PLEASE ANSWER ALL QUESTIONS

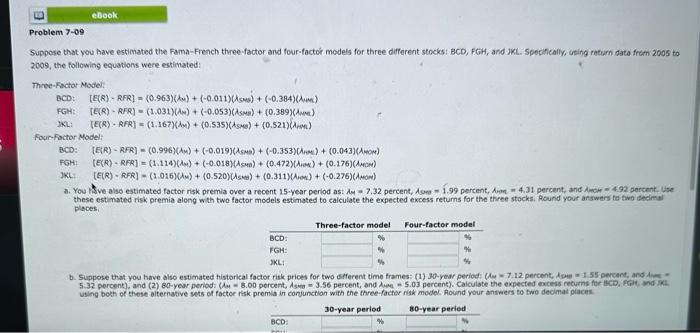

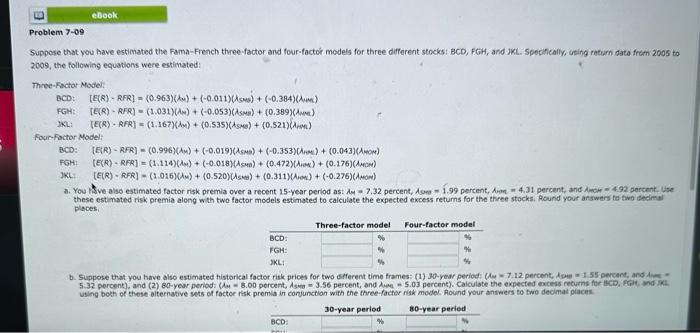

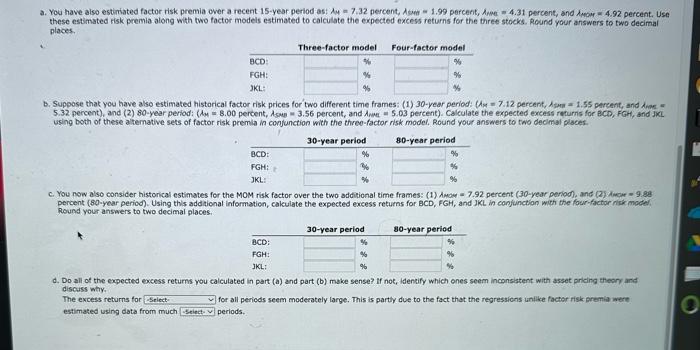

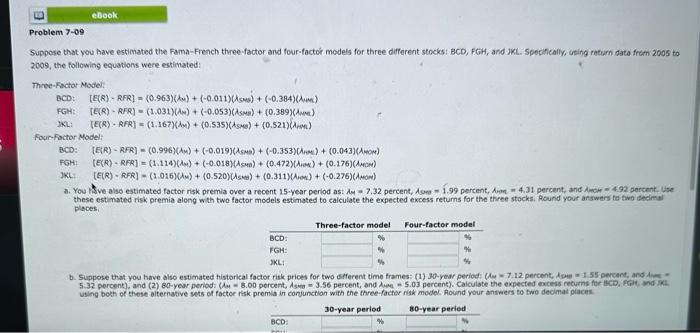

Suppose that you have estimated the Fama-French three-factor and four-factor models for three different stocks: BCD, FGH, anid JKL. Spesifically, using raturn data frum 2005 to 2009 , the following equations were estimated: Three-Factor Model: BCD: [E(R)RFR]=(0.963)(u)+(0.011)(ses)+(0.384)( ius ) FG: [E(R)RFR]=(1.031)(M)+(0.053)(sma)+(0.389)(thm) 3ML: [E(R)RFR]=(1.167)(Am)+(0.535)(s.re)+(0.521)(Amint) Four-foctor Modelt BCD: [E(R)RFR]=(0.996)()+(0.019)(sma)+(0.353)(11)+(0.043)(mow) 3KL: [E(R)RFR]=(1.016)(m)+(0.520)(s)+(0.311)(sow)+(0.276)(Amom) a. You hive asso estimated factor risk premia over a recent 15 -year period as: Ay=7,32 percent, A one =1.99 percent, Ame =4.31 percant, and A arou =4. 92 percent. Use these estimated risk premia along with two factor models estimated to calculate the expected excess returns for the three stocks. Round your arswers to two decimel places; a. You have also estiniated factor risk premia over a recent-15-year period as: Ay =7.32 percent, 1 sint =1.99 percent, Aimet =4.31 percent, and Amow =4.92 percent. Use these estimated risk premia along with two factor models estimated to calculate the expected excess returns for the three stocks. Round your answers to two decimal places, 5.32 percent), and (2) 50 -year period: ( 4=8.00 percent, Aowi =3.56 percent, and Anwe = 5.03 percent). Calculate the expected excess raturns for acc. FGH, and JxL using both of these a temative sets of factor risk premia in conjunction with the threo-factor risk model, Round your answers to two decimal places. c. You now also consider historical estimates for the MoM risk fector over the two additional time frames: (1) Amow = 7.92 percent (30-year period), and (2) hicie = 9.88 percent (80-year period). Using this addtional information, cakulate the expected excess returns for BCD, FGH, and JKL in eonfunction with the four-factse nisis model. Round your answers to two decimal places. d. Do all of the expected excess returns you calculated in part (a) and part (b) make sense? If not, idenkify which ones seem inconsistent with asset priaing theory and discuss why, The excess returns for for all periods seem moderately large. This is partly due to the