Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all question as no more asks remain! Thumbs up! Consider a firm that has $18 million in debt, $3 million in preferred stock,

Please answer all question as no more asks remain! Thumbs up!

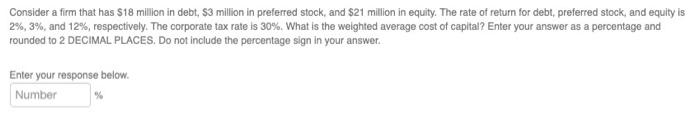

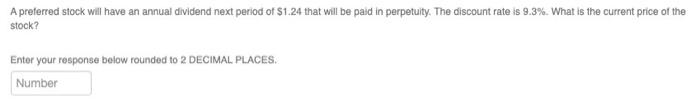

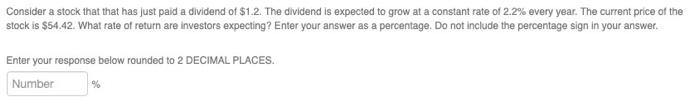

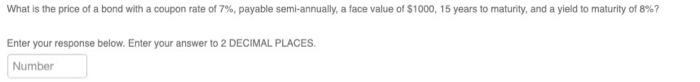

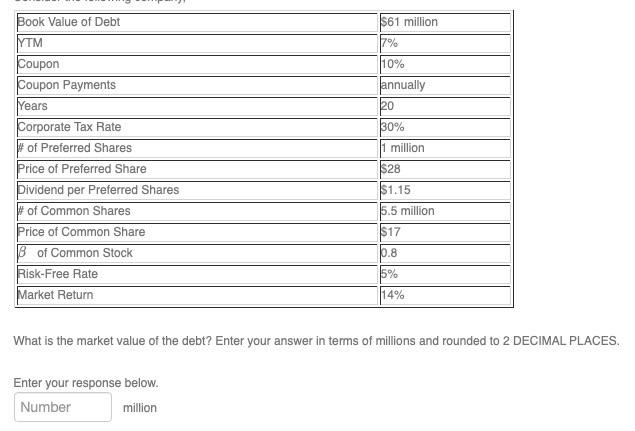

Consider a firm that has $18 million in debt, $3 million in preferred stock, and $21 million in equity. The rate of return for debt, preferred stock, and equity is 2%, 3%, and 12%, respectively. The corporate tax rate is 30%. What is the weighted average cost of capital? Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include the percentage sign in your answer. Enter your response below. Number % A preferred stock will have an annual dividend next period of $1.24 that will be paid in perpetuity. The discount rate is 9.3%. What is the current price of the stock? Enter your response below rounded to 2 DECIMAL PLACES. Number Consider a stock that that has just paid a dividend of $1.2. The dividend is expected to grow at a constant rate of 2.2% every year. The current price of the stock is $54.42. What rate of return are investors expecting? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES. Number % What is the price of a bond with a coupon rate of 7%, payable semi-annually, a face value of $1000, 15 years to maturity, and a yield to maturity of 8%7 Enter your response below. Enter your answer to 2 DECIMAL PLACES Number $61 million 7% 10% Book Value of Debt YTM Coupon Coupon Payments Years Corporate Tax Rate of Preferred Shares Price of Preferred Share Dividend per Preferred Shares of Common Shares Price of Common Share B of Common Stock Risk-Free Rate Market Return annually 20 30% 1 million $28 $1.15 5.5 million $17 0.8 5% 14% What is the market value of the debt? Enter your answer in terms of millions and rounded to 2 DECIMAL PLACES. Enter your response below. Number million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started