Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all Questions and provide working out Which of the following statements about the assumptions of the Capital Asset Pricing Model (CAPM) is correct?

Please answer all Questions and provide working out

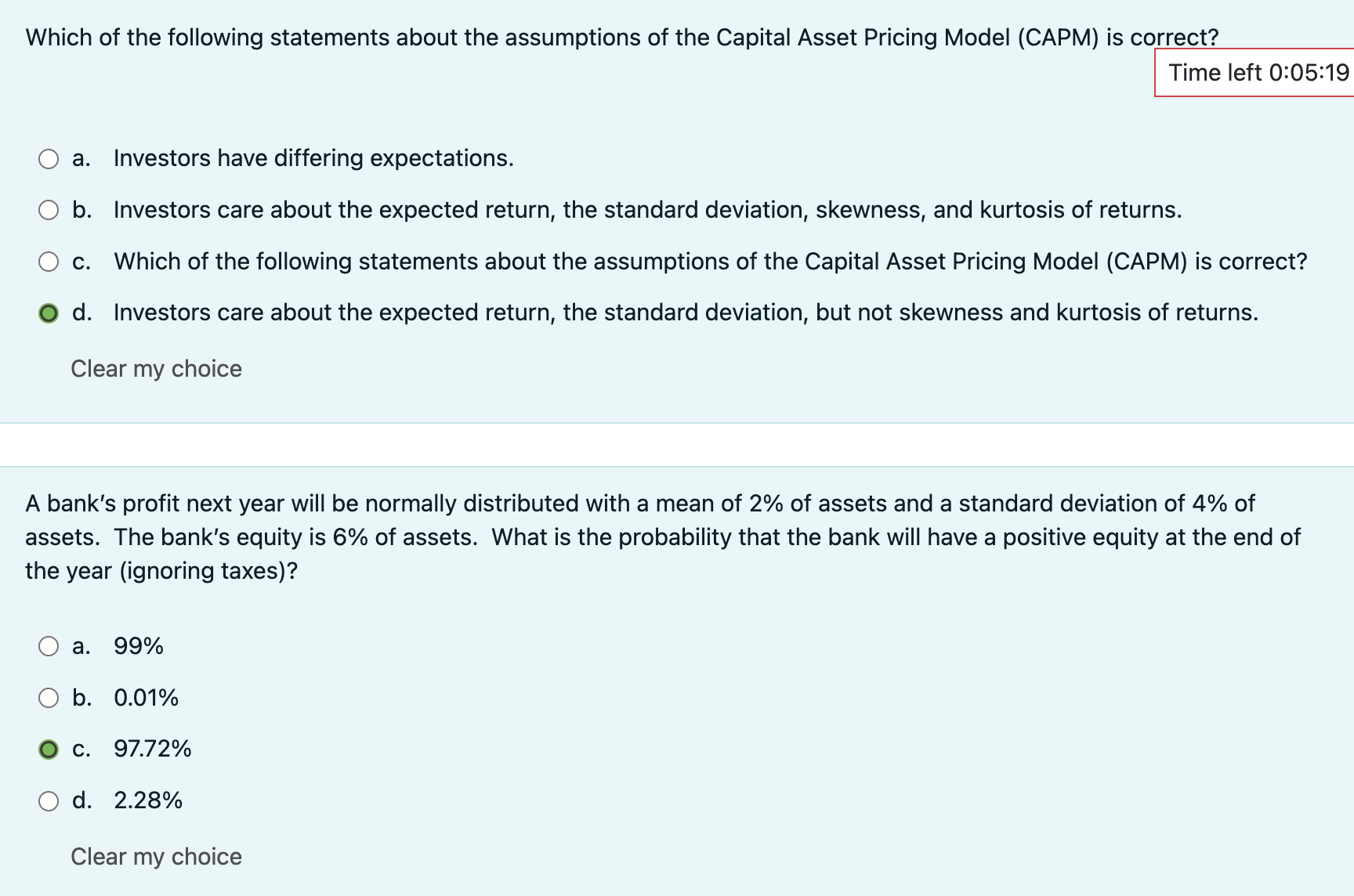

Which of the following statements about the assumptions of the Capital Asset Pricing Model (CAPM) is correct? a. Investors have differing expectations. b. Investors care about the expected return, the standard deviation, skewness, and kurtosis of returns. c. Which of the following statements about the assumptions of the Capital Asset Pricing Model (CAPM) is correct? d. Investors care about the expected return, the standard deviation, but not skewness and kurtosis of returns. Clear my choice A bank's profit next year will be normally distributed with a mean of 2% of assets and a standard deviation of 4% of assets. The bank's equity is 6% of assets. What is the probability that the bank will have a positive equity at the end of the year (ignoring taxes)? a. 99% b. 0.01% c. 97.72% d. 2.28% Clear my choice

Which of the following statements about the assumptions of the Capital Asset Pricing Model (CAPM) is correct? a. Investors have differing expectations. b. Investors care about the expected return, the standard deviation, skewness, and kurtosis of returns. c. Which of the following statements about the assumptions of the Capital Asset Pricing Model (CAPM) is correct? d. Investors care about the expected return, the standard deviation, but not skewness and kurtosis of returns. Clear my choice A bank's profit next year will be normally distributed with a mean of 2% of assets and a standard deviation of 4% of assets. The bank's equity is 6% of assets. What is the probability that the bank will have a positive equity at the end of the year (ignoring taxes)? a. 99% b. 0.01% c. 97.72% d. 2.28% Clear my choice Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started