Answered step by step

Verified Expert Solution

Question

1 Approved Answer

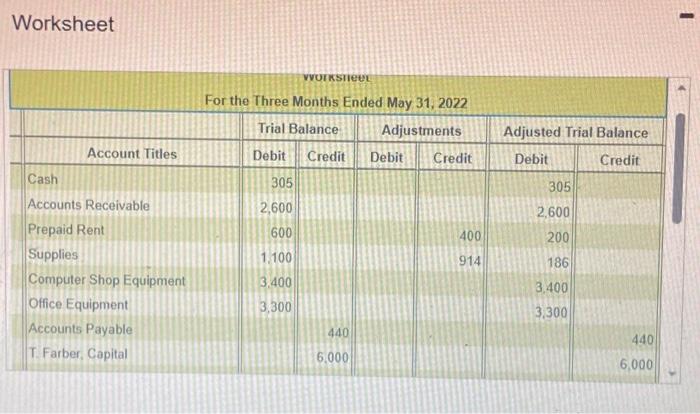

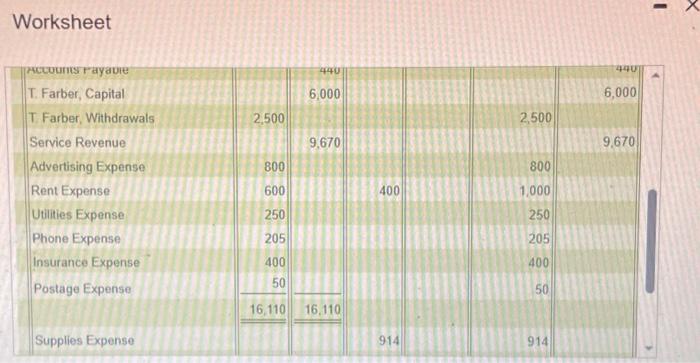

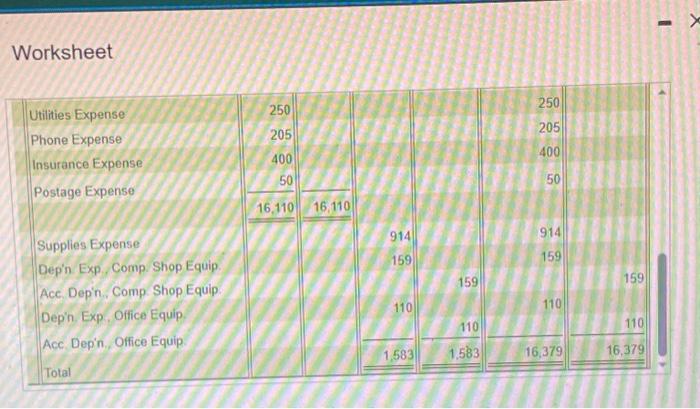

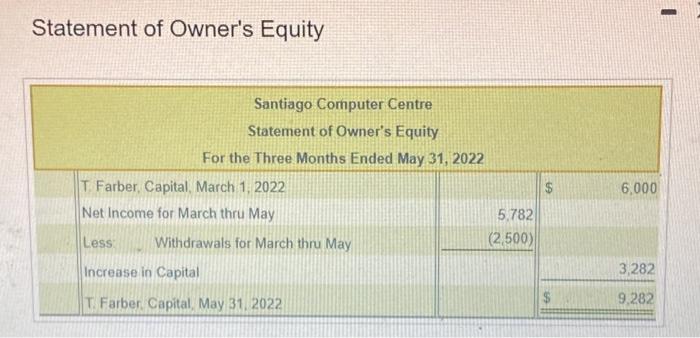

please answer all parts Tyler has decided to end the Santiago Computer Centre's first year as of May 31, 2022 and has prepared he following.

please answer all parts

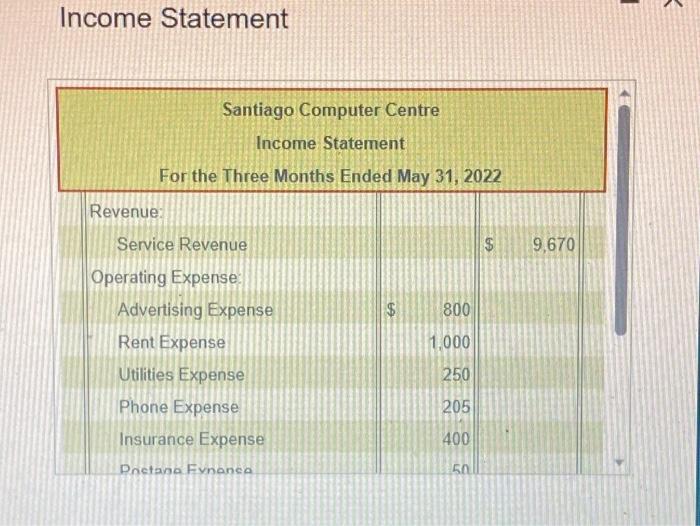

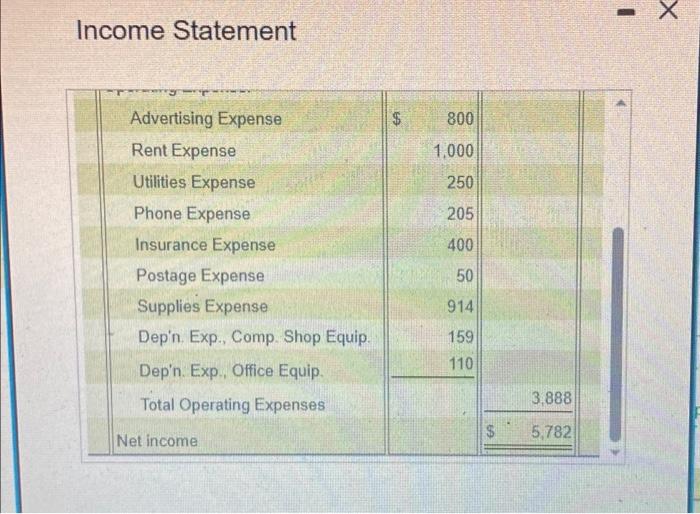

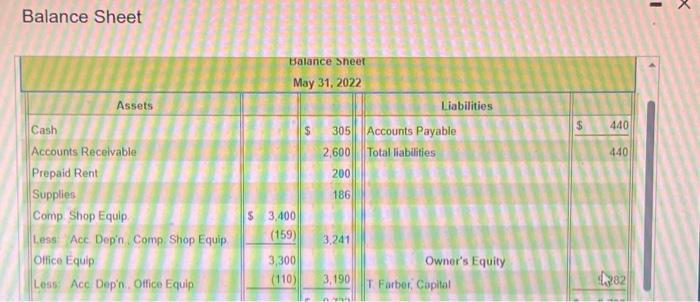

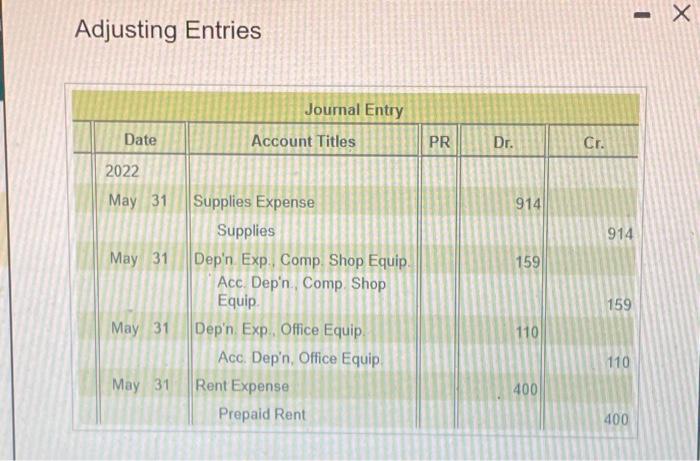

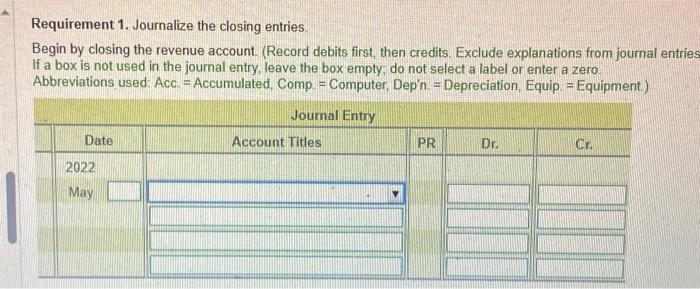

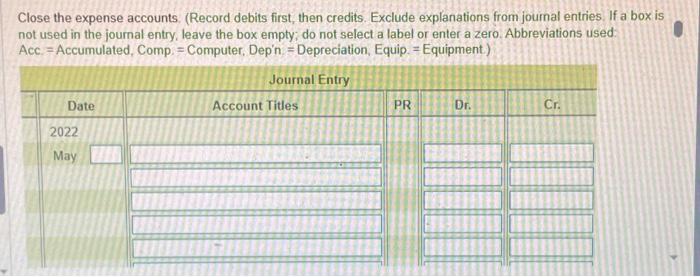

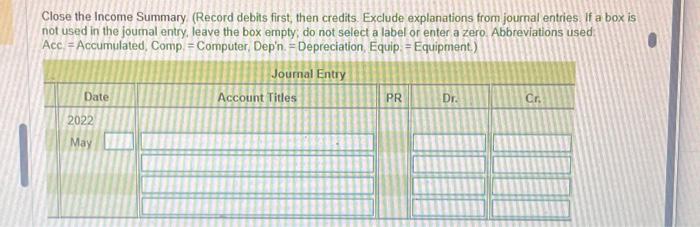

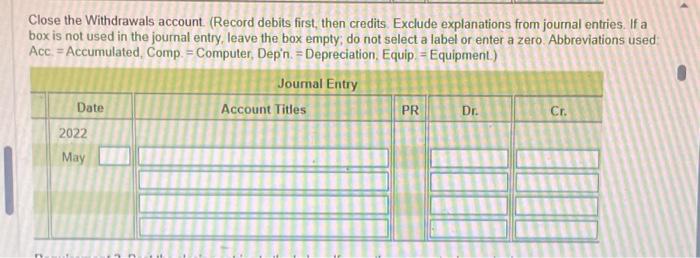

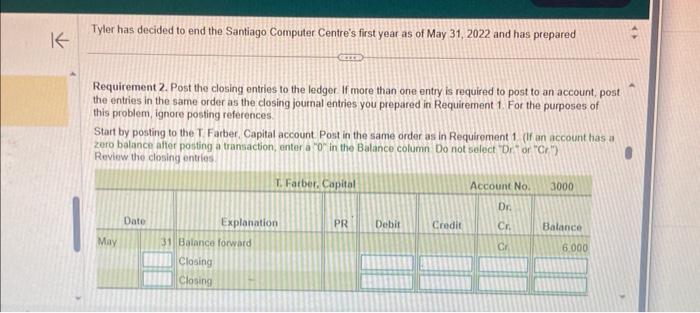

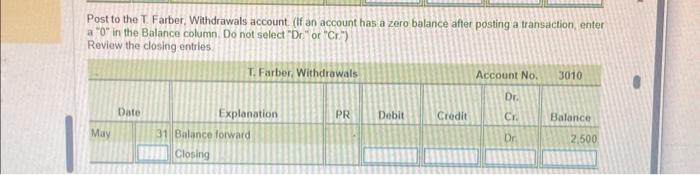

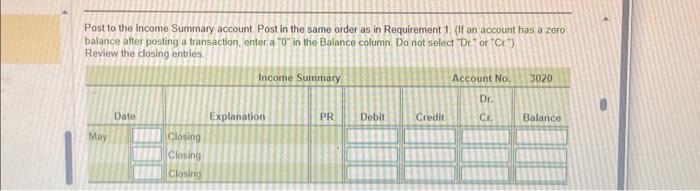

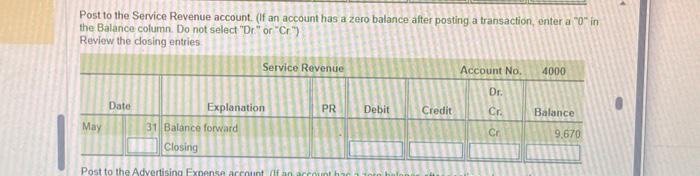

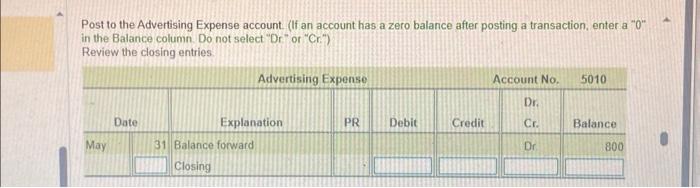

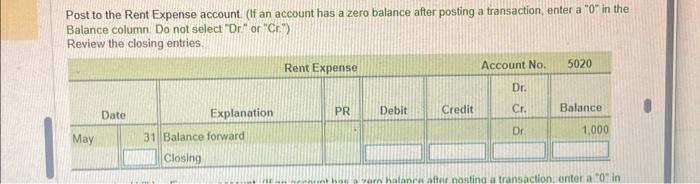

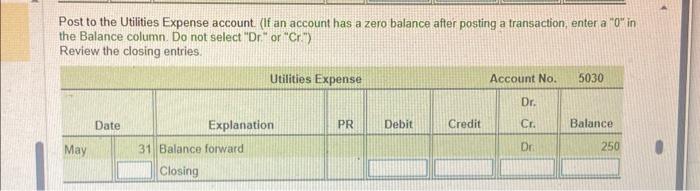

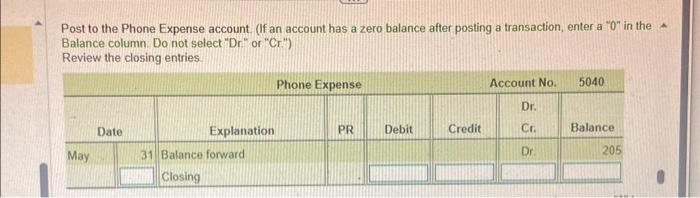

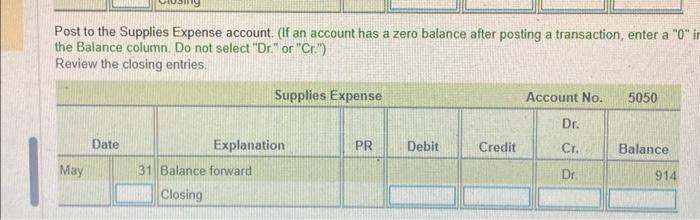

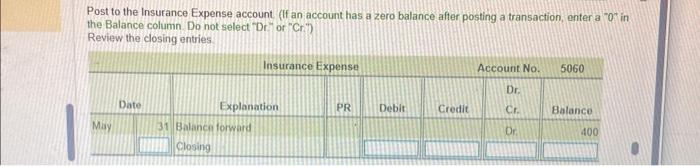

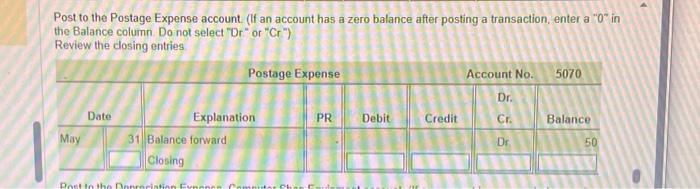

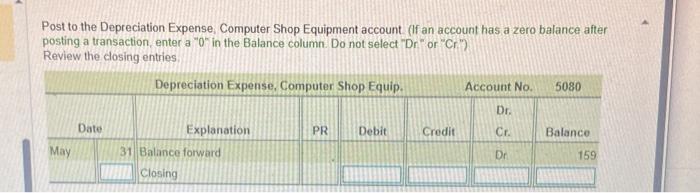

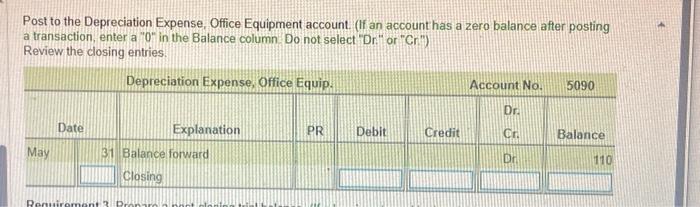

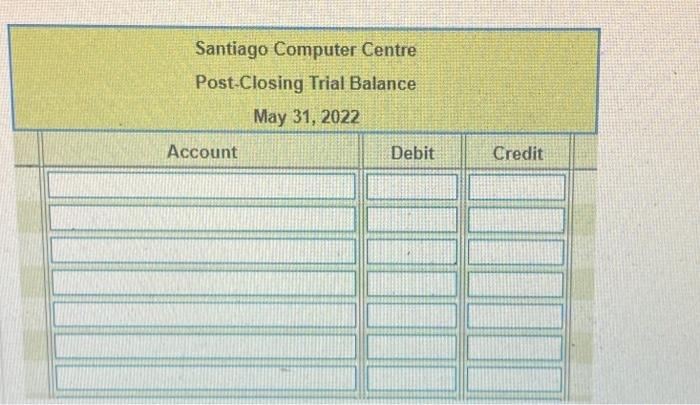

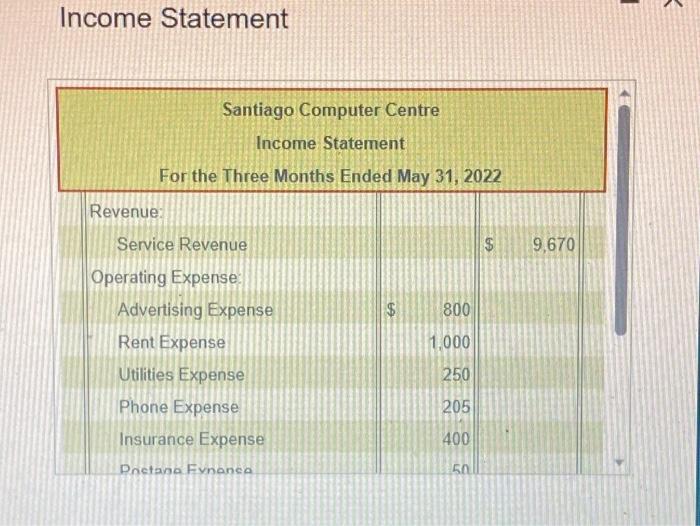

