibrium, the current expected capital gains yield on Super's stock will be per share