Answered step by step

Verified Expert Solution

Question

1 Approved Answer

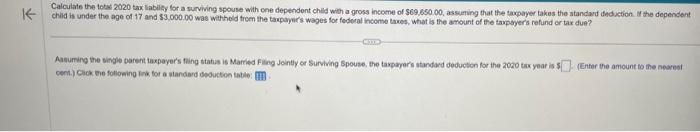

please answer all questions Calculate the totai 2020 tax liabilfy for a surviving spouse wilh one dependent child with a gross income of $69,650.00, assuming

please answer all questions

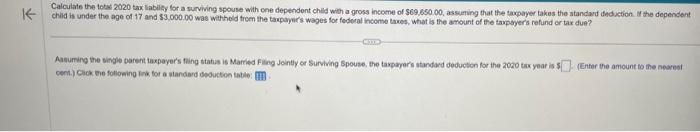

Calculate the totai 2020 tax liabilfy for a surviving spouse wilh one dependent child with a gross income of $69,650.00, assuming that the taxpayer lakes the atandard deduebon If the dependent child is under the age of 17 and $3,000.00 was witheld freen the tapaysis wages for fedctal inconse taves, what is the anount of the tapayers refund or tar due? (Enter the amount to the nearest cemt.) Click ele folloming Ins for a alandard desucton tatlle: Calculate the totai 2020 tax liabilfy for a surviving spouse wilh one dependent child with a gross income of $69,650.00, assuming that the taxpayer lakes the atandard deduebon If the dependent child is under the age of 17 and $3,000.00 was witheld freen the tapaysis wages for fedctal inconse taves, what is the anount of the tapayers refund or tar due? (Enter the amount to the nearest cemt.) Click ele folloming Ins for a alandard desucton tatlle

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started