fact that the regressicns unilike factor risk premia were estimated using data from much periods, Suppose that you have estimated the Fama-French three-factor and four-factor models for three different stocks: BCD, FGH, anid JKL. Spesifically, using raturn data frum 2005 to 2009 , the following equations were estimated: Three-Factor Model: BCD: [E(R)RFR]=(0.963)(u)+(0.011)(ses)+(0.384)( ius ) FG: [E(R)RFR]=(1.031)(M)+(0.053)(sma)+(0.389)(thm) 3ML: [E(R)RFR]=(1.167)(Am)+(0.535)(s.re)+(0.521)(Amint) Four-foctor Modelt BCD: [E(R)RFR]=(0.996)()+(0.019)(sma)+(0.353)(11)+(0.043)(mow) 3KL: [E(R)RFR]=(1.016)(m)+(0.520)(s)+(0.311)(sow)+(0.276)(Amom) a. You hive asso estimated factor risk premia over a recent 15 -year period as: Ay=7,32 percent, A one =1.99 percent, Ame =4.31 percant, and A arou =4. 92 percent. Use these estimated risk premia along with two factor models estimated to calculate the expected excess returns for the three stocks. Round your arswers to two decimel places; a. You have also estiniated factor risk premia over a recent-15-year period as: Ay =7.32 percent, 1 sint =1.99 percent, Aimet =4.31 percent, and Amow =4.92 percent. Use these estimated risk premia along with two factor models estimated to calculate the expected excess returns for the three stocks. Round your answers to two decimal places, 5.32 percent), and (2) 50 -year period: ( 4=8.00 percent, Aowi =3.56 percent, and Anwe = 5.03 percent). Calculate the expected excess raturns for acc. FGH, and JxL using both of these a temative sets of factor risk premia in conjunction with the threo-factor risk model, Round your answers to two decimal places. c. You now also consider historical estimates for the MoM risk fector over the two additional time frames: (1) Amow = 7.92 percent (30-year period), and (2) hicie = 9.88 percent (80-year period). Using this addtional information, cakulate the expected excess returns for BCD, FGH, and JKL in eonfunction with the four-factse nisis model. Round your answers to two decimal places. d. Do all of the expected excess returns you calculated in part (a) and part (b) make sense? If not, idenkify which ones seem inconsistent with asset priaing theory and discuss why, The excess returns for for all periods seem moderately large. This is partly due to the fact that the regressicns unilike factor risk premia were estimated using data from much periods