Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions and state answer clearly. Question 16 (2.5 points) Which of the traditional approaches to value is normally considered the most applicable

please answer all questions and state answer clearly.

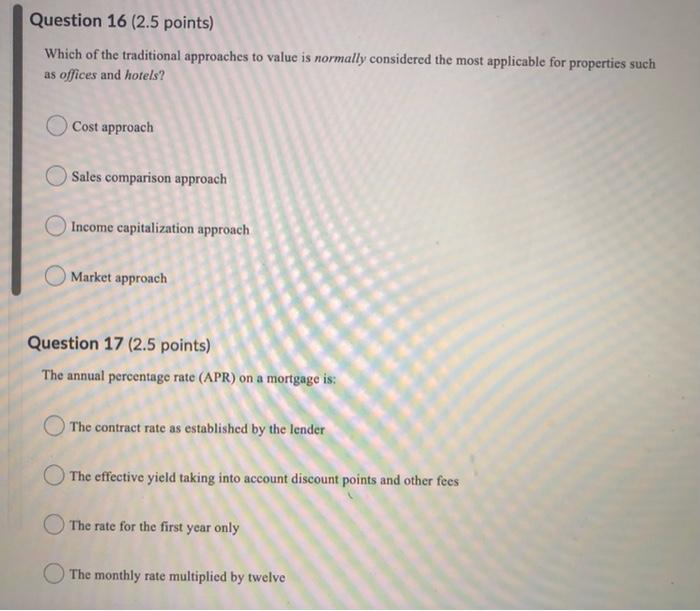

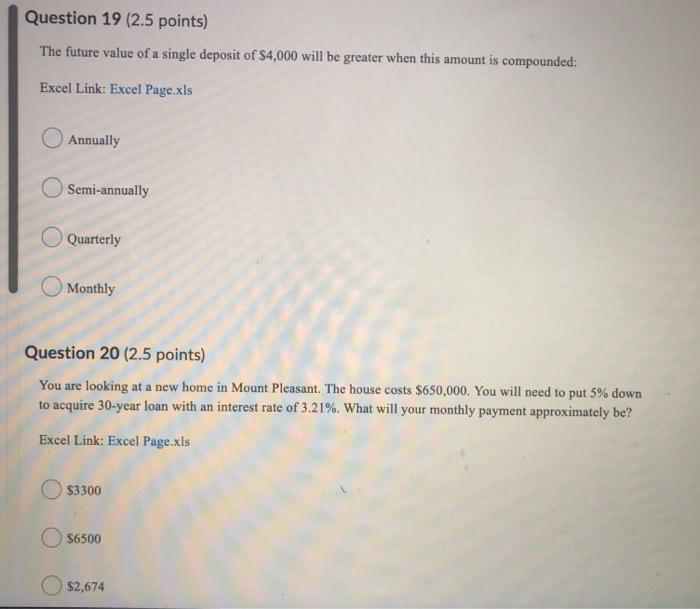

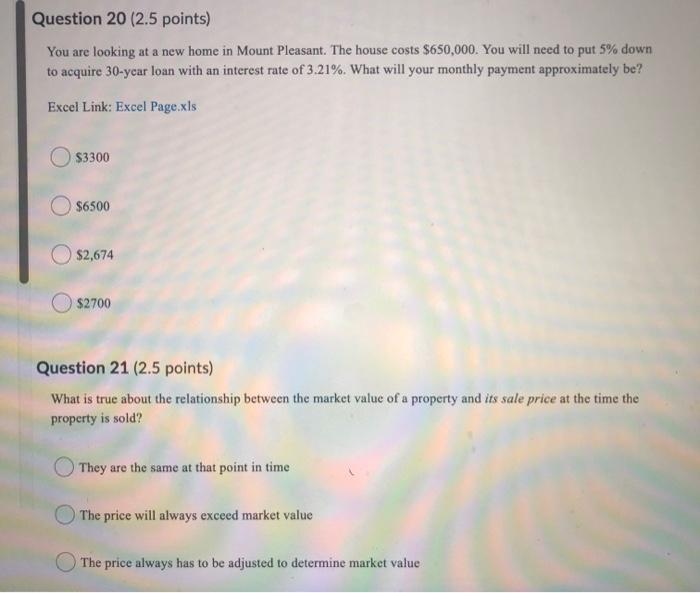

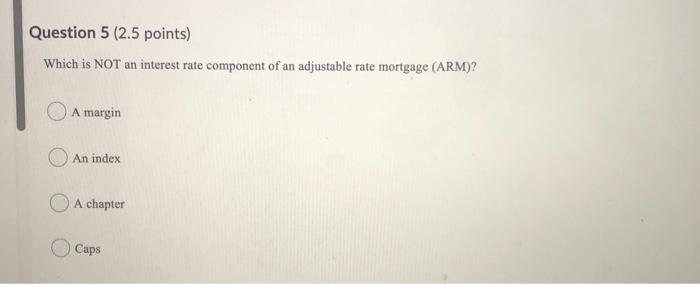

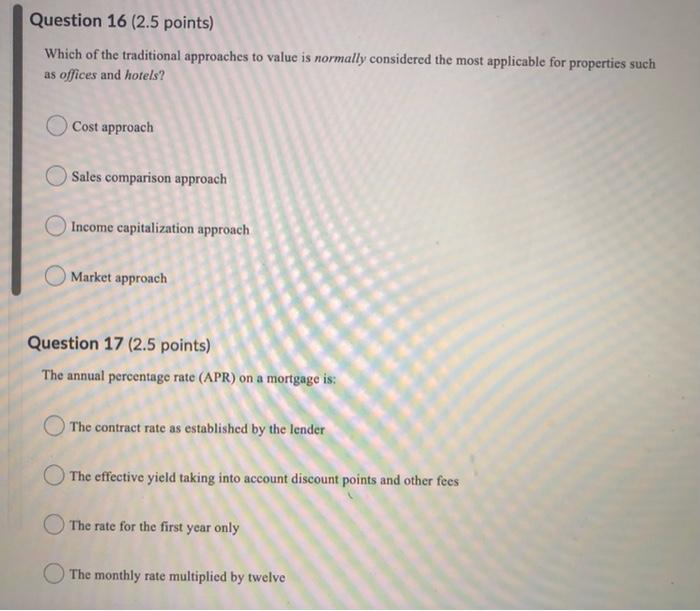

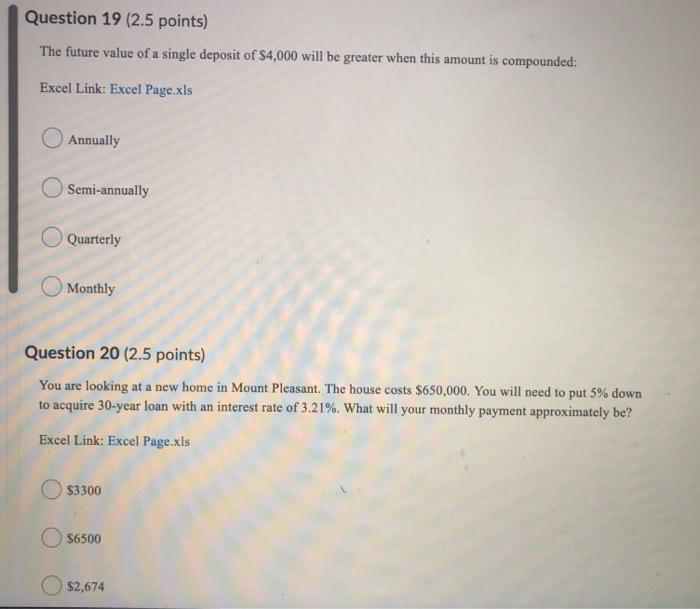

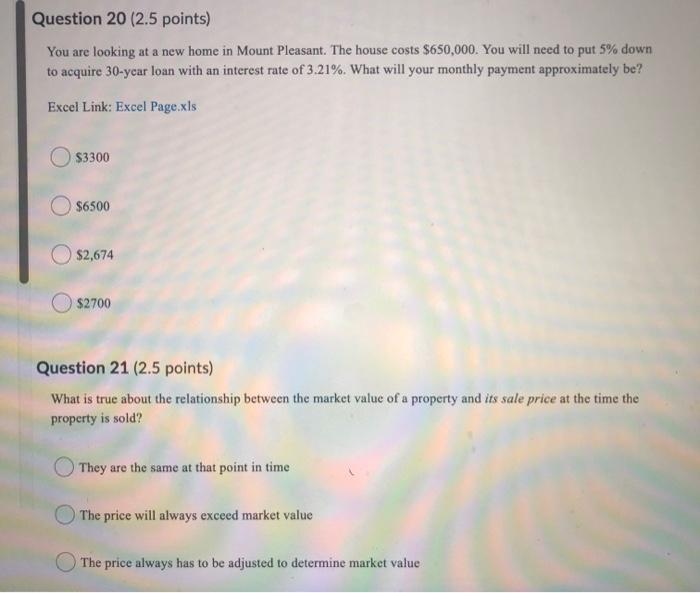

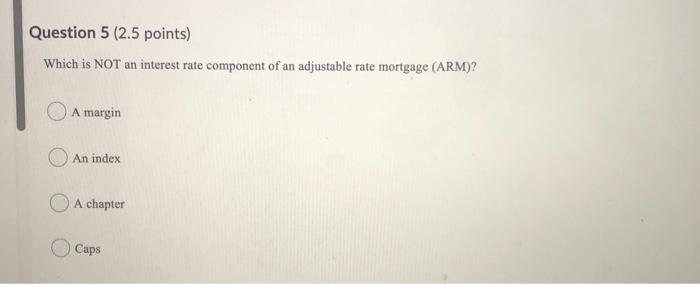

Question 16 (2.5 points) Which of the traditional approaches to value is normally considered the most applicable for properties such as offices and hotels? Cost approach Sales comparison approach Income capitalization approach Market approach Question 17 (2.5 points) The annual percentage rate (APR) on a mortgage is: The contract rate as established by the lender The effective yield taking into account discount points and other fees The rate for the first year only The monthly rate multiplied by twelve Question 19 (2.5 points) The future value of a single deposit of $4,000 will be greater when this amount is compounded: Excel Link: Excel Page.xls Annually O Semi-annually O Quarterly Monthly Question 20 (2.5 points) You are looking at a new home in Mount Pleasant. The house costs $650,000. You will need to put 5% down to acquire 30-year loan with an interest rate of 3.21%. What will your monthly payment approximately be? Excel Link: Excel Page.xls $3300 $6500 $2,674 Question 20 (2.5 points) You are looking at a new home in Mount Pleasant. The house costs $650,000. You will need to put 5% down to acquire 30-year loan with an interest rate of 3.21%. What will your monthly payment approximately be? Excel Link: Excel Page.xls $3300 $6500 $2,674 $2700 Question 21 (2.5 points) What is true about the relationship between the market value of a property and its sale price at the time the property is sold? They are the same at that point in time The price will always exceed market value The price always has to be adjusted to determine market value Question 5 (2.5 points) Which is NOT an interest rate component of an adjustable rate mortgage (ARM)? A margin An index A chapter Caps

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started