please answer all questions and show full work and solutions, thanks!

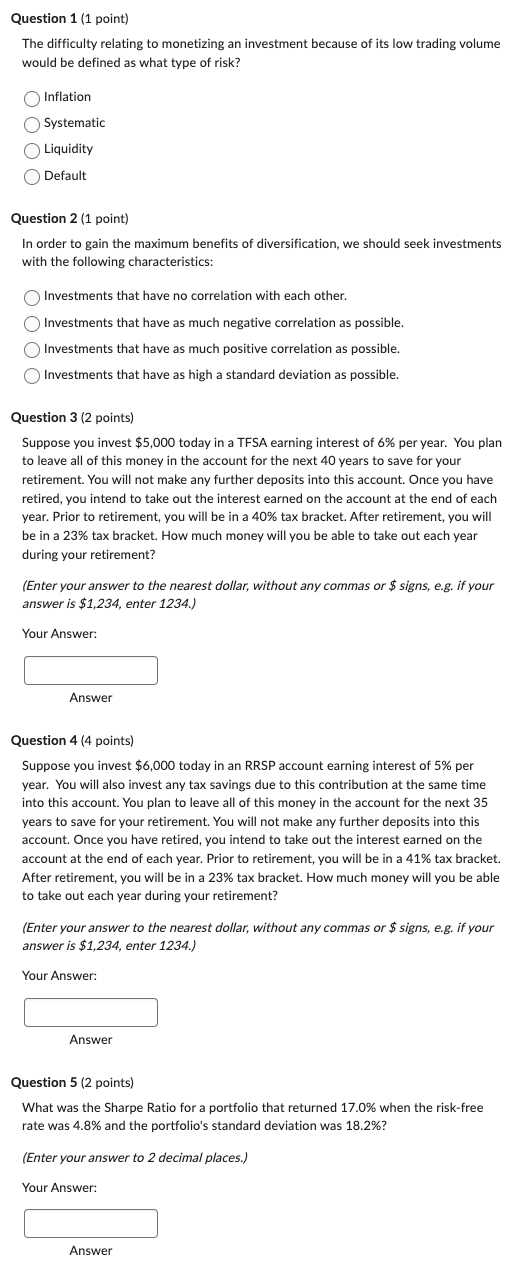

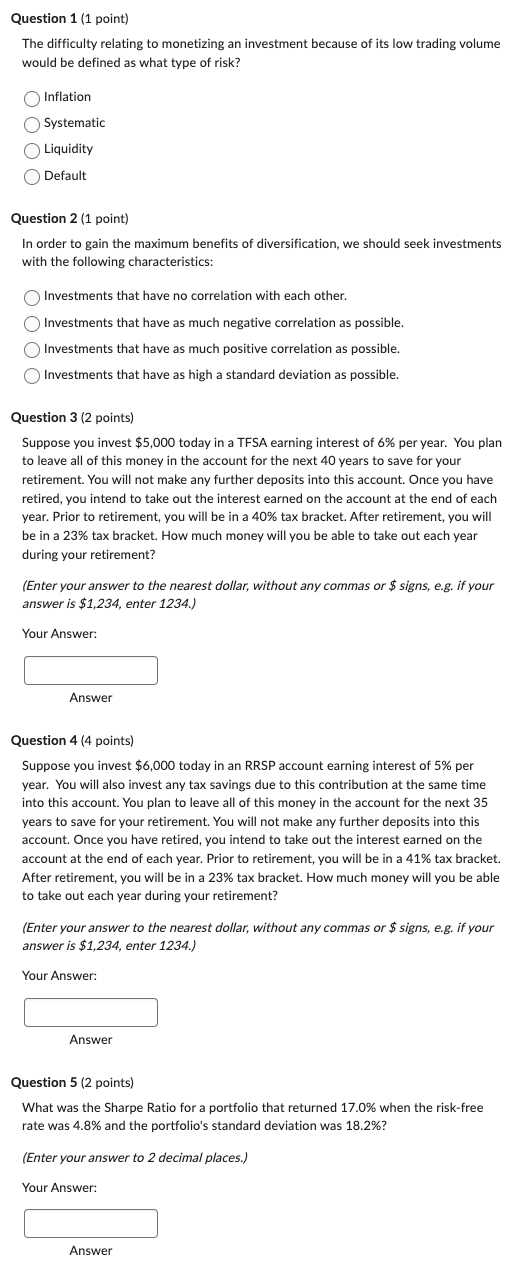

Question 1 (1 point) The difficulty relating to monetizing an investment because of its low trading volume would be defined as what type of risk? Inflation Systematic Liquidity Default Question 2 (1 point) In order to gain the maximum benefits of diversification, we should seek investments with the following characteristics: Investments that have no correlation with each other. Investments that have as much negative correlation as possible. Investments that have as much positive correlation as possible. Investments that have as high a standard deviation as possible. Question 3 (2 points) Suppose you invest $5,000 today in a TFSA earning interest of 6% per year. You plan to leave all of this money in the account for the next 40 years to save for your retirement. You will not make any further deposits into this account. Once you have retired, you intend to take out the interest earned on the account at the end oach year. Prior to retirement, you will be in a 40% tax bracket. After retirement, you will be in a 23% tax bracket. How much money will you be able to take out each year during your retirement? (Enter your answer to the nearest dollar, without any commas or $ signs, e.g. if your answer is $1,234, enter 1234.) Your Answer: Answer Question 4 (4 points) Suppose you invest $6,000 today in an RRSP account earning interest of 5% per year. You will also invest any tax savings due to this contribution at the same time into this account. You plan to leave all of this money in the account for the next 35 years to save for your retirement. You will not make any further deposits into this account. Once you have retired, you intend to take out the interest earned on the account at the end of each year. Prior to retirement, you will be in a 41% tax bracket. After retirement, you will be in a 23% tax bracket. How much money will you be able to take out each year during your retirement? (Enter your answer to the nearest dollar, without any commas or $ signs, e.g. if your answer is $1,234, enter 1234 .) Your Answer: Answer Question 5 (2 points) What was the Sharpe Ratio for a portfolio that returned 17.0% when the risk-free rate was 4.8% and the portfolio's standard