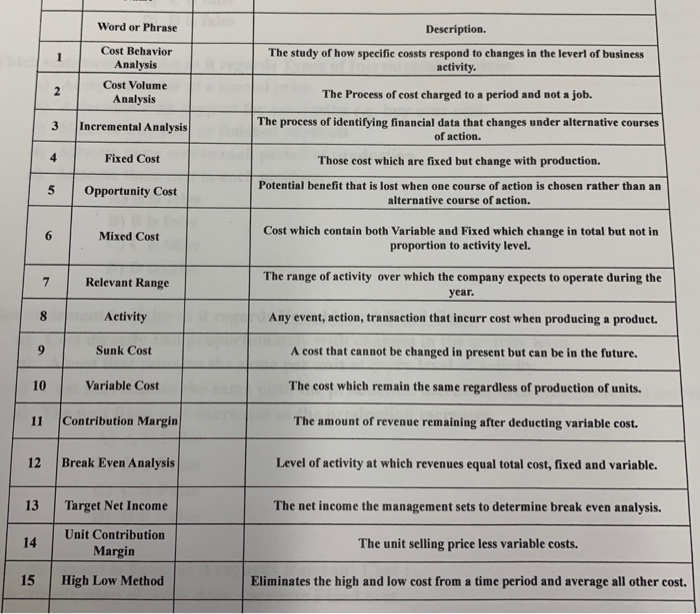

Question: please answer all questions. #1-15 is true and false Word or Phrase Cost Behavior Analysis Cost Volume Analysis Description The study of how specific cossts

