Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all Questions and provide working out How were the risks in ABS CDOs misjudged by the market? a. Investors underestimated default correlations between

Please answer all Questions and provide working out

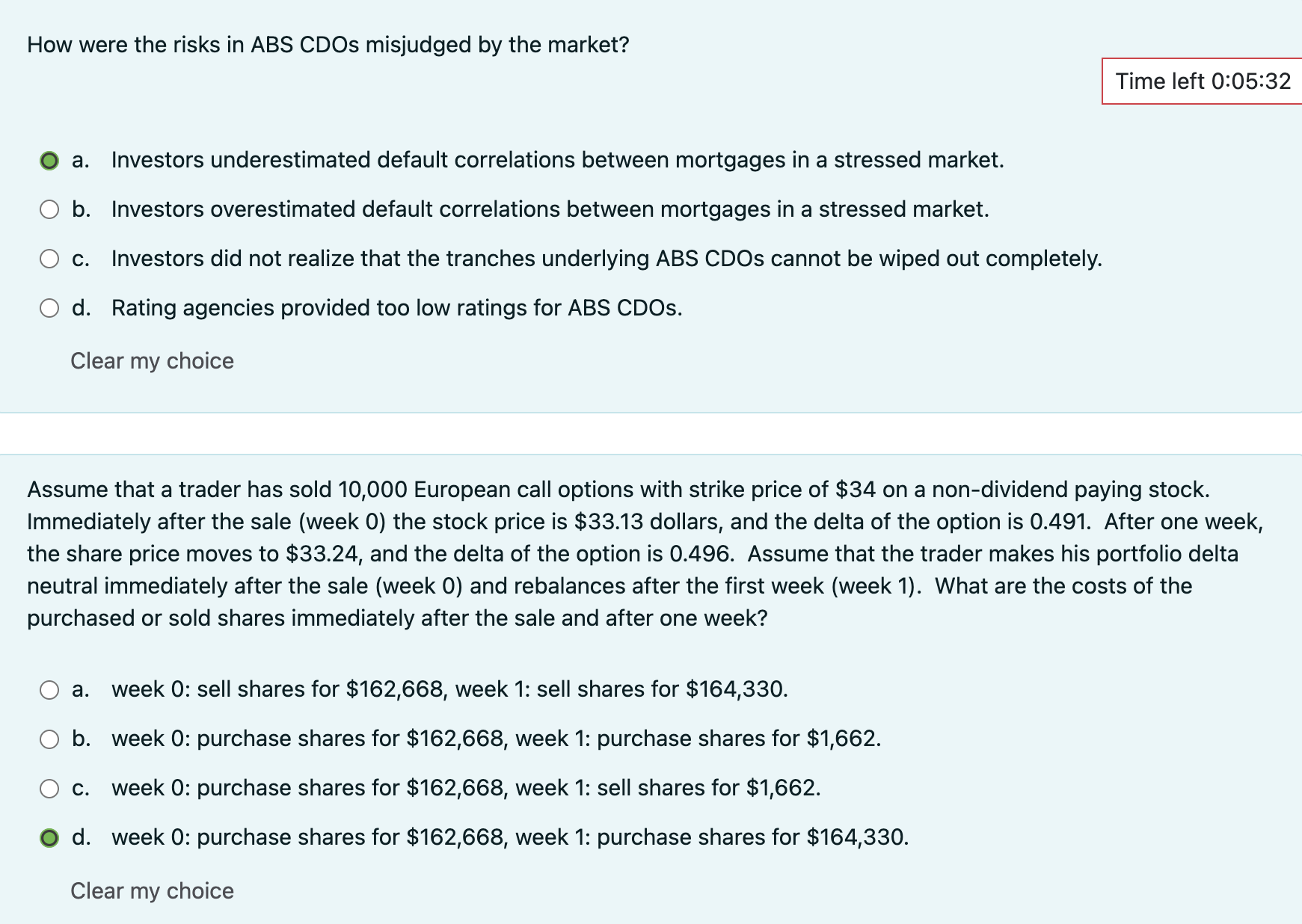

How were the risks in ABS CDOs misjudged by the market? a. Investors underestimated default correlations between mortgages in a stressed market. b. Investors overestimated default correlations between mortgages in a stressed market. c. Investors did not realize that the tranches underlying ABS CDOs cannot be wiped out completely. d. Rating agencies provided too low ratings for ABS CDOs. Clear my choice Assume that a trader has sold 10,000 European call options with strike price of $34 on a non-dividend paying stock. Immediately after the sale (week 0 ) the stock price is $33.13 dollars, and the delta of the option is 0.491 . After one week, the share price moves to $33.24, and the delta of the option is 0.496 . Assume that the trader makes his portfolio delta neutral immediately after the sale (week 0 ) and rebalances after the first week (week 1). What are the costs of the purchased or sold shares immediately after the sale and after one week? a. week 0: sell shares for $162,668, week 1: sell shares for $164,330. b. week 0: purchase shares for $162,668, week 1: purchase shares for $1,662. c. week 0: purchase shares for $162,668, week 1 : sell shares for $1,662. d. week 0: purchase shares for $162,668, week 1: purchase shares for $164,330. Clear my choice

How were the risks in ABS CDOs misjudged by the market? a. Investors underestimated default correlations between mortgages in a stressed market. b. Investors overestimated default correlations between mortgages in a stressed market. c. Investors did not realize that the tranches underlying ABS CDOs cannot be wiped out completely. d. Rating agencies provided too low ratings for ABS CDOs. Clear my choice Assume that a trader has sold 10,000 European call options with strike price of $34 on a non-dividend paying stock. Immediately after the sale (week 0 ) the stock price is $33.13 dollars, and the delta of the option is 0.491 . After one week, the share price moves to $33.24, and the delta of the option is 0.496 . Assume that the trader makes his portfolio delta neutral immediately after the sale (week 0 ) and rebalances after the first week (week 1). What are the costs of the purchased or sold shares immediately after the sale and after one week? a. week 0: sell shares for $162,668, week 1: sell shares for $164,330. b. week 0: purchase shares for $162,668, week 1: purchase shares for $1,662. c. week 0: purchase shares for $162,668, week 1 : sell shares for $1,662. d. week 0: purchase shares for $162,668, week 1: purchase shares for $164,330. Clear my choice Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started