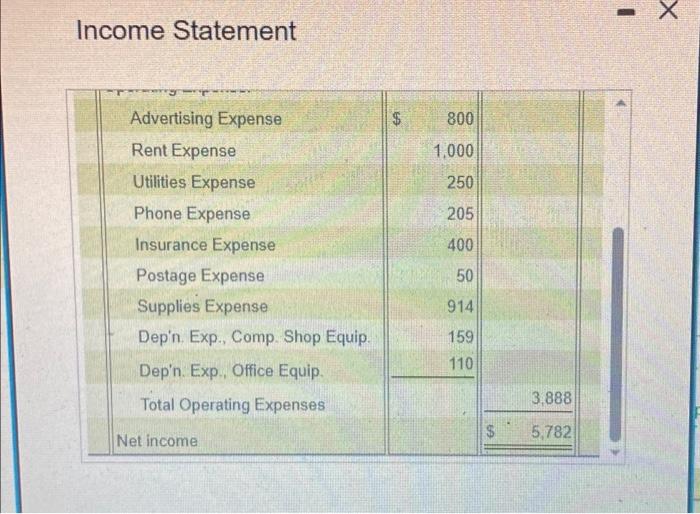

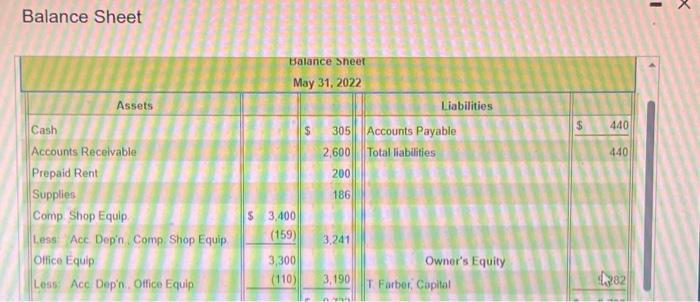

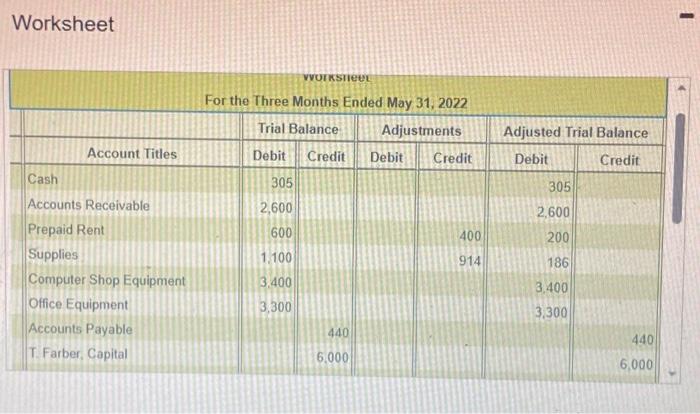

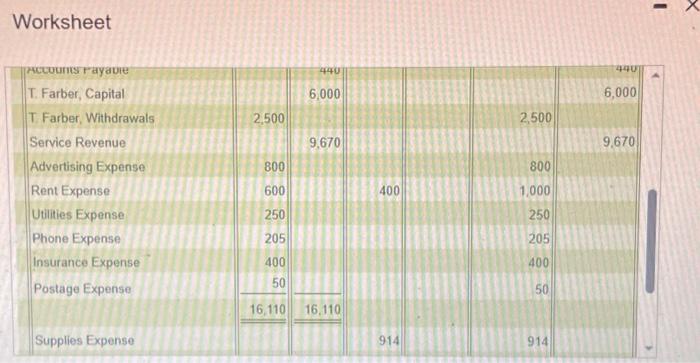

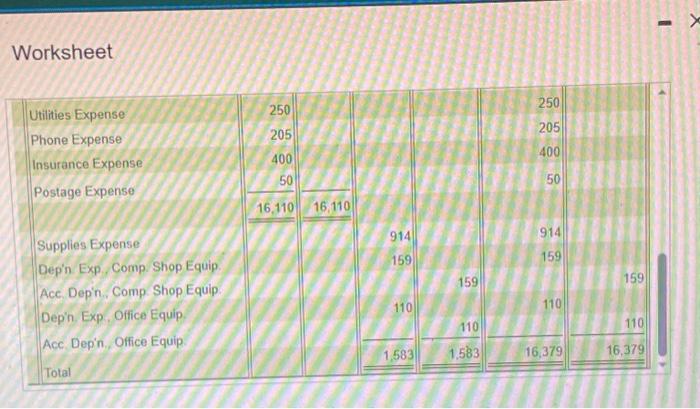

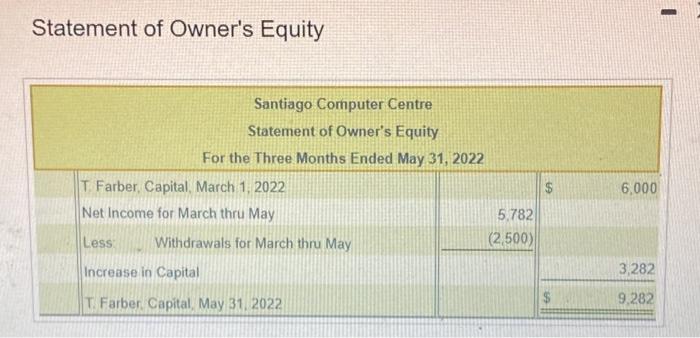

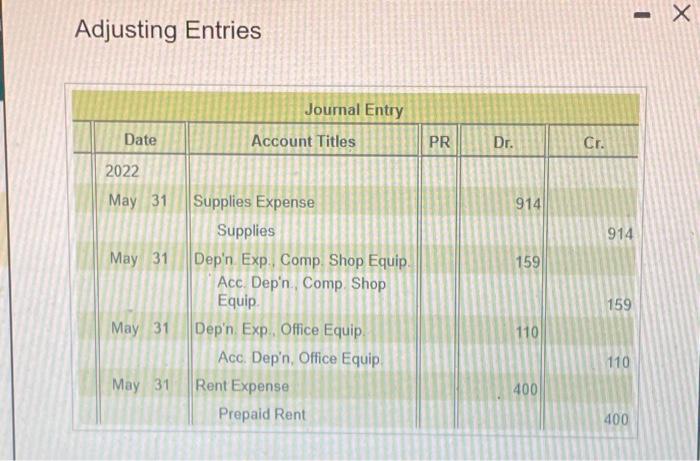

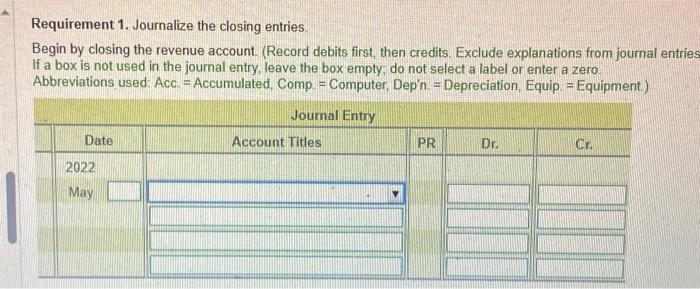

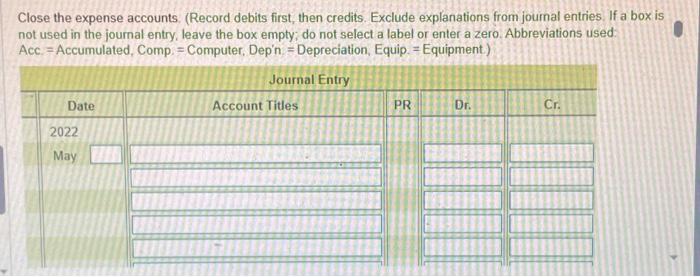

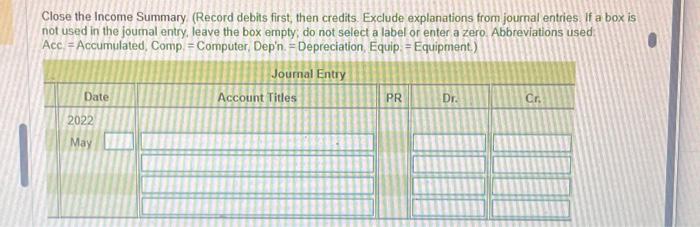

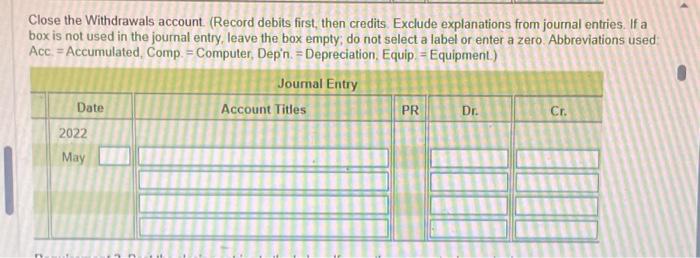

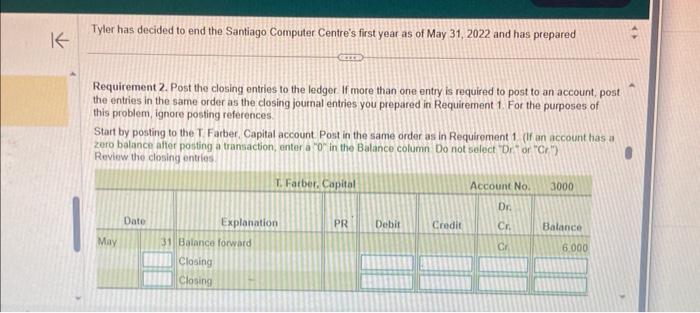

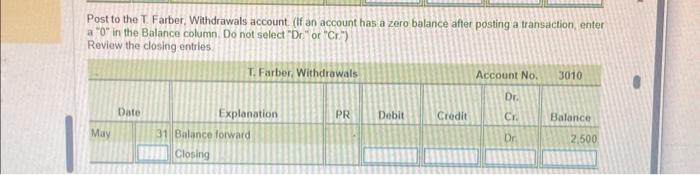

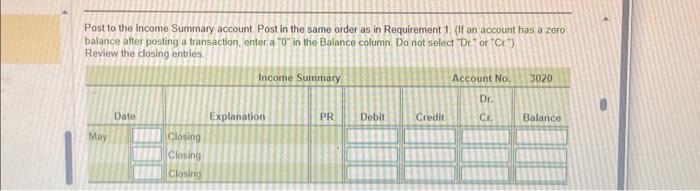

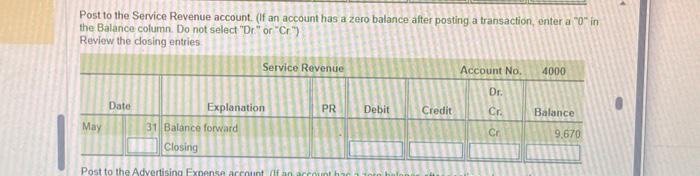

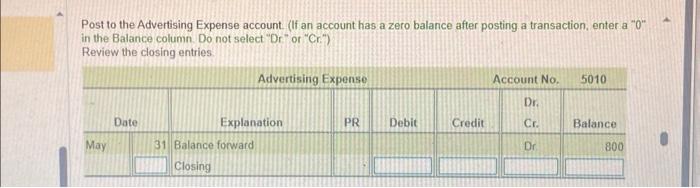

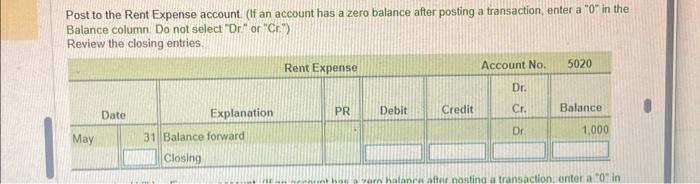

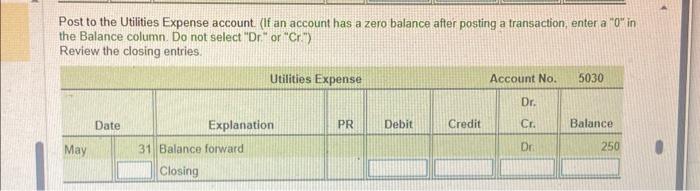

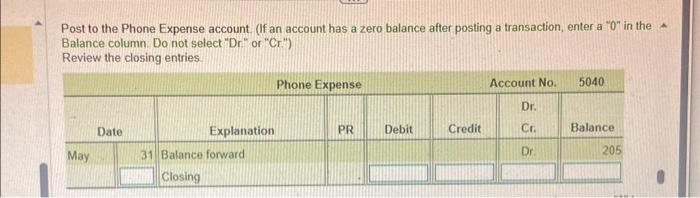

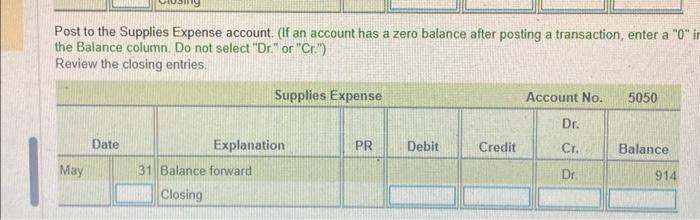

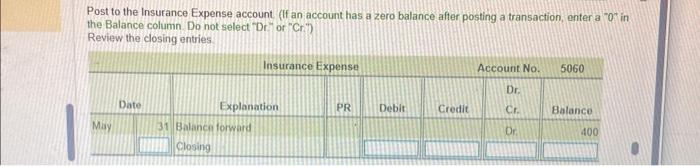

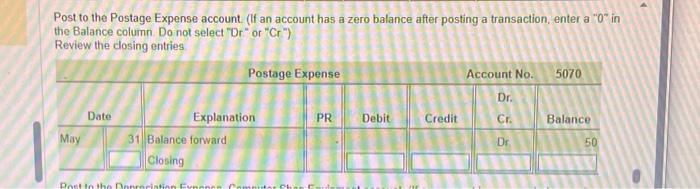

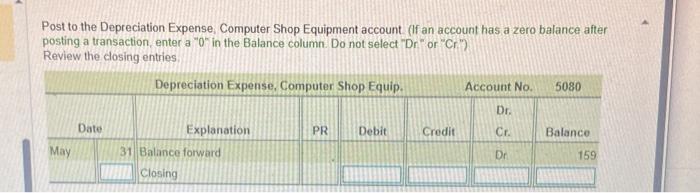

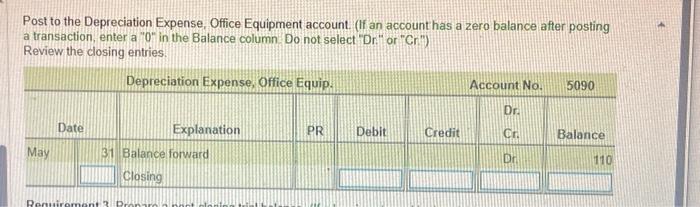

