Answered step by step

Verified Expert Solution

Question

1 Approved Answer

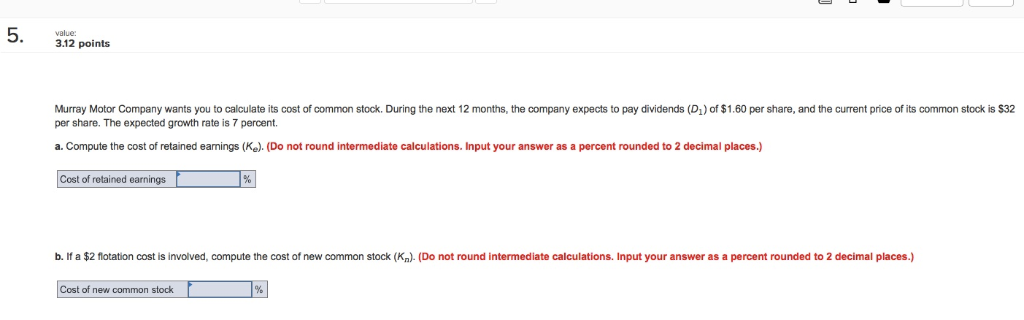

PLEASE ANSWER ALL QUESTIONS OR I WILL THUMBS DOWN!!! 3.12 points Murray Motor Company wants you to calculate its cost of common stock. During the

PLEASE ANSWER ALL QUESTIONS OR I WILL THUMBS DOWN!!!

