please answer all premises

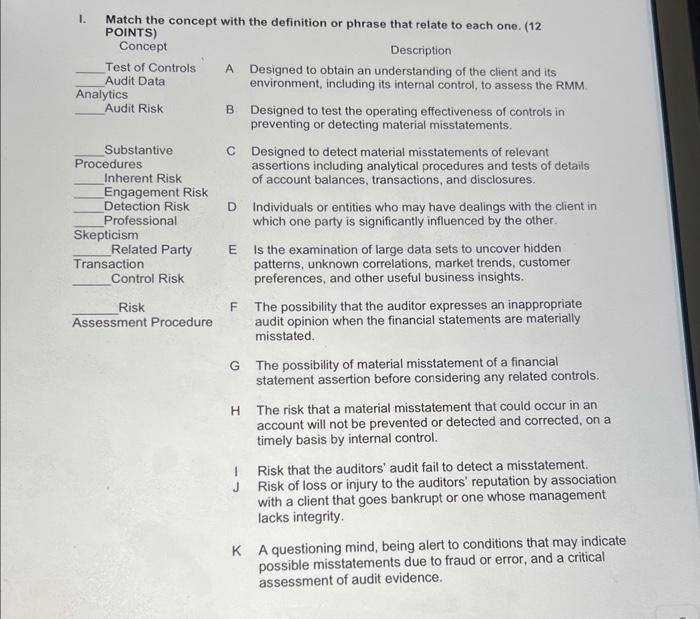

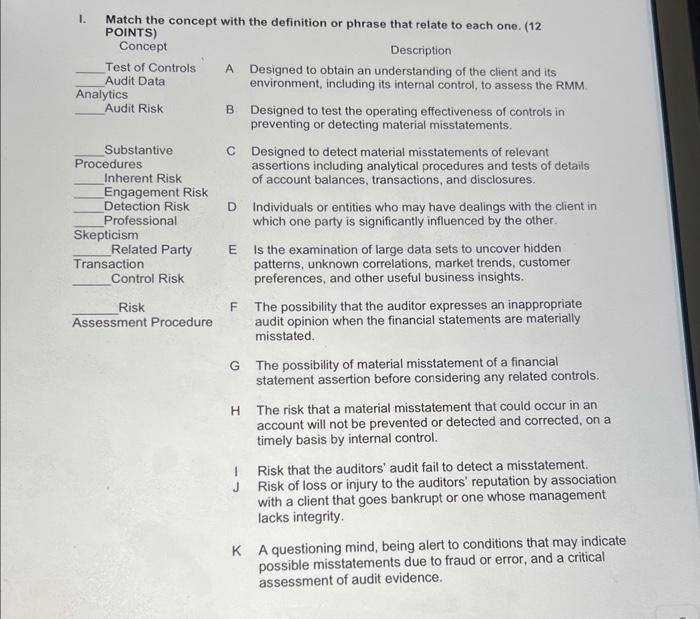

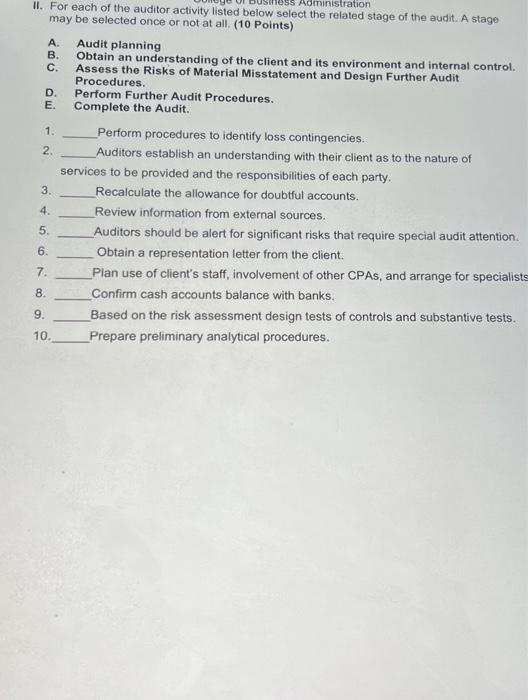

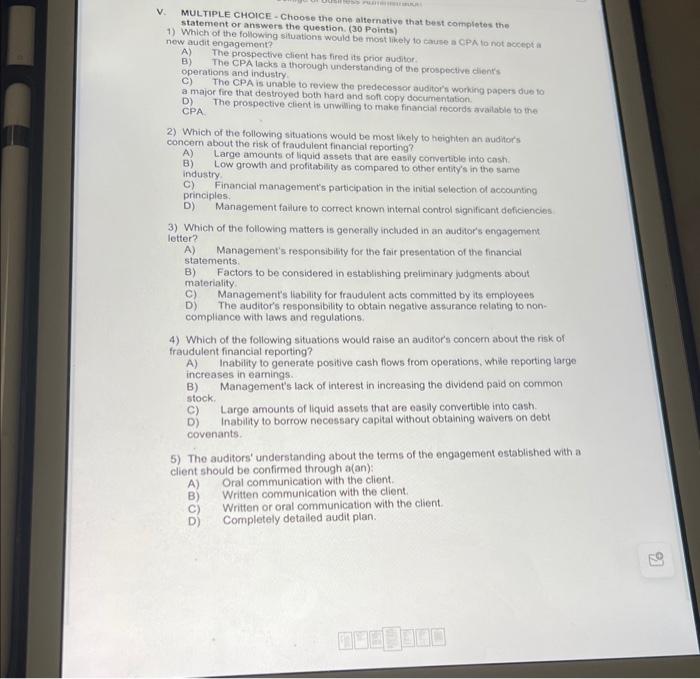

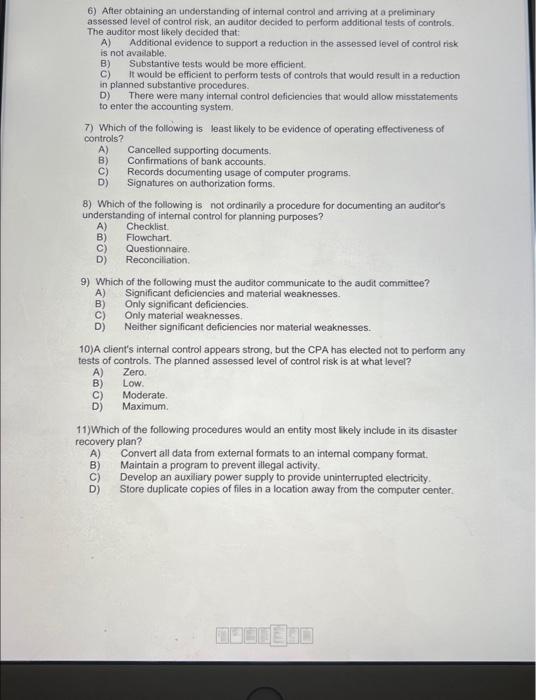

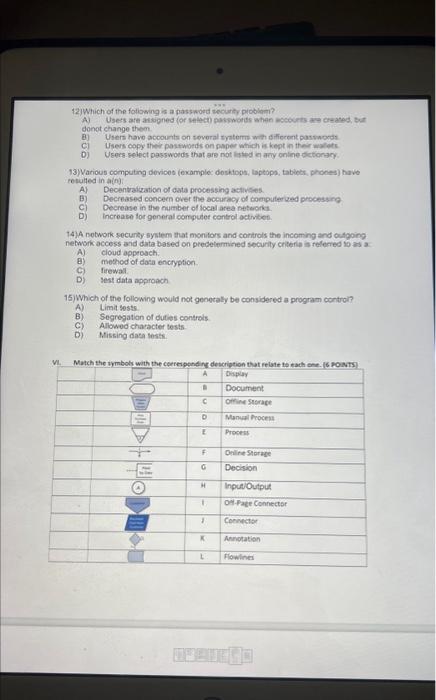

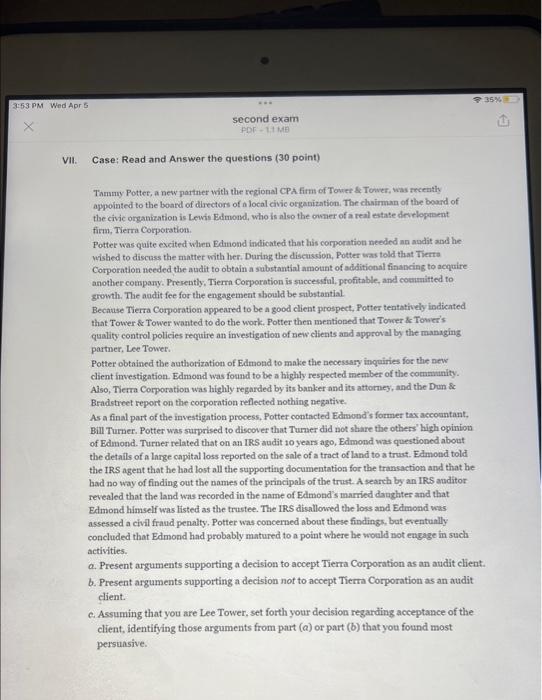

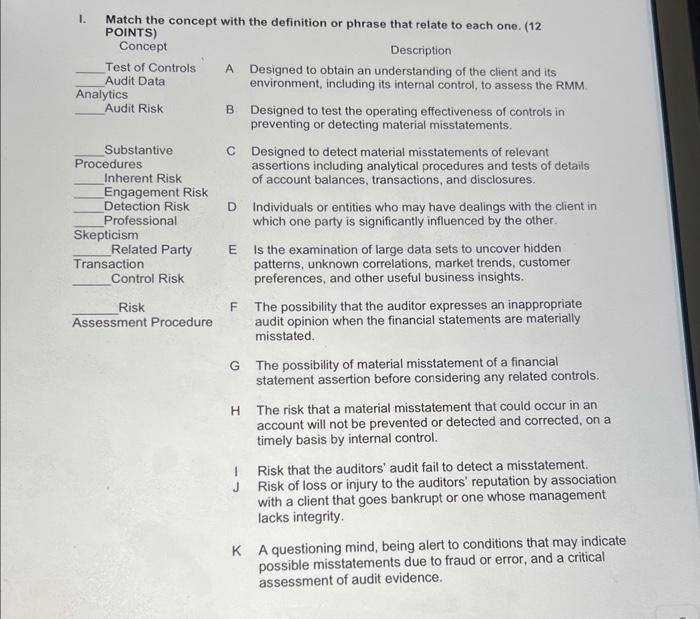

POINTS) Concept Description Test of Controls A Designed to obtain an understanding of the client and its Audit Data environment, including its internal control, to assess the RMM. Analytics Audit Risk B Designed to test the operating effectiveness of controls in preventing or detecting material misstatements. H The risk that a material misstatement that could occur in an account will not be prevented or detected and corrected, on a timely basis by internal control. 1 Risk that the auditors' audit fail to detect a misstatement. J Risk of loss or injury to the auditors' reputation by association with a client that goes bankrupt or one whose management lacks integrity. K A questioning mind, being alert to conditions that may indicate possible misstatements due to fraud or error, and a critical assessment of audit evidence. II. For each of the auditor activity listed below select the related stage of the audit. A stage may be selected once or not at all. (10 Points) A. Audit planning B. Obtain an understanding of the client and its environment and internal control. C. Assess the Risks of Material Misstatement and Design Further Audit D. Procedures. E. Complete the Audit. 1. Perform procedures to identify loss contingencies. 2. Auditors establish an understanding with their client as to the nature of services to be provided and the responsibilities of each party. 3. Recalculate the allowance for doubtful accounts. 4. Review information from external sources. 5. Auditors should be alert for significant risks that require special audit attention. 6. Obtain a representation letter from the client. 7. Plan use of client's staff, involvement of other CPAs, and arrange for specialist 8. Confirm cash accounts balance with banks. 9. Based on the risk assessment design tests of controls and substantive tests. 10. Prepare preliminary analytical procedures. II. For each of the audit procedure listed below select the type of audit procedure, if any, that the auditor performed. A type of audit procedure may be selected once or not at all. IV. For each of the audit procedure listed below select the related management aceartion A mananement assertion mav be selected once or not at all. (6 Points) V. MULTIPLE CHOICE - Choose the one alternative