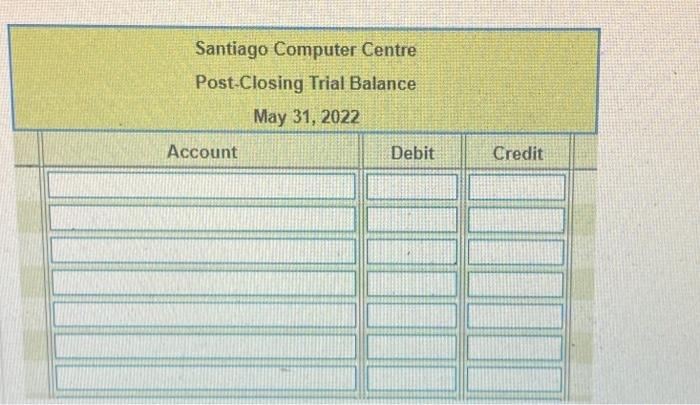

Tyler has decided to end the Santiago Computer Centre's first year as of May 31, 2022 and has prepared he following. (Click the icon to view the chart of accounts.) (Click the icon to view the worksheet.) (Click the icon to view the income statement.) (Click the icon to view the statement of owner's equity.) (Click the icon to view the balance sheet) (Click the icon to view the adjusting joumal entries.) Chart of Accounts Income Statement Income Statement Balance Sheet Worksheet Worksheet Worksheet Statement of Owner's Equity Adjusting Entries Requirement 1. Journalize the closing entries. Begin by closing the revenue account. (Record debits first, then credits. Exclude explanations from journal entrie If a box is not used in the journal entry, leave the box empty; do not select a label or enter a zero. Abbreviations used: Acc = Accumulated, Comp = Computer, Dep'n = Depreciation, Equip = Equipment.) Close the expense accounts. (Record