Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions in 10 min thanks The use of which of the following could lead to incorrect decisions in comparing mutually exclusive projects?

please answer all questions in 10 min thanks

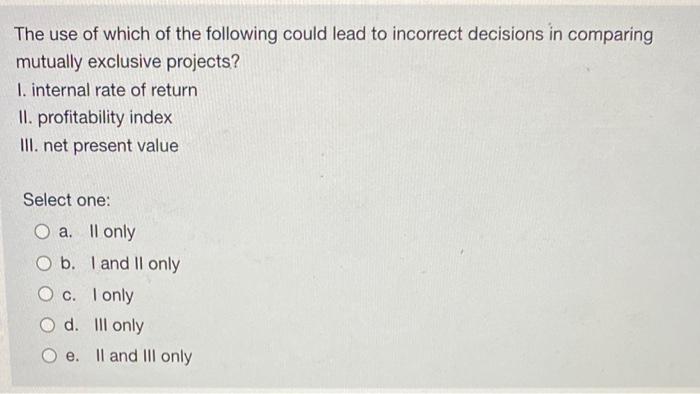

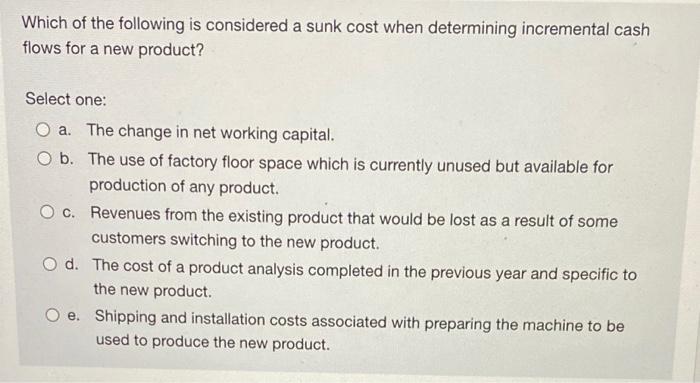

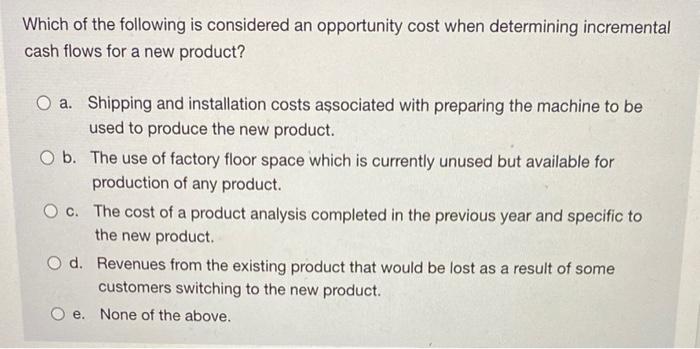

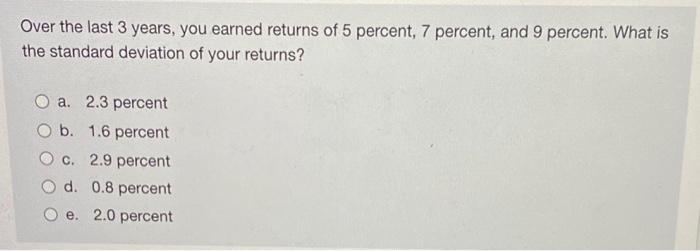

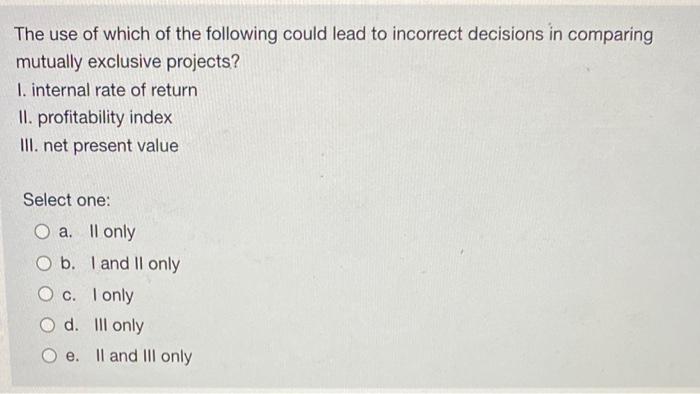

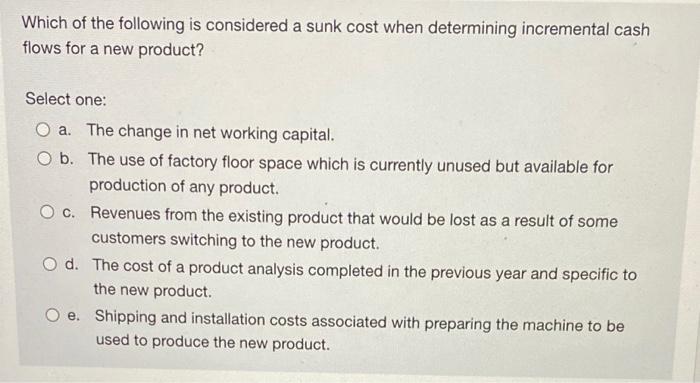

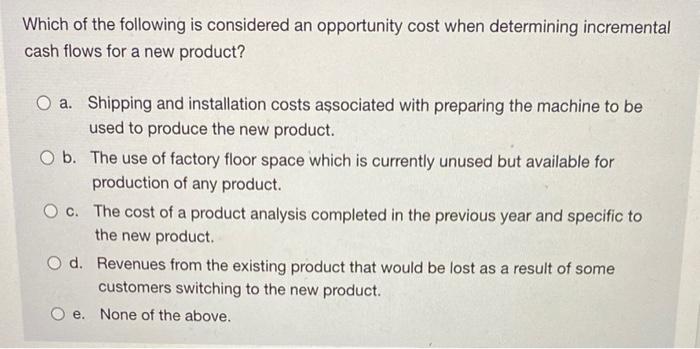

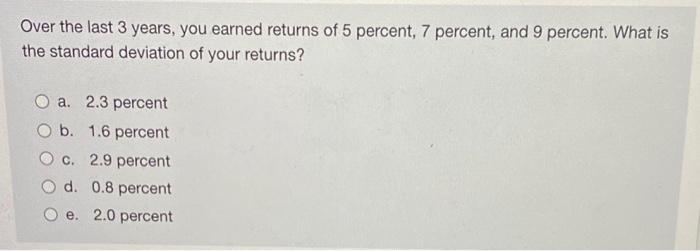

The use of which of the following could lead to incorrect decisions in comparing mutually exclusive projects? I. internal rate of return II. profitability index III. net present value Select one: O a. ll only O b. I and II only O c. I only O d. lll only II and III only e. Which of the following is considered a sunk cost when determining incremental cash flows for a new product? Select one: a. The change in net working capital. O b. The use of factory floor space which is currently unused but available for production of any product. O c. Revenues from the existing product that would be lost as a result of some customers switching to the new product. O d. The cost of a product analysis completed in the previous year and specific to the new product. O e. Shipping and installation costs associated with preparing the machine to be used to produce the new product. Which of the following is considered an opportunity cost when determining incremental cash flows for a new product? O a. Shipping and installation costs associated with preparing the machine to be used to produce the new product. O b. The use of factory floor space which is currently unused but available for production of any product. O c. The cost of a product analysis completed in the previous year and specific to the new product. O d. Revenues from the existing product that would be lost as a result of some customers switching to the new product. e. None of the above. Over the last 3 years, you earned returns of 5 percent, 7 percent, and 9 percent. What is the standard deviation of your returns? O a. 2.3 percent b. 1.6 percent O c. 2.9 percent Od 0.8 percent e. 2.0 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started