Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions..... Showing all work. 1. On December 31, 2020 Pip & Associates owned the following securities, held as long-term investments. None

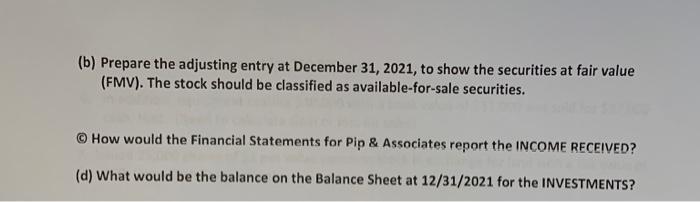

Please answer all questions..... Showing all work. 1. On December 31, 2020 Pip & Associates owned the following securities, held as long-term investments. None of the investments represented MORE than a 20% Ownership Interest. Common Stock Shares Cost Apel Co. Burns Co. Denny Co. 3,000 6,000 1,200 Apel Co. $18, Burns Co. $6 Denny Co. $19. $60,000 36,000 24,000 On this date, the total fair value of the securities was equal to its cost. The securities are not held for influence or control over the investees. In 2021, the following transactions occurred. July 1 Received $1 per share semiannual cash dividend on Burns Co. common stock. Aug. 1 Received $0.50 per share cash dividend on Apel Co. common stock. Sept. 1 Sold 2,000 shares of Burns Co. common stock for cash at $8 per share. Oct. 1 Sold 600 shares of Apel Co. common stock for cash at $27 per share. Nov. 1 Received $1 per share cash dividend on Denny Co. common stock. and on Apel Co. common stock. Dec. 15 Received $0.50 per share Dec 31 Received $1 per share semiannual cash dividend on Burns Co. common stock. At December 31, the fair values per share of the common stocks were: Instructions: (a) Journalize the 2021 transactions and update the balances in each Stock Investments. (b) Prepare the adjusting entry at December 31, 2021, to show the securities at fair value (FMV). The stock should be classified as available-for-sale securities. How would the Financial Statements for Pip & Associates report the INCOME RECEIVED? (d) What would be the balance on the Balance Sheet at 12/31/2021 for the INVESTMENTS?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a July 1 Deb i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started