deviation was 18.2% ? (Enter your answer to 2 decimal places.) Your Answer: Answer Question 1 (1 point) The difficulty relating to monetizing an investment because of its low trading volume would be defined as what type of risk? Inflation Systematic Liquidity Default Question 2 (1 point) In order to gain the maximum benefits of diversification, we should seek investments with the following characteristics: Investments that have no correlation with each other. Investments that have as much negative correlation as possible. Investments that have as much positive correlation as possible. Investments that have as high a standard deviation as possible. Question 3 (2 points) Suppose you invest $5,000 today in a TFSA earning interest of 6% per year. You plan to leave all of this money in the account for the next 40 years to save for your retirement. You will not make any further deposits into this account. Once you have retired, you intend to take out the interest earned on the account at the end oach year. Prior to retirement, you will be in a 40% tax bracket. After retirement, you will be in a 23% tax bracket. How much money will you be able to take out each year during your retirement? (Enter your answer to the nearest dollar, without any commas or $ signs, e.g. if your answer is $1,234, enter 1234.) Your Answer: Answer Question 4 (4 points) Suppose you invest $6,000 today in an RRSP account earning interest of 5% per year. You will also invest any tax savings due to this contribution at the same time into this account. You plan to leave all of this money in the account for the next 35 years to save for your retirement. You will not make any further deposits into this account. Once you have retired, you intend to take out the interest earned on the account at the end of each year. Prior to retirement, you will be in a 41% tax bracket. After retirement, you will be in a 23% tax bracket. How much money will you be able to take out each year during your retirement? (Enter your answer to the nearest dollar, without any commas or $ signs, e.g. if your answer is $1,234, enter 1234 .) Your Answer: Answer Question 5 (2 points) What was the Sharpe Ratio for a portfolio that returned 17.0% when the risk-free rate was 4.8% and the portfolio's standard deviation was 18.2% ? (Enter your answer to 2 decimal places.) Your