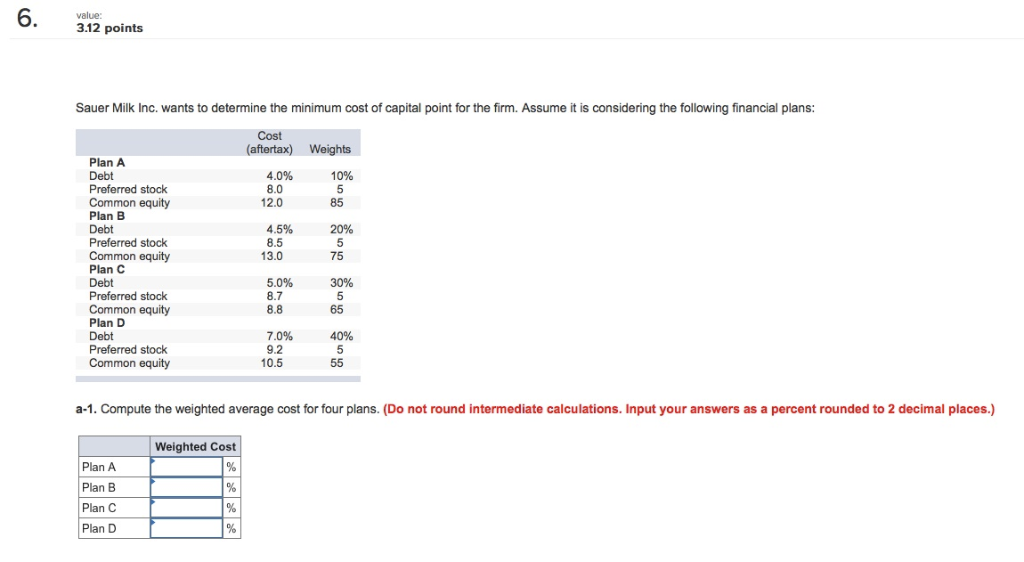

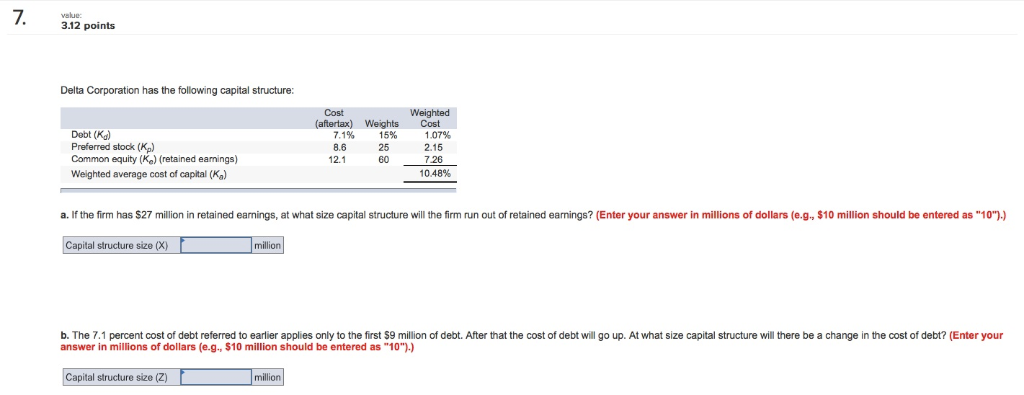

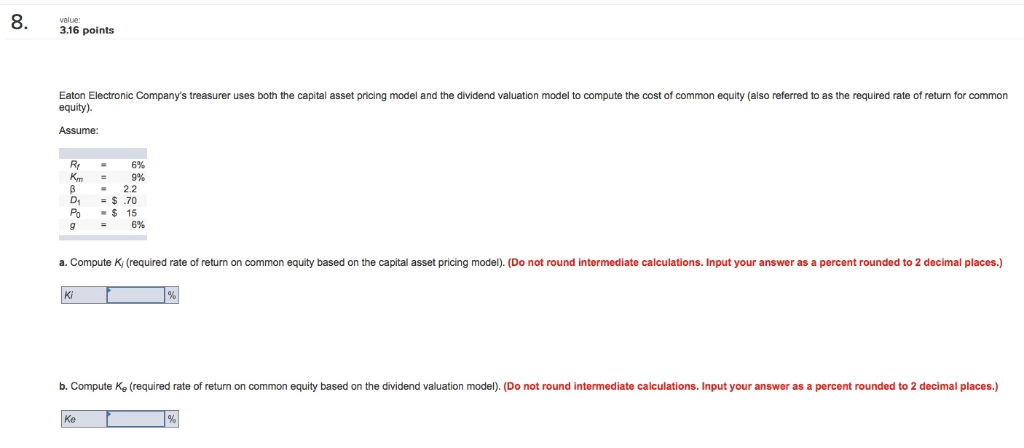

3.12 points Murray Motor Company wants you to calculate its cost of common stock. During the next 12 months, the company expects to pay dividends (D)of $1.60 per share, and the current price of its common stock is $32 per share. The expected growth rate is 7 percent. a. Compute the cost of retained earnings (Ke). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Cost of retained earnings 1 b. If a $2 flotation cost is involved, compute the cost of new common stock (Kn).(Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Cost of new common stock% 3.12 points Sauer Milk Inc. wants to determine the minimum cost of capital point for the firm. Assume it is considering the following financial plans: (aftertax) Weights Plan A Debt Preferred stock Common equity Plan B Debt Preferred stock Common equity Plan C 4.0% 8.0 10% 12.0 4.5% 8.5 13.0 5.0% 8.7 8.8 75 30% 65 Preferred stock Common equity Plan D Debt Preferred stock Common equity 70% 9.2 10.5 a-1. Compute the weighted average cost for four plans. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Weighted Cost Plan A Plan B Plan C Plan D 3.12 points Delta Corporation has the following capital structure Cost (aftertax) Weights Cost Debt (Ka) Preferred stock (Kp) Common equity (Ke) (retained earnings) Weighted average cost of capital (Ka) 7.1% 8.6 2.1 15% 25 60 1.07% 2.15 7.26 10 48% a. If the firm has $27 million in retained earnings, at what size capital structure will the firm run out of retained earnings? (Enter your answer in millions of dollars (e.g, $10 million should be entered as "10")) Capital structure size (X) million b. The 7.1 percent cost of debt referred to earlier applies only to the first S9 million of debt. After that the cost of debt will go up. At what size capital structure will there be a change in the cost of debt? (Enter your answer in millions of dollars (e.g., $10 million should be entered as "10").) Capital structure size (Z) million 8 value: 3.16 points Eaton Electronic Company's treasurer uses both the capital asset pricing model and the dividend valuation model to compute the cost of common equity (also referred to as the required rate of return for common equity). Assume: 9% B2.2 Po $ 15 a. Compute Ki (required rate of return on common equity based on the capital asset pricing model). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Ki b. Compute Ke (required rate of return on common equity based on the dividend valuation model). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Ke

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started