that best completes the statement or answers the question. (30 Points) 1) Which of the following sifuations would be mont likely to cause a CPA lo not accept is new audit engagemont? A) The prospective client has fired its prior auditor B) The CPA lacks a thorough understanding of the prospective clients. operations and industry C) Tho CPA is unable to review the predecessor auditoi's working papers due to a major fire that destroyed both hard and soft copy documentation. D) The prospective client in unwiling to make financial rocords available to the CPA. 2) Which of the following situations would be most likely to heighten an auditor's concern about the risk of fraudulent financial reporting? A) Large amounts of liquid assets that are easily corvertsole into cash. B) Low growth and profitability as compared to other entity's in the same industry C) Financial management's participation in the initial selection of accounting principles. D) Management fallure to correct known internal control significant deficiencies 3) Which of the following matters is generally included in an auditor's engagement letter? A) Management's responsibisty for the fair presentation of the financial statements B) Factors to be considered in establishing preliminary judgments about materiality C) Management's liability for fraudulent acts committed by its employees D) The auditor's responsibility to obtain negatlve assurance relating to noncompliance with laws and regulations. 4) Which of the following situations would raise an auditor's concern about the risk of fraudulent financial reporting? A) Inability to generate positive cash flows from operations, while reporting large increases in earnings. B) Management's lack of interest in increasing the dividend paid on common stock. C) Large amounts of liquid assets that are easily comvertible into cash. D) Inability to borrow necessary capital without obtaining waivers on debt covenants. 5) The auditors' understanding about the terms of the engagement established with a client should be confirmed through a(an): A) Oral communication with the client. B) Written communication with the client. C) Written or oral communication with the client. D) Completely detailed audit plan. 6) After obtaining an understanding of internal control and afriving at a preliminary assessed level of control risk, an auditor decided to perform additional tests of controls. The auditor most likely decided that: A) Additional evidence to support a reduction in the assessed level of control risk. is not avadiable. B) Substantive tests would be more efficient C) It would be efficient to perform tests of controls that would result in a reduction in planned substantive procedures. D) There were many intemal control doficiencies that would allow misstatements to enter the accounting system. 