Answered step by step

Verified Expert Solution

Question

1 Approved Answer

