Answered step by step

Verified Expert Solution

Question

1 Approved Answer

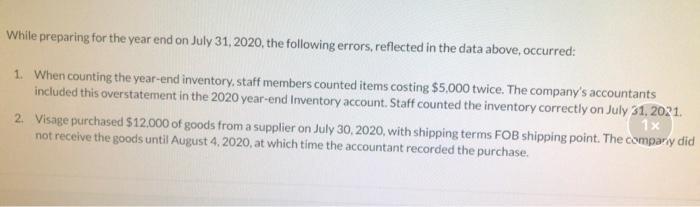

While preparing for the year end on July 31, 2020, the following errors, reflected in the data above, occurred: 1. When counting the year-end

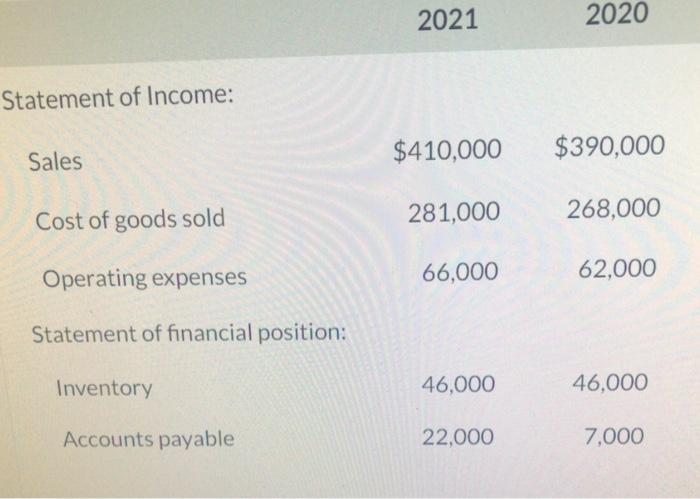

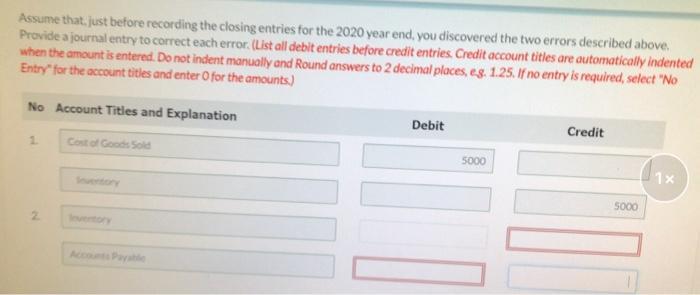

While preparing for the year end on July 31, 2020, the following errors, reflected in the data above, occurred: 1. When counting the year-end inventory, staff members counted items costing $5,000 twice. The company's accountants included this overstatement in the 2020 year-end Inventory account. Staff counted the inventory correctly on July 31, 2021. 1x 2. Visage purchased $12,000 of goods from a supplier on July 30, 2020, with shipping terms FOB shipping point. The company did not receive the goods until August 4, 2020, at which time the accountant recorded the purchase. Statement of Income: 2021 2020 Sales $410,000 $390,000 Cost of goods sold 281,000 268,000 Operating expenses 66,000 62,000 Statement of financial position: Inventory 46,000 46,000 Accounts payable 22,000 7,000 Assume that, just before recording the closing entries for the 2020 year end, you discovered the two errors described above. Provide a journal entry to correct each error. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually and Round answers to 2 decimal places, eg. 1.25. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No Account Titles and Explanation 2 Cost of Goods Sold Sventory 2 eventory Accounts Payable Debit 5000 Credit 1x 5000

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Calculations for the journal entries Error 1 Correction Inventory was overstated by 5000 due to item...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started