7) Which of the following is least likely to be evidence of operating effectiveness of controls? A) Cancelled supporting documents. B) Confirmations of bank accounts. C) Records documenting usage of computer programs. D) Signatures on authorization forms. 8) Which of the following is not ordinarily a procedure for documenting an auditor's understanding of internal control for planning purposes? A) Checklist. B) Flowehart. C) Questionnaire. D) Reconciliation. 9) Which of the following must the auditor communicate to the audit committee? A) Significant deficiencies and material weaknesses. B) Only significant deficiencies. C) Only material weaknesses. D) Neither significant deficiencies nor material weaknesses. 10)A client's internal control appears strong, but the CPA has elected not to perform any tests of controls. The planned assessed level of control risk is at what level? A) Zero. B) Low. C) Moderate. D) Maximum. 11) Which of the following procedures would an entity most likely include in its disaster recovery plan? A) Convert all data from external formats to an intemal company format. B) Maintain a program to prevent illegal activity. C) Develop an auxiliary power supply to provide uninterrupted electricity. D) Store duplicate copies of files in a location away from the computer center. 12. Which of the fotiosing is a passwoed wecurty pioblewi? donct ehange them. B) Uhers have a6oounts on sovoral tyaterm with difiecent patswords C) Users oopy their pastwoeds on noper which is kept in their wather D) Ueers peipct passwoeds that are not lasted a acy onige dictonacy 13) Various oomputing devices (exampiec doskiove, laptapo, tablots, phones) have petulted in aing A) Decentraileation of cata processing activites. B) Decreased concern over the accuracy of coenputer zad processing C) Decrease in the number of focal area netecoks. D) increase for general computet control octmited. 14) A notwork security system that moritors and controls the incoming and oudgoing nebwork access and data based on predelermited socurity criteril is felered io als a A) cloud appeouch. B) methed of dosa encryption (C) firewal. D) Mest dita approech 15) Which of the following would not genecaly be considered a program controi? A) Limit Yests B) Segregation of duties contreis C) Allowed character tests D) M,Fissing daca tests. 