Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions or dont answer at all 7. The original maturity of a Government bond is a. Zero years to five years. b.

please answer all questions or dont answer at all

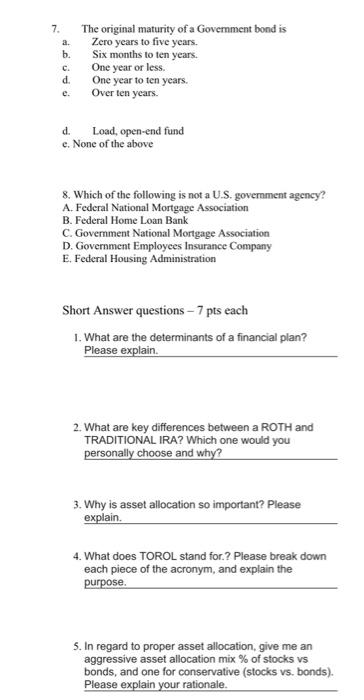

7. The original maturity of a Government bond is a. Zero years to five years. b. Six months to ten years. c. One year or less. d. One year to ten years. e. Over ten years. d. Load, open-end fund c. None of the above 8. Which of the following is not a U.S. government agency? A. Federal National Mortgage Association B. Federal Home Loan Bank C. Govemment National Mortgage Association D. Government Employees Insurance Company E. Federal Housing Administration Short Answer questions 7pts each 1. What are the determinants of a financial plan? Please explain. 2. What are key differences between a ROTH and TRADITIONAL IRA? Which one would you personally choose and why? 3. Why is asset allocation so important? Please explain. 4. What does TOROL stand for.? Please break down each piece of the acronym, and explain the purpose. 5. In regard to proper asset allocation, give me an aggressive asset allocation mix % of stocks vs bonds, and one for conservative (stocks vs. bonds). Please explain your rationale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started