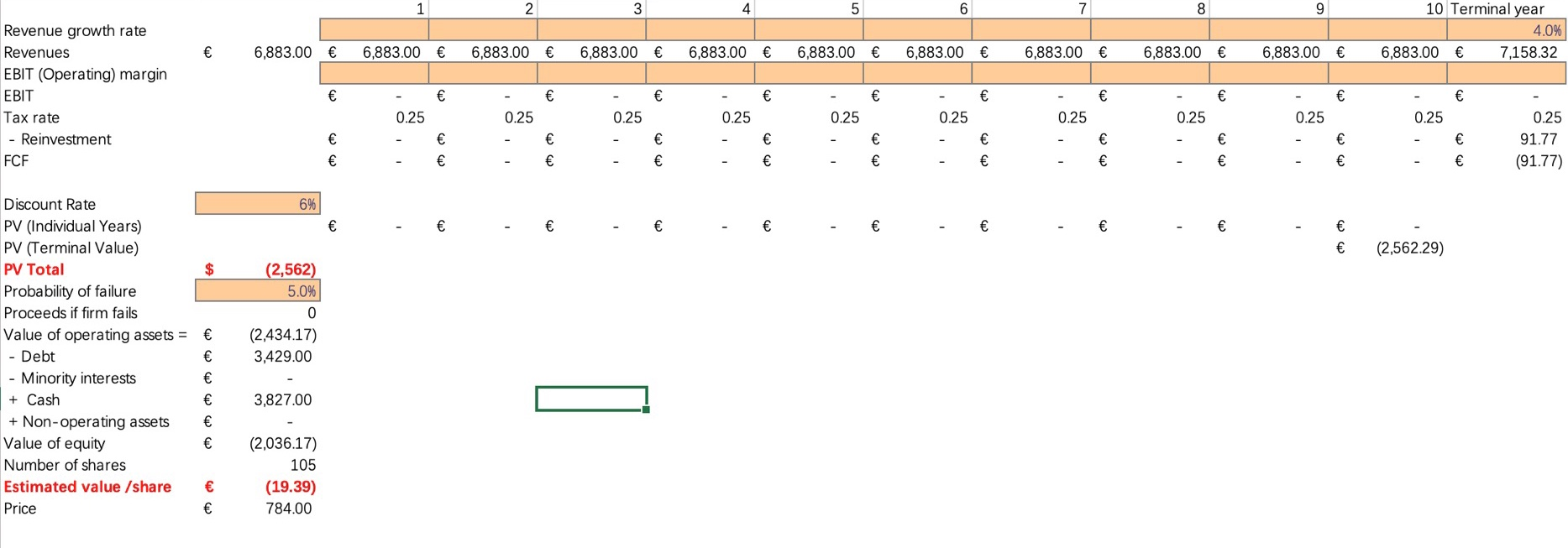

Please answer all questions according to the first picture! Thanks!