debits first, then credits. Exclude explanations from journal entries. If a box is not used in the journal entry, leave the box empty; do not select a label or enter a zero. Abbreviations used: Acc = Accumulated, Comp = Computer, Dep'n = Depreciation, Equip. = Equipment. Close the income Summary. (Record debits first, then credits. Exclude explanations from journal entries. If a box is not used in the joumal entry, leave the box empty; do not select a label or enter a zero Abbreviations used. Acc = Accumulated, Comp = Computer, Dep'n. = Depreciation, Equip: = Equipment. Close the Withdrawals account (Record debits first, then credits. Exclude explanations from journal entries. If a box is not used in the journal entry, leave the box empty; do not select a label or enter a zero. Abbreviations used Acc. = Accumulated, Comp. = Computer, Dep'n = Depreciation. Equip. = Equipment. Tyler has decided to end the Santiago Computer Centre's first year as of May 31,2022 and has prepared Requirement 2. Post the closing entries to the ledger. If more than one entry is required to post to an account, post the entries in the same order as the closing journal entries you prepared in Requirement 1. For the purposes of this problem, ignore posting references. Start by posting to the T. Farber. Capital account. Post in the same order as in Requirement 1 . (If an account has a) zero balance after posting a transaction, enter a "O" in the Balance column Do not select "Dr " or "Cr.") Review the closing entrles. Post to the T. Farber, Withdrawals account (if an account has a zero balance after postinga transaction, enter a " 0 " in the Balance column. Do not select "Dr" or " Cr ") Review the closing entries. Post to the income Summary account. Post in the same order as in Requirement 1 . (If an account has a zero balance after posting a transaction, enter a " 0 in the Balance column. Do not select "Dr. "or "Cr.") Review the closing entries Post to the Service Revenue account. (If an account has a zero balance after postirg a transaction, enter a " 0 in the Balance column. Do not select "Dr." or "Cr") Reviow the closing entries Post to the Advertising Expense account. (If an account has a zero balance after posting a transaction, enter a "0" in the Balance column. Do not select "Dr" or "Cr") Review the closing entries Post to the Rent Expense account. (If an account has a zero balance after posting a transaction, enter a "0" in the Balance column. Do not select "Dr." or "Cr.") Review the closing entries. Post to the Utilities Expense account. (If an account has a zero balance after posting a transaction, enter a " 0 " in the Balance column. Do not select "Dr." or " Cr.) Review the closing entries. Post to the Phone Expense account. (If an account has a zero balance after posting a transaction, enter a " 0 " in the Balance column. Do not select "Dr." or "Cr") Review the closing entries Post to the Supplies Expense account. (If an account has a zero balance after posting a transaction, enter a "0" the Balance column. Do not select "Dr." or "Cr") Review the closing entries. Oost to the Insurance Expense account (If an account has a zero balance after posting a transaction, enter a " in he Balance column. Do not select DDr. or "Cr.") Review the closing entries Post to the Postage Expense account. (If an account has a zero balance after posting a transaction, enter a "0" in the Balance column. Do not select "Dr." or "Cr") Review the closing entries Post to the Depreciation Expense, Computer Shop Equipment account (If an account has a zero balance after posting a transaction, enter a " 0 in the Balance column. Do not select "Dr" or " Cr ") Review the closing entries: Post to the Depreciation Expense, Office Equipment account. (If an account has a zero balance after posting a transaction, enter a " 0 " in the Balance column. Do not select "Dr. "or " Cr ") Review the closing entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started