Question

PLEASE ANSWER ALL QUESTIONS FOR THUMBS UP Assume that you have been appointed as finance consultant to assist the company. Extracts details from recent financial

PLEASE ANSWER ALL QUESTIONS FOR THUMBS UP

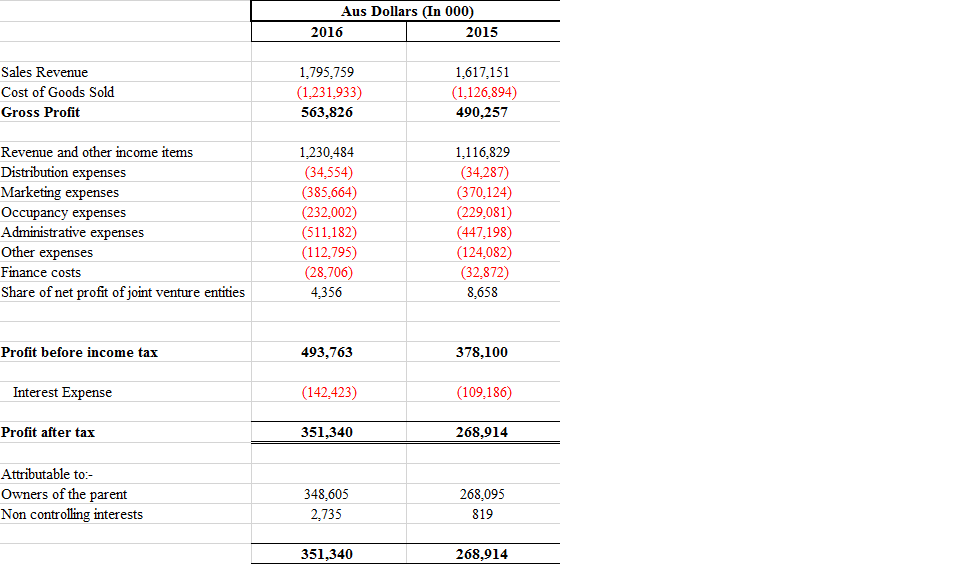

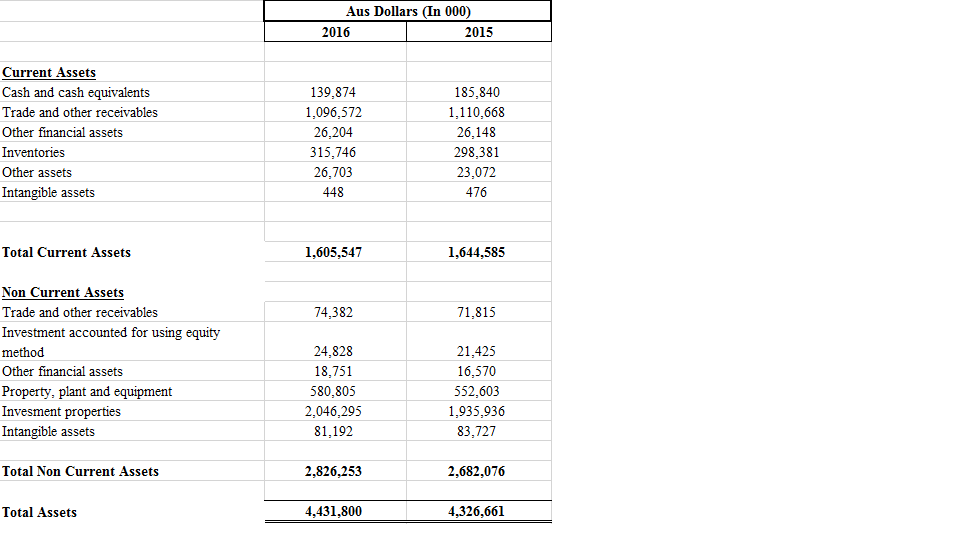

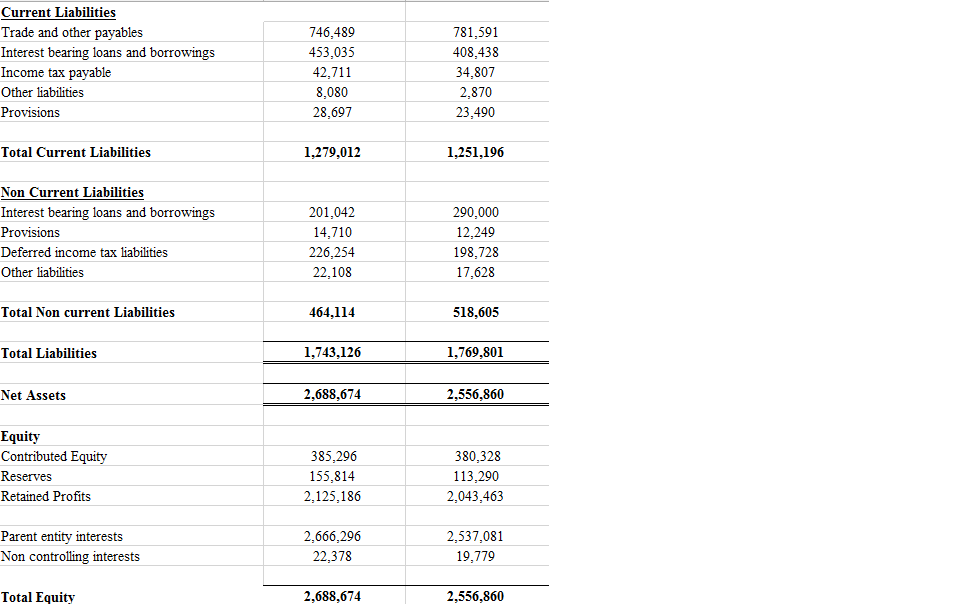

Assume that you have been appointed as finance consultant to assist the company. Extracts details from recent financial statements of the company (attached below) and analyses the situation by using below guidance:

Required:

You have to make report to cover the followings;

(a) Calculate the following ratios for each year and comment on your findings.

(i) Inventory days

(ii) Receivables days

(iii) Payables days

(b) Calculate the length of the cash operating cycle (working capital cycle) for each year and explain its significance.

(c) Discuss the relationship between working capital management and business solvency, and explain the factors that influence the optimum cash level for a business.

(d) A factor has offered to take over sales ledger administration and debt collection for an annual fee of 0.5% of credit sales. A condition of the offer is that the factor will advance ABC 80% of the face value of its debtors at an interest rate 1% above the current overdraft rate. The factor claims that it would reduce outstanding debtors by 30% and reduce administration expenses by 2% per year if its offer were accepted.

Required:

Evaluate whether the factors offer is financially acceptable, basing your answer on the financial information relating to a year

Aus Dollars (In 000) 2016 2015 Sales Revenue Cost of Goods Sold Gross Profit 1,795,759 (1,231,933) 563,826 1,617,151 (1,126.894) 490,257 Revenue and other income items 1,230,484 (34,554 (385,664 (232,002) (511,182) (112,795) (28,706) 4,356 1,116,829 (34,28 (370,124) (229,081) 447,198) (124,082) (32,872) expenses Marketing expenses Occupancy expenses Admnstrative expenses Other expenses Fnance costs Share of net profit of joint venture entities 8,658 Profit before income tax 378,100 493,763 (142,423) 351,340 Interest Expense (109,186) Profit after tax 268,914 Attributable to:- Owners of the parent Non controlling interests 268,095 819 348,605 2,735 351,340 268,914

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started