Answered step by step

Verified Expert Solution

Question

1 Approved Answer

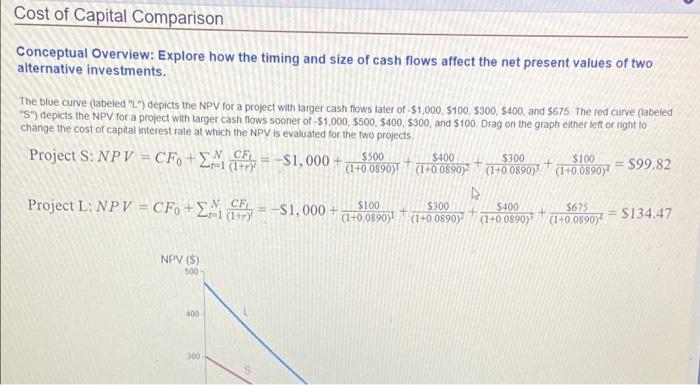

please answer all questions Cost of Capital Comparison Conceptual Overview: Explore how the timing and size of cash flows affect the net present values of

please answer all questions

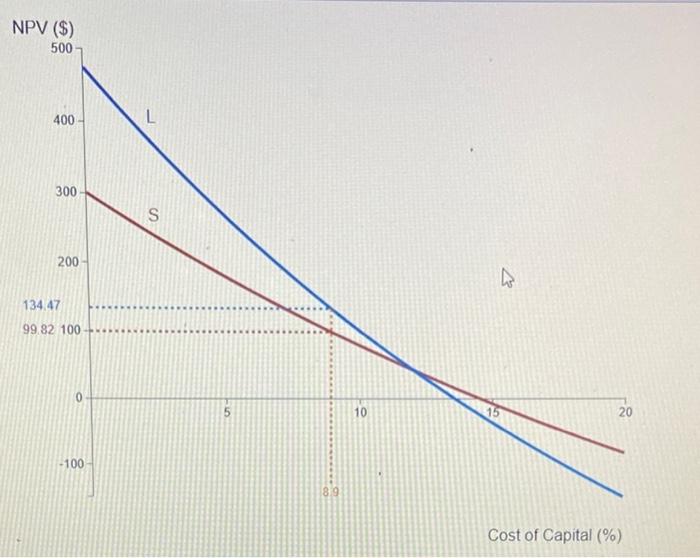

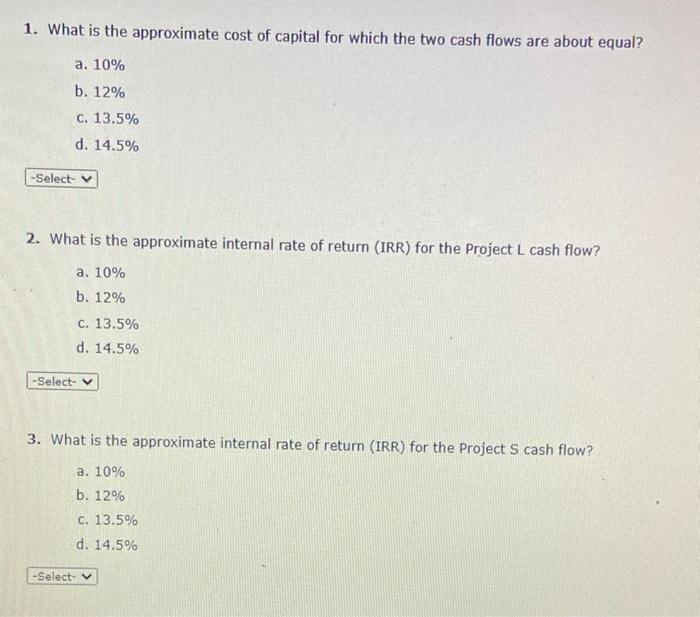

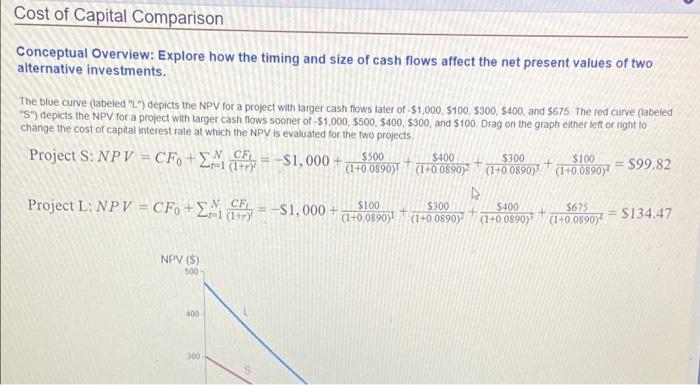

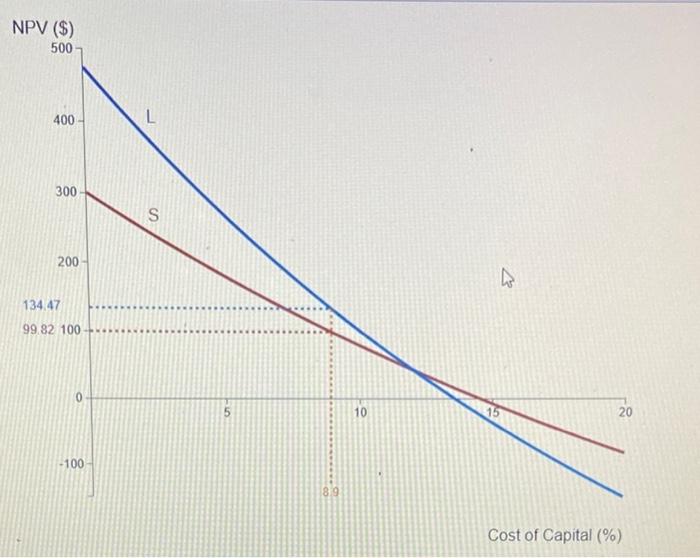

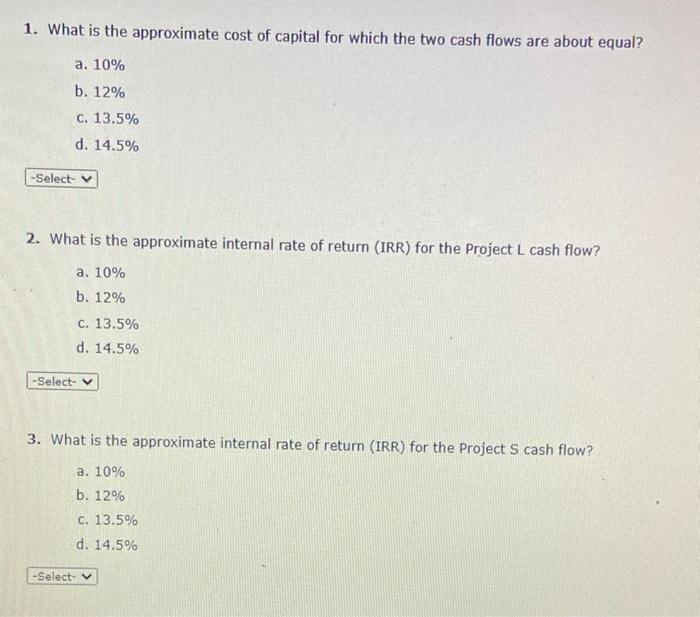

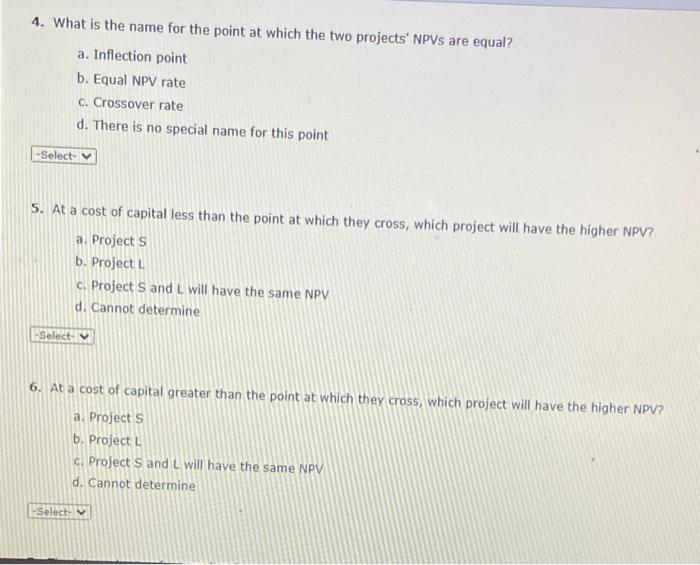

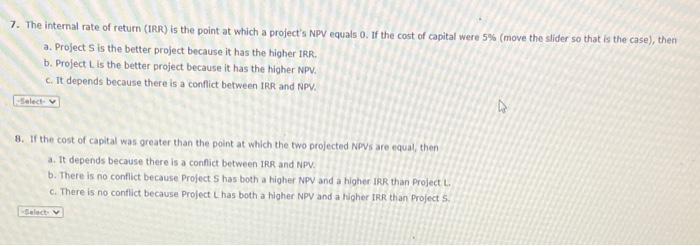

Cost of Capital Comparison Conceptual Overview: Explore how the timing and size of cash flows affect the net present values of two alternative investments. The blue curve (labeled "L") depicts the NPV for a project with larger cash flows later or -$1,000, 5100.5300, $400, and $675 The red curve (labeled **S") depicts the NPV for a project with larger cash flows sooner of $1,000, 5500 $400, $300 and 5100 Drag on the graph either left or right to change the cost of