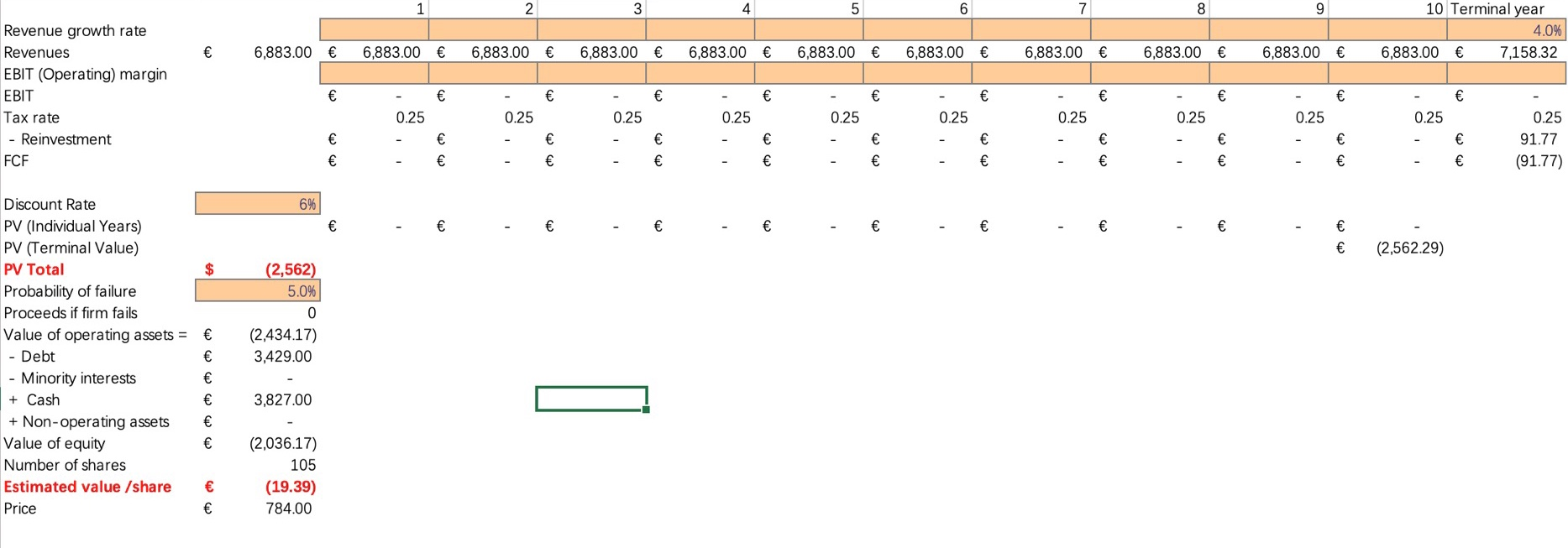

- B C D E F G 1 Estimate revenue growth for the first ten years (Leave the terminal growth at 4%). Explain your estimate in 1-2 sentences. N Estimate the operating margin for the first ten years and the terminal year. Explain your estimate in 1-2 sentences. 3 (Leave the discount rate at 5%). 4 (Leave the probability of failure at 5%). 5 Is Hermes over- or underpriced based on your analysis? How would you trade? Explain in 1-2 sentences. 1 2 3 5 6 7 8 9 10 Terminal year 4.0% 6,883.00 7,158.32 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 Revenue growth rate Revenues EBIT (Operating) margin EBIT Tax rate - Reinvestment FCF 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 91.77 (91.77) 6% (2,562.29) Discount Rate PV (Individual Years) PV (Terminal Value) PV Total Probability of failure Proceeds if firm fails Value of operating assets = - Debt - Minority interests + Cash + Non-operating assets Value of equity Number of shares Estimated value /share Price (2,562) 5.0% 0 (2,434.17) 3,429.00 3,827.00 (2,036.17) 105 (19.39) 784.00 B C D E F 1 2 PE 4 Hermes 45.63 5 6 7 8 9 10 11 12 13 14 15 > U 16 - B C D E F G 1 Estimate revenue growth for the first ten years (Leave the terminal growth at 4%). Explain your estimate in 1-2 sentences. N Estimate the operating margin for the first ten years and the terminal year. Explain your estimate in 1-2 sentences. 3 (Leave the discount rate at 5%). 4 (Leave the probability of failure at 5%). 5 Is Hermes over- or underpriced based on your analysis? How would you trade? Explain in 1-2 sentences. 1 2 3 5 6 7 8 9 10 Terminal year 4.0% 6,883.00 7,158.32 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 Revenue growth rate Revenues EBIT (Operating) margin EBIT Tax rate - Reinvestment FCF 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 91.77 (91.77) 6% (2,562.29) Discount Rate PV (Individual Years) PV (Terminal Value) PV Total Probability of failure Proceeds if firm fails Value of operating assets = - Debt - Minority interests + Cash + Non-operating assets Value of equity Number of shares Estimated value /share Price (2,562) 5.0% 0 (2,434.17) 3,429.00 3,827.00 (2,036.17) 105 (19.39) 784.00 B C D E F 1 2 PE 4 Hermes 45.63 5 6 7 8 9 10 11 12 13 14 15 > U 16