Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions, fast and correctly! Required information [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine

Please answer all questions, fast and correctly!

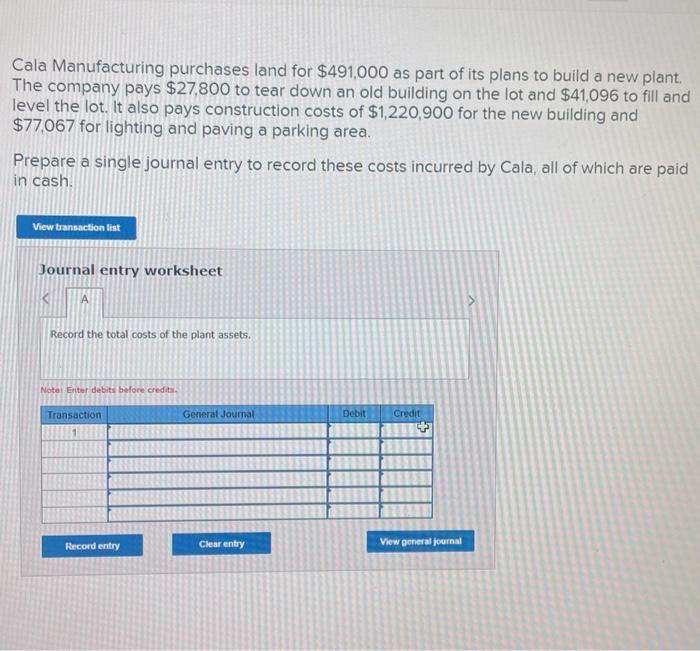

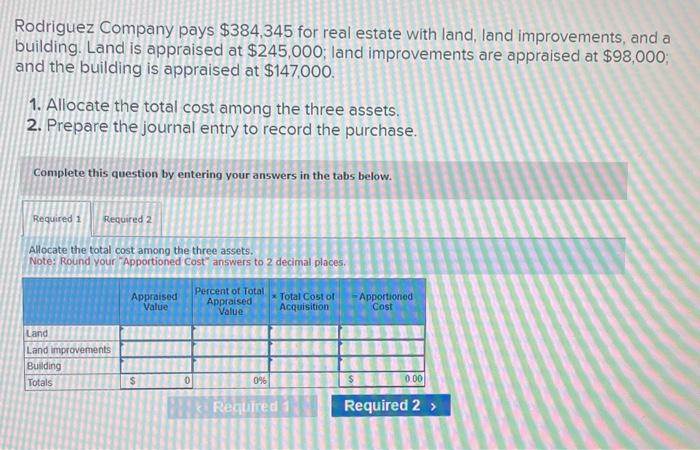

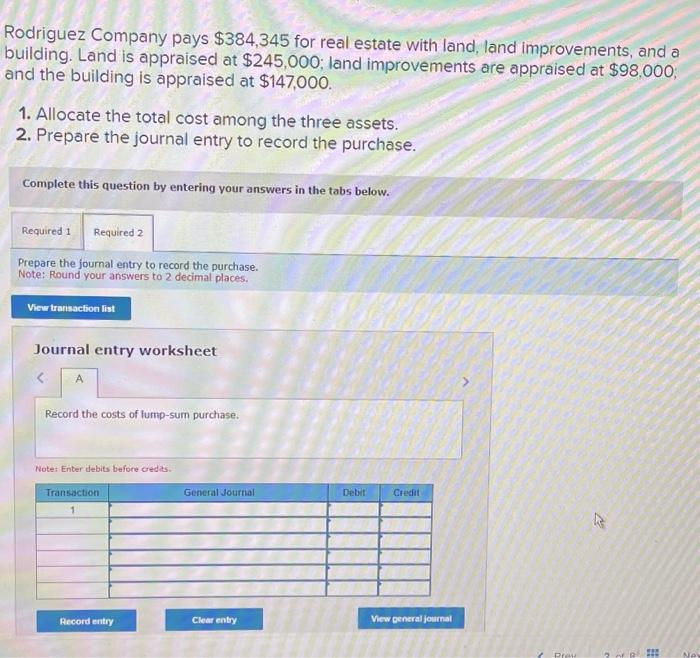

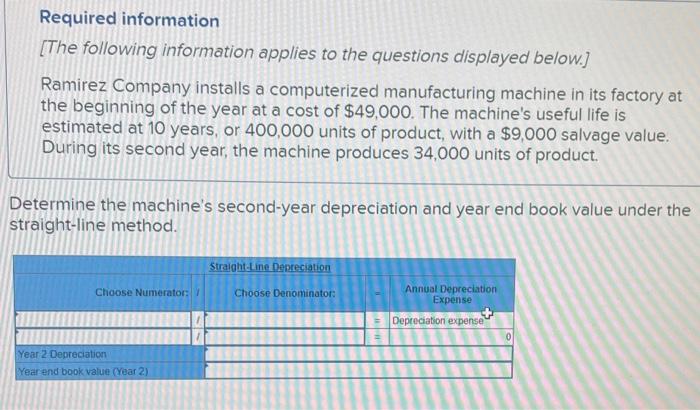

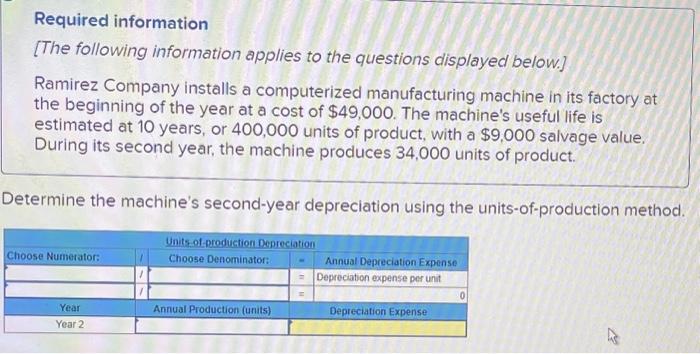

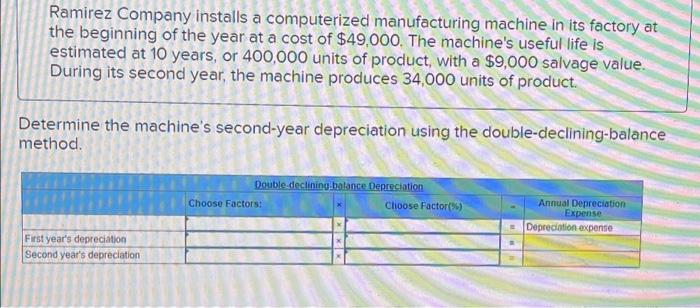

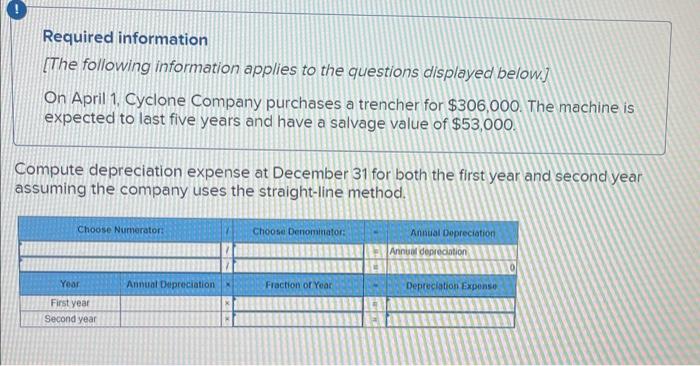

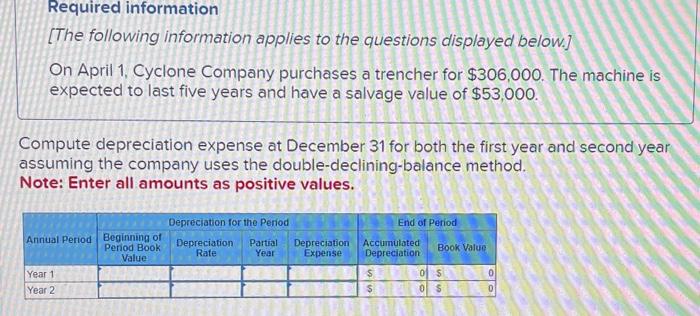

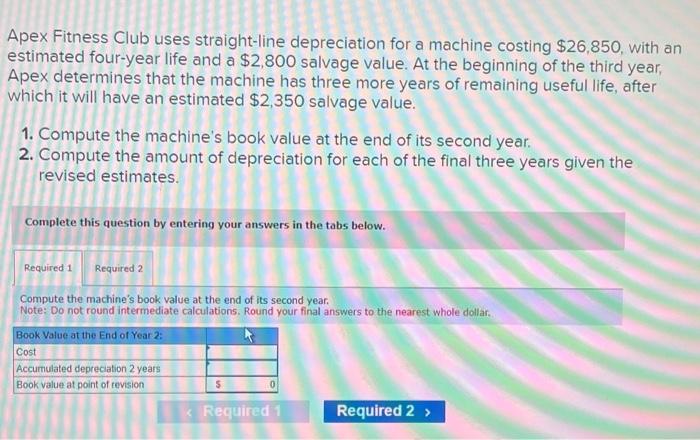

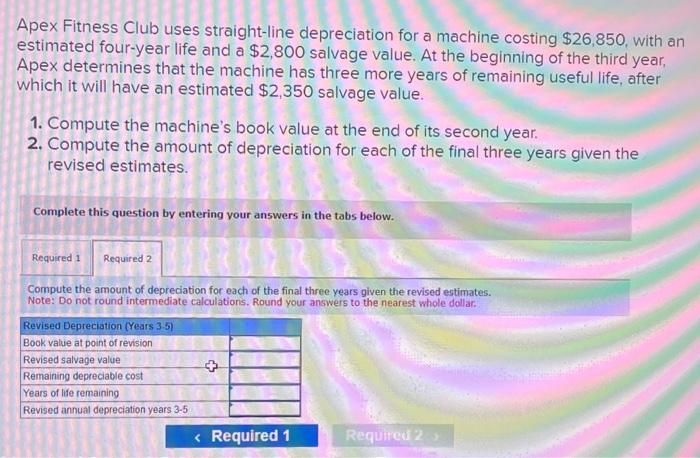

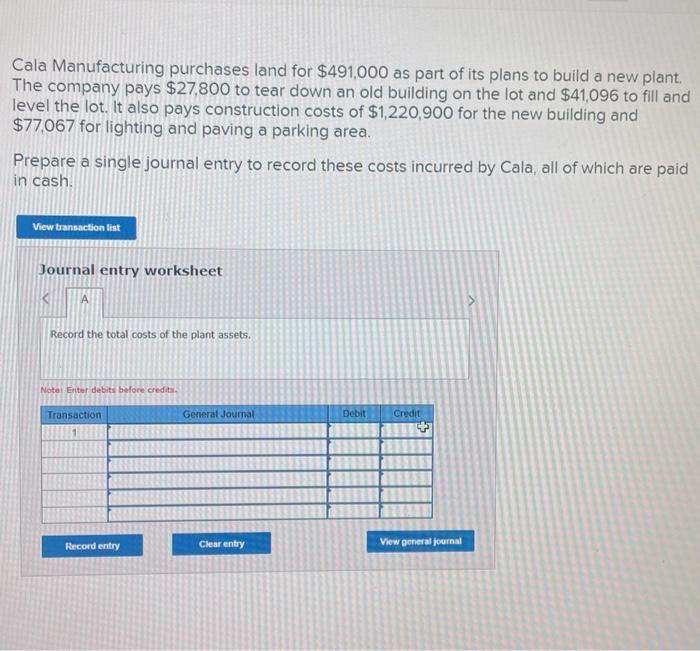

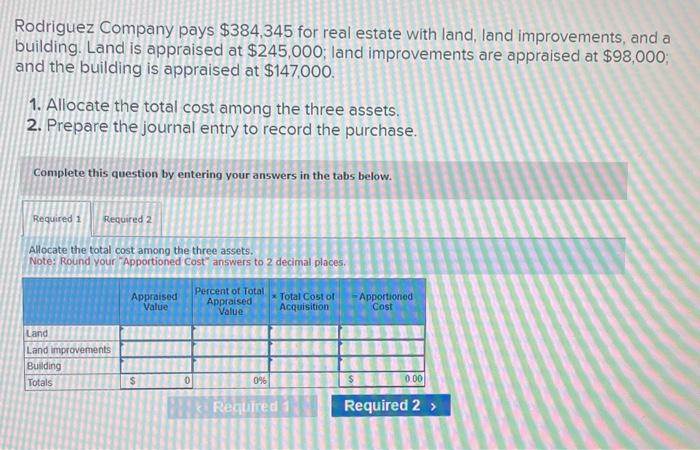

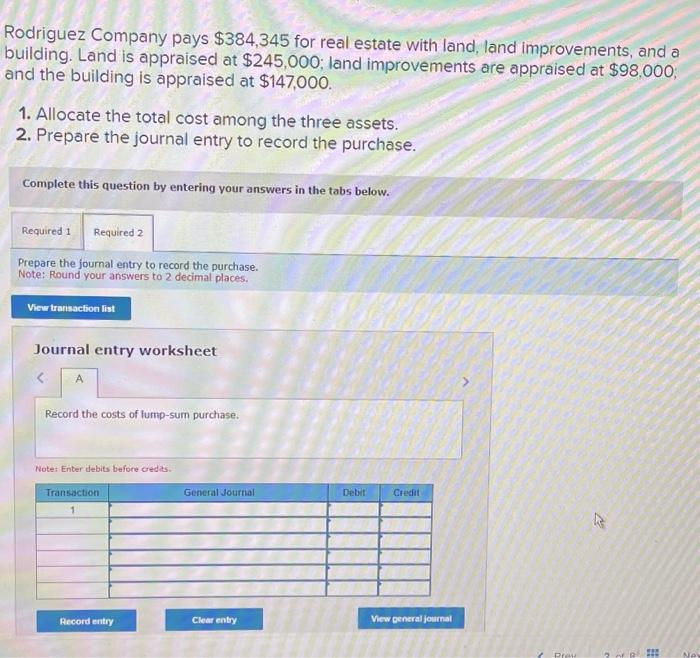

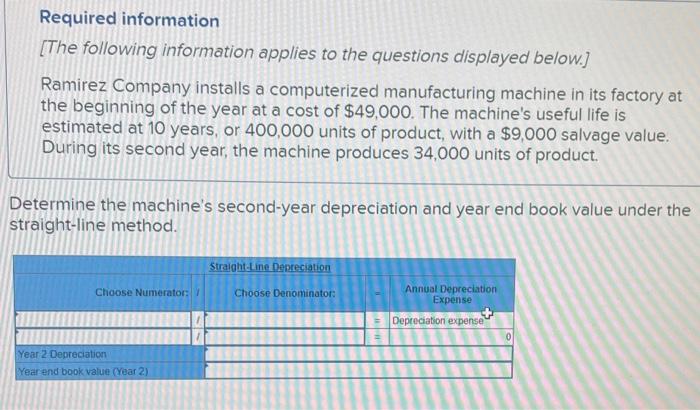

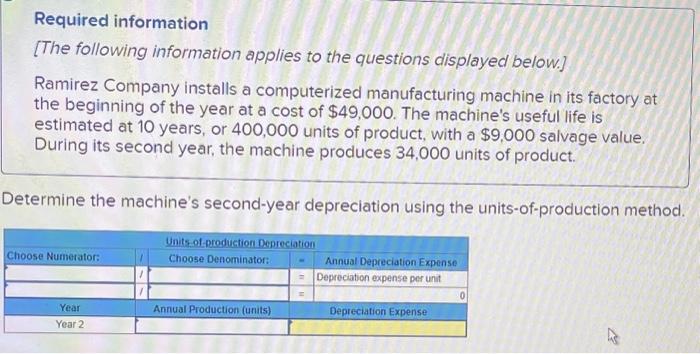

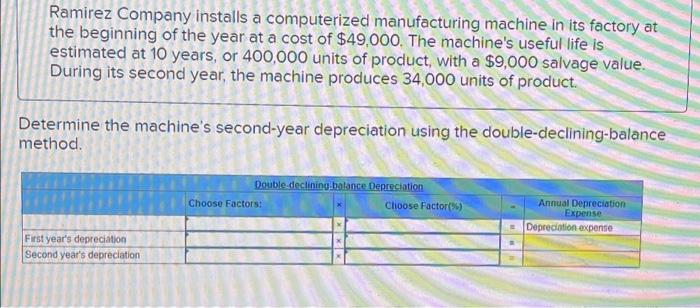

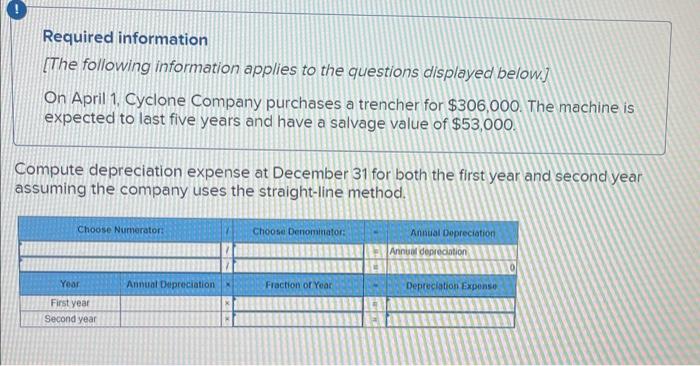

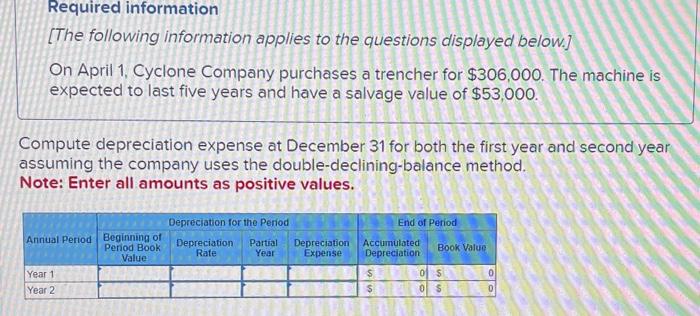

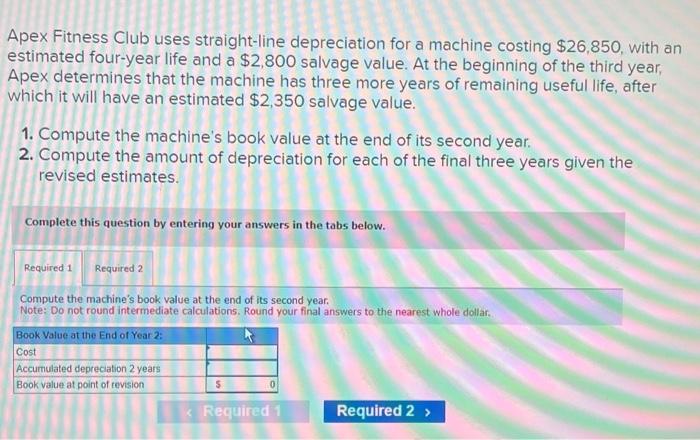

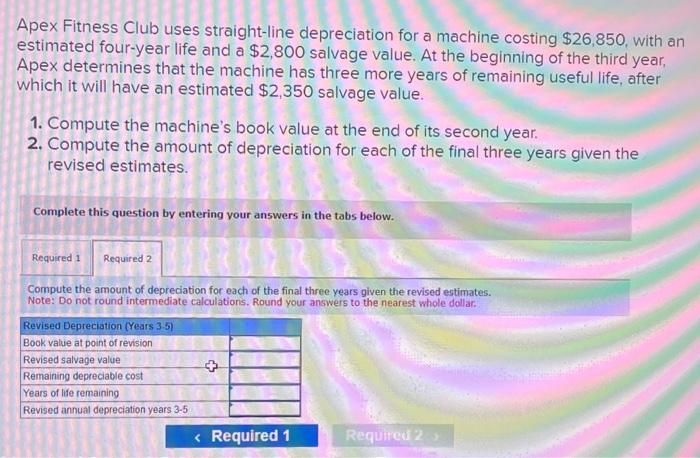

Required information [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $49,000. The machine's useful life is estimated at 10 years, or 400,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,000 units of product. Determine the machine's second-year depreciation using the units-of-production method. Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $49,000. The machine's useful life is estimated at 10 years, or 400,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,000 units of product. Determine the machine's second-year depreciation using the double-declining-balance method. [The following information applies to the questions displayed below.] On April 1, Cyclone Company purchases a trencher for $306,000. The machine is expected to last five years and have a salvage value of $53,000. Compute depreciation expense at December 31 for both the first year and second year assuming the company uses the double-declining-balance method. Note: Enter all amounts as positive values. Apex Fitness Club uses straight-line depreciation for a machine costing $26,850, with an estimated four-year life and a $2,800 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $2,350 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Compute the machine's book value at the end of its second year. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Apex Fitness Club uses straight-line depreciation for a machine costing $26,850, with an estimated four-year life and a $2,800 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $2,350 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering vour answers in the tabs below. Compute the amount of depreciation for each of the final three years given the revised estimates. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar. Rodriguez Company pays $384,345 for real estate with land, land improvements, and a building. Land is appraised at $245,000; land improvements are appraised at $98,000; and the building is appraised at $147,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Allocate the total cost among the three assets. Note: Round your "Apportioned Cost" answers to 2 decimal places. Required information [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $49,000. The machine's useful life is estimated at 10 years, or 400,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,000 units of product. Determine the machine's second-year depreciation and year end book value under the straight-line method. Rodriguez Company pays $384,345 for real estate with land, land improvements, and a building. Land is appraised at $245,000; land improvements are appraised at $98,000; and the building is appraised at $147,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Prepare the fournal entry to record the purchase. Note: Round your answers to 2 decimal places. Journal entry worksheet Cala Manufacturing purchases land for $491,000 as part of its plans to build a new plant. The company pays $27,800 to tear down an old building on the lot and $41,096 to fill and level the lot. It also pays construction costs of $1,220,900 for the new building and $77,067 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash. Journal entry worksheet Record the total costs of the plant assets. Required information [The following information applies to the questions displayed below.] On April 1, Cyclone Company purchases a trencher for $306,000. The machine is expected to last five years and have a salvage value of $53,000. Compute depreciation expense at December 31 for both the first year and second year assuming the company uses the straight-line method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started