Answered step by step

Verified Expert Solution

Question

1 Approved Answer

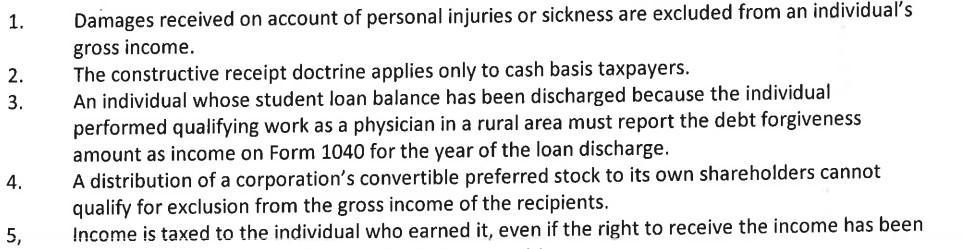

Please answer all question. True Or False 1. Damages received on account of personal injuries or sickness are excluded from an individual's gross income.

![]()

Please answer all question. True Or False 1. Damages received on account of personal injuries or sickness are excluded from an individual's gross income. The constructive receipt doctrine applies only to cash basis taxpayers. An individual whose student loan balance has been discharged because the individual performed qualifying work as a physician in a rural area must report the debt forgiveness amount as income on Form 1040 for the year of the loan discharge. A distribution of a corporation's convertible preferred stock to its own shareholders cannot qualify for exclusion from the gross income of the recipients. Income is taxed to the individual who earned it, even if the right to receive the income has been 2. 3. 4. 5,

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answers 1 True Explanation Damages received on account of personal physical injuries or physical sickness In general Section 104a2 excludes from gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started