captal interest rate at which the NPV is evaluated for the two projects Project S: NPV = CF + EN CE $400 $ 21 (1+ (1+0.089037* (1+0 0890) + (1+0.089033 + (1+0.0890)= $99.82 -$1,000+ $500 Project L: NPV = CF0 + CF = $1,000+ $100 $300 (1+0,0890)! (1+0 0890) $400 (1+0.0890) $625 (140.08907 S134,47 NPV (S) 500 400 300 NPV ($) 500 400 L 300 S 200 134.47 99.82 100 10 20 -100 89 Cost of Capital (%) 1. What is the approximate cost of capital for which the two cash flows are about equal? a. 10% b. 12% C. 13.5% d. 14.5% -Select 2. What is the approximate internal rate of return (IRR) for the Project L cash flow? a. 10% b. 12% C. 13.5% d. 14.5% -Select- 3. What is the approximate internal rate of return (IRR) for the Project S cash flow? a. 10% b. 12% C. 13.5% d. 14.5% -Select- 4. What is the name for the point at which the two projects' NPVs are equal? a. Inflection point b. Equal NPV rate c. Crossover rate d. There is no special name for this point -Select- 5. At a cost of capital less than the point at which they cross, which project will have the higher NPV? a. Projects b. Project L c. Project S and I will have the same NPV d. Cannot determine -Select 6. At a cost of capital greater than the point at which they cross, which project will have the higher NPV? a. Projects b. Project c. Project S and L will have the same NPV d. Cannot determine -Select 7. The internal rate of return (IRR) is the point at which a project's NPV equals 0. If the cost of capital were 5% (move the slider so that is the case), then a. Project S is the better project because it has the higher IRR. b. Project Lis the better project because it has the higher NPV. c. It depends because there is a conflict between IRR and NPV. 8. If the cost of capital was greater than the point at which the two projected NPVs are equal, then a. It depends because there is a conflict between IRR and NPV. b. There is no conflict because Project Shas both a higher NPV and a higher IRR than Project c. There is no conflict because Project L has both a higher NPV and a higher IRR than Projects

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started