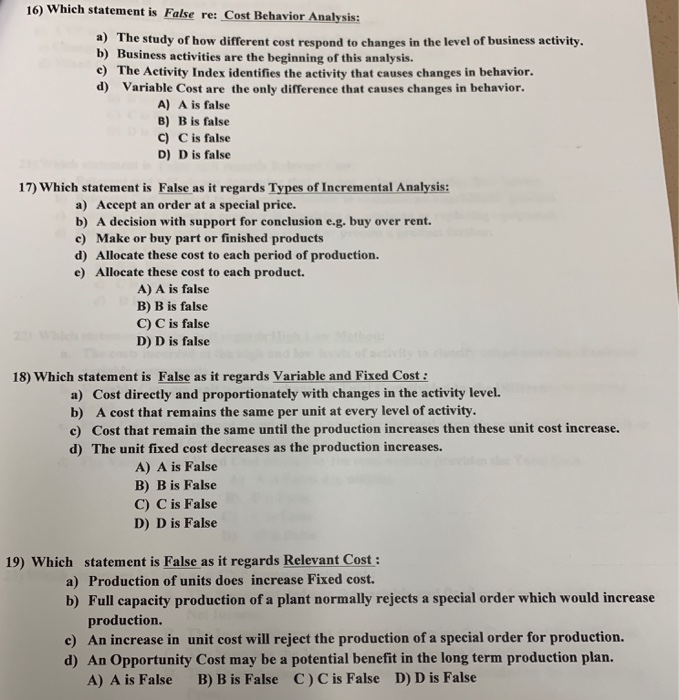

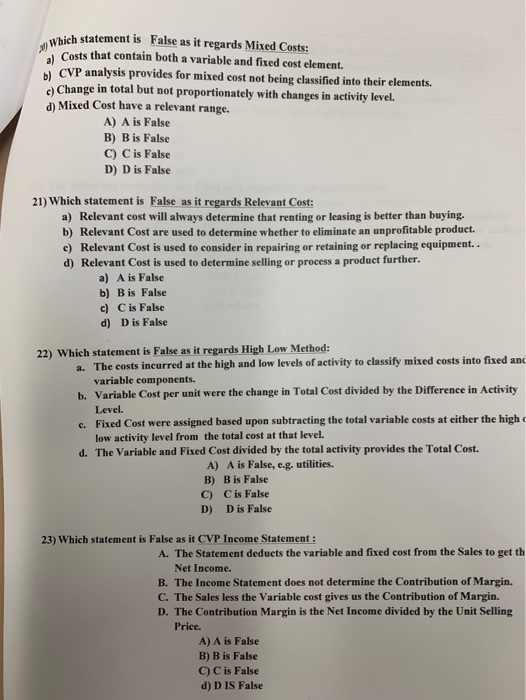

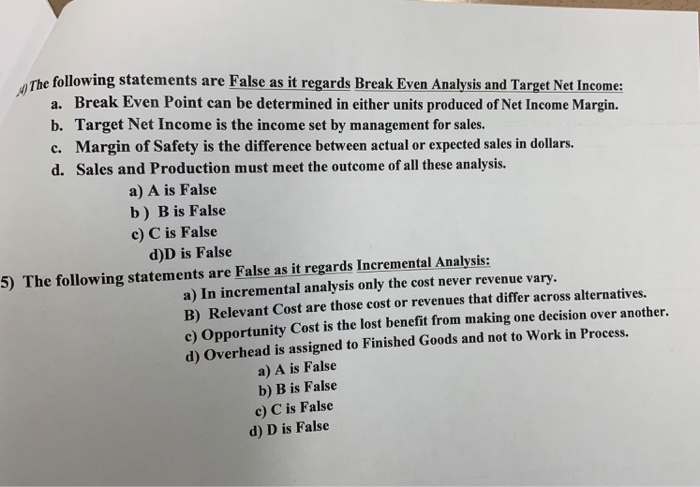

Word or Phrase Cost Behavior Analysis Cost Volume Analysis Description The study of how specific cossts respond to changes in the leverl of business activity The Process of cost charged to a period and not a job. The process of identifying financial data that changes under alternative courses 3 Incremental Analysis of action. Those cost which are fixed but change with production. Potential benefit that is lost when one course of action is chosen rather than an Fixed Cost 5 Opportunity Cost alternative course of action. Cost which contain both Variable and Fixed which change in total but not in proportion to activity level. Mixed Cost The range of activity over which the company expecets to operate during the 7 Relevant Range year. Any event, action, transaction that incurr cost when producing a product A cost that cannot be changed in present but can be in the future. The cost which remain the same regardless of production of units. The amount of revenue remaining after deducting variable cost. Level of activity at which revenues equal total cost, fixed and variable. The net income the management sets to determine break even analysis. The unit selling price less variable costs. Eliminates the high and low cost from a time period and average all other cost. Activity Sunk Cost 10 Variable Cost 11 Contribution Margin 12 Break Even Analysis 13 Target Net Income 14 Unit Contribution Margin 15 High Low Method 16) Which statement is False re: Cost Behavior Analysis: a) The study of how different cost respond to changes in the level of business activity. b) Business activities are the beginning of this analysis. c) The Activity Index identifies the activity that causes changes in behavior. d) Variable Cost are the only difference that causes changes in behavior. A) A is false B) B is false C) C is false D) D is false 17) Which statement is False as it regards Types of Incremental Analysis: a) Accept an order at a special price b) A decision with support for conclusion e.g. buy over rent. c) Make or buy part or finished products d) Allocate these cost to each period of production. e) Allocate these cost to each product. A) A is false B) B is false C) C is false D) D is false 18) Which statement is False as it regards Variable and Fixed Cost: a) Cost directly and proportionately with changes in the activity level b) A cost that remains the same per unit at every level of activity. e) Cost that remain the same until the production increases then these unit cost increase. d) The unit fixed cost decreases as the production increases. A) A is False B) B is False C) C is False D) D is False 19) Which statement is False as it regards Relevant Cost: a) Production of units does increase Fixed cost. b) Full capacity production of a plant normally rejects a special order which would increase production. c) An increase in unit cost will reject the production of a special order for production. d) An Opportunity Cost may be a potential benefit in the long term production plan. C) C is False D) D is False B) B is False A) A is False Which statement is False as it regards Mixed Costs Costs that contain both a variable and fixed cost element CVP analysis provides for mixed cost not being classified into their elements. e) Change in total but not proportionately with changes in activity level d) Mixed Cost have a relevant range. A) A is False B) B is False C) C is False D) D is False 21) Which statement is False as it regards Relevant Cost a) Relevant cost will always determine that renting or leasing is better than buying. b) Relevant Cost are used to determine whether to eliminate an unprofitable product. c) Relevant Cost is used to consider in repairing or retaining or replacing equipment. d) Relevant Cost is used to determine selling or process a product further a) A is False b) Bis False c) C is False d) D is False 22) Which statement is False as it regards High Low Method: a. The costs incurred at the high and low levels of activity to classify mixed costs into fied and variable components. Level low activity level from the total cost at that level. b. Variable Cost per unit were the change in Total Cost divided by the Difference in Activity c. Fixed Cost were assigned based upon subtracting the total variable costs at either the high d. The Variable and Fixed Cost divided by the total activity provides the Total Cost. A) A is False, e.g. utilities. B) B is False C) C is False D) D is False 23) Which statement is False as it CVP Income Statement: A. The Statement deduets the variable and fixed cost from the Sales to get th Net Income. B. The Income Statement does not determine the Contribution of Margin. C. The Sales less the Variable cost gives us the Contribution of Margin. D. The Contribution Margin is the Net Income divided by the Unit Selling Price. A) A is False B) B is False C) C is False d) D IS False The following statements are False as it regards Break Even Analysis and Target Net Income: a. Break Even Point can be determined in either units produced of Net Income Margin b. Target Net Income is the income set by management for sales. c. Margin of Safety is the difference between actual or expected sales in dollars. d. Sales and Production must meet the outcome of all these analysis. a) A is False b) Bis False c) C is False d)D is False 5) The following statements are False as it regards Incremental Analysis a) In incremental analysis only the cost never revenue vary. B) Relevant Cost are those cost or revenues that differ across alternatives. c) Opportunity Cost is the lost benefit from making one decision over another. d) Overhead is assigned to Finished Goods and not to Work in Process. a) A is False b) B is False c) C is False d) D is False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts