Answered step by step

Verified Expert Solution

Question

1 Approved Answer

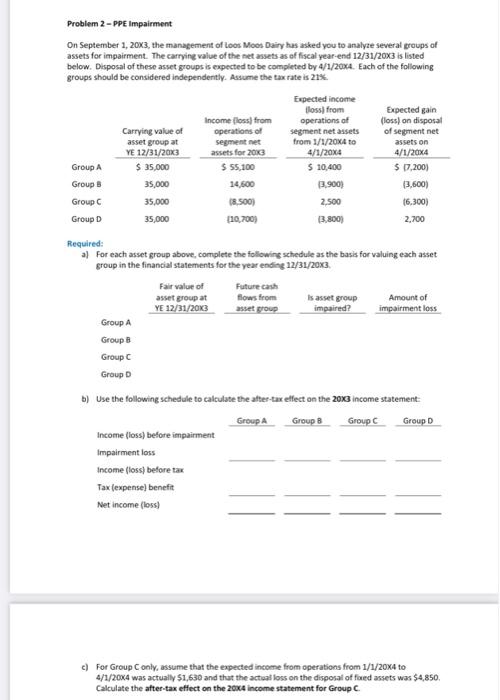

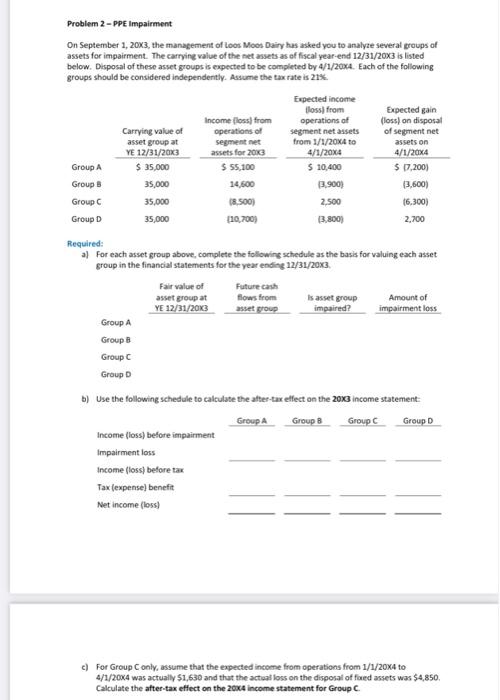

Please answer all questions Problem 2-PPE Impairment On September 1, 2013, the management of Loos Moos Dairy has asked you to analyze several proups of

Please answer all questions

Problem 2-PPE Impairment On September 1, 2013, the management of Loos Moos Dairy has asked you to analyze several proups of assets for impairment. The carrying value of the net assets as of fiscal year-end 12/31/20X3 is listed below. Disposal of these asset groups is expected to be completed by 4/1/20x4. Each of the following groups should be considered independently. Assume the tax rate is 21% Carrying value of asset group at YE 12/31/2003 $ 35,000 35,000 35,000 35,000 Group A Group B Group Group D Expected income floss from operations of segment net assets from 1/1/2004 to 4/1/2034 $ 10,400 3.900) 2.500 13,800 Income floss from operations of segmentet assets for 2013 $ 55,100 14,600 18.500) [10.700) Expected gain (loss on disposal of segment net assets on 4/1/2034 $ 0,2001 (3,600) (6,300) 2,700 Required: a) For each asset group above, complete the following schedule as the basis for valuing each asset group in the financial statements for the year ending 12/31/20x3 Fair value of Future cash asset group at flows from Is asset group Amount of YE 12/31/2013 asset group impaired? impairment loss Group A Group B Group Group b) Use the following schedule to calculate the after-tax effect on the 2013 income statement Group A Group B Group Group D Income (loss) before impairment Impairment loss Income (loss) before tax Tax (expense) benefit Net income (loss) c) For Group Conly, assume that the expected income from operations from 1/1/20x4 to 4/1/20x4 was actually 51,530 and that the actual loss on the disposal of foued assets was $4,850 Calculate the after-tax effect on the 20x4 income statement for Group C Problem 2-PPE Impairment On September 1, 2013, the management of Loos Moos Dairy has asked you to analyze several proups of assets for impairment. The carrying value of the net assets as of fiscal year-end 12/31/20X3 is listed below. Disposal of these asset groups is expected to be completed by 4/1/20x4. Each of the following groups should be considered independently. Assume the tax rate is 21% Carrying value of asset group at YE 12/31/2003 $ 35,000 35,000 35,000 35,000 Group A Group B Group Group D Expected income floss from operations of segment net assets from 1/1/2004 to 4/1/2034 $ 10,400 3.900) 2.500 13,800 Income floss from operations of segmentet assets for 2013 $ 55,100 14,600 18.500) [10.700) Expected gain (loss on disposal of segment net assets on 4/1/2034 $ 0,2001 (3,600) (6,300) 2,700 Required: a) For each asset group above, complete the following schedule as the basis for valuing each asset group in the financial statements for the year ending 12/31/20x3 Fair value of Future cash asset group at flows from Is asset group Amount of YE 12/31/2013 asset group impaired? impairment loss Group A Group B Group Group b) Use the following schedule to calculate the after-tax effect on the 2013 income statement Group A Group B Group Group D Income (loss) before impairment Impairment loss Income (loss) before tax Tax (expense) benefit Net income (loss) c) For Group Conly, assume that the expected income from operations from 1/1/20x4 to 4/1/20x4 was actually 51,530 and that the actual loss on the disposal of foued assets was $4,850 Calculate the after-tax effect on the 20x4 income statement for Group C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started