1. Case: Read and Answer the questions (30 point) Tammy Potter, a new partner with the regional CPA firm of Tovee \& Tover, was recenth appointed to the boand of dlirectors of a local civic organization. The chairman of the boand of the civic organization is Lewis Bdmond, who is also the owner of a real estate develogabent firm, Tierra Corpotation: Potter was quite excited when Edmond indioated that his corporation needed an andit and he mished to discuss the matter with her. During the discussion, Potter was told that Therrs Corporation needed the audit to obtoin a substantial amount of additional financing to acquire another company. Presently. Tierra Corporation is succestifl, profitable, and connuitted to growth. The andit fee for the engagemeat sbould be substantial Because Tierra Corporation appeared to be a good client prospect, Potter tentatively indicated that Tower \& Tower wanted to do the work. Potter then mentioned that Tower \& Tover's quality control policies require an investigation of new elients and approval by the managing partner, Lee Tower. Potter obtained the authotization of Edmond to make the necessary inguiries for the new chient investigation. Edmond was found to be a highly respected member of the community. Also, Tierra Corporation was lighly regarded by its banker and its attorney, and the Dun \&c Bradstreet report on the corporation reflected nothing negative. As a final part of the investigation process, Potter contacted Edmwond s former tax accountant. Bill Turner. Potter was suprised to discover that Tumer did not share the others' high opinion of Edmond. Turner related that on an IRS audit 10 years ago, Edmond was questioned about the details of a large capital loss reported on the sale of a tract of land to a trust. Edmond told the IRS agent that he had lost all the supporting documentation for the transaction and that be had no way of finding out the names of the principals of the trust. A search by an IRS auditor revealed that the land was recorded in the name of Edmond's married daughter and that Edmond himself was listed as the trustee. The IRS disallowed the loss and Edmond was assessed a civil fraud penalty. Potter was concerned about these findings, but eventually concluded that Edmond had probably matured to a point where he would not engage in such activities. a. Present arguments supporting a decision to accept Tierm Corporation as an audit client: b. Present arguments supporting a decision not to acoept Tierra Corporation as an audit client. e. Assuming that you are Lee Tower, set forth your decision regarding acceptance of the client, identifying those arguments from part (a) or part (b) that you found most persunsive