Please answer all parts to this question (A-D) and show your work. Thank you

Please answer all parts to this question (A-D) and show your work. Thank you

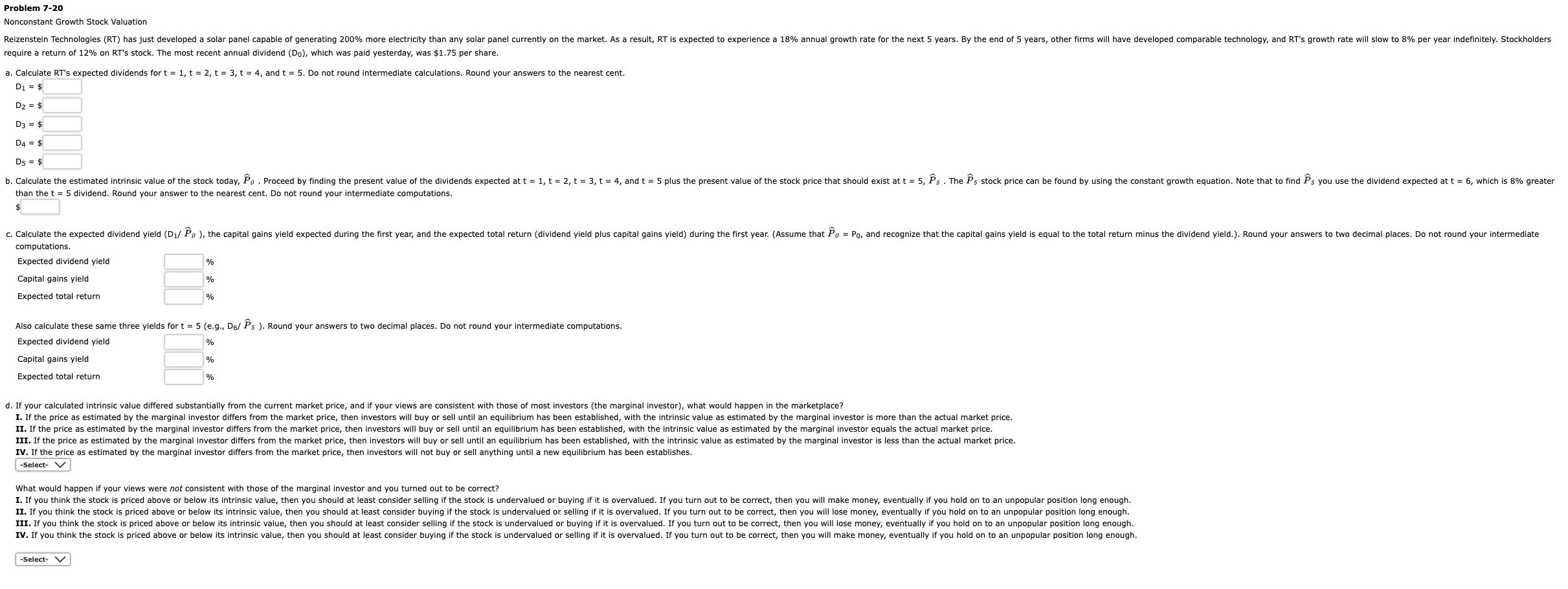

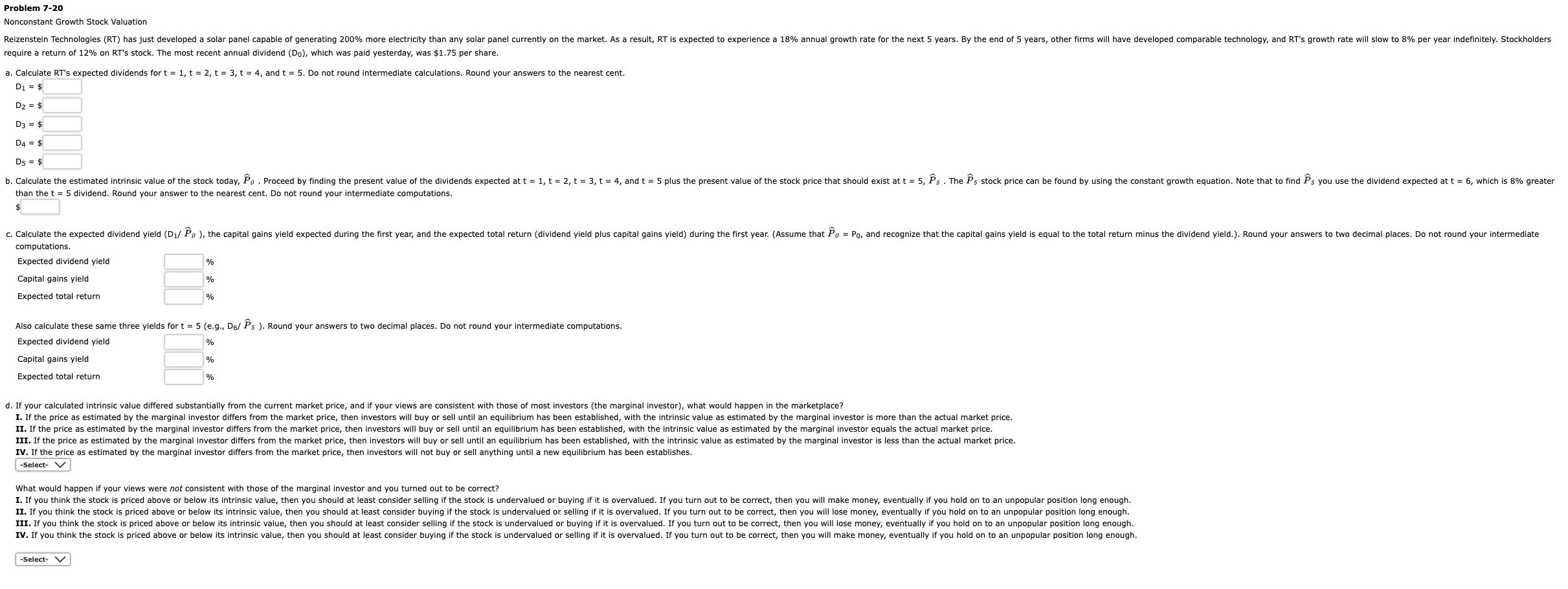

require a return of 12% on RT 's stock. The most recent annual dividend (D0), which was paid yesterday, was $1.75 per share. a. Calculate RT's expected dividends for t=1,t=2,t=3,t=4, and t=5. Do not round intermediate calculations. Round your answers to the nearest cent. D1=$ D2=$ D3=$ D4=$ D5=$ Calculate the estimated intrinsic value of the stock today, P0. Proceed by finding the present value than the t=5 dividend. Round your answer to the nearest cent. Do not round your intermediate computations. Also calculate these same three yields for t=5 (e.g., D6/P5 ). Round your answers to two decimal places. Do not round your intermediate computations. Capital gains yield Expected total return IV. If the price as estimated by the marginal investor differs from the market price, then investors will not buy or sell anything until a new equilibrium has been establishes. -Select- What would happen if your views were not consistent with those of the marginal investor and you turned out to be correct? require a return of 12% on RT 's stock. The most recent annual dividend (D0), which was paid yesterday, was $1.75 per share. a. Calculate RT's expected dividends for t=1,t=2,t=3,t=4, and t=5. Do not round intermediate calculations. Round your answers to the nearest cent. D1=$ D2=$ D3=$ D4=$ D5=$ Calculate the estimated intrinsic value of the stock today, P0. Proceed by finding the present value than the t=5 dividend. Round your answer to the nearest cent. Do not round your intermediate computations. Also calculate these same three yields for t=5 (e.g., D6/P5 ). Round your answers to two decimal places. Do not round your intermediate computations. Capital gains yield Expected total return IV. If the price as estimated by the marginal investor differs from the market price, then investors will not buy or sell anything until a new equilibrium has been establishes. -Select- What would happen if your views were not consistent with those of the marginal investor and you turned out to be correct

Please answer all parts to this question (A-D) and show your work. Thank you

Please answer all parts to this question (A-D) and show your work. Thank you