Answered step by step

Verified Expert Solution

Question

1 Approved Answer

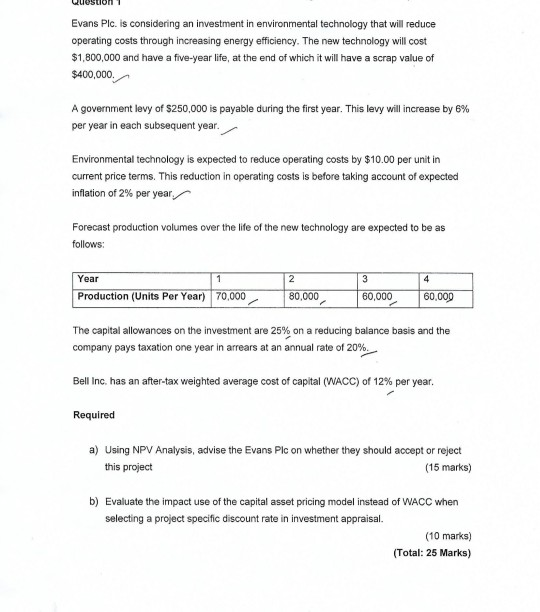

Please answer all question and workings.. Tq UUSUT Evans Plc. is considering an investment in environmental technology that will reduce operating costs through increasing energy

Please answer all question and workings.. Tq

UUSUT Evans Plc. is considering an investment in environmental technology that will reduce operating costs through increasing energy efficiency. The new technology will cost $1,800,000 and have a five-year life, at the end of which it will have a scrap value of $400,000 A government levy of $250,000 is payable during the first year. This levy will increase by 6% per year in each subsequent year. Environmental technology is expected to reduce operating costs by $10.00 per unit in current price terms. This reduction in operating costs is before taking account of expected inflation of 2% per year. Forecast production volumes over the life of the new technology are expected to be as follows: Year Production (Units Per Year) 70,000 80,000 60,000 60,000 The capital allowances on the investment are 25% on a reducing balance basis and the company pays taxation one year in arrears at an annual rate of 20% Bell Inc. has an after-tax weighted average cost of capital (WACC) of 12% per year. Required a) Using NPV Analysis, advise the Evans Pic on whether they should accept or reject this project (15 marks) b) Evaluate the impact use of the capital asset pricing model instead of WACC when selecting a project specific discount rate in investment appraisal. (10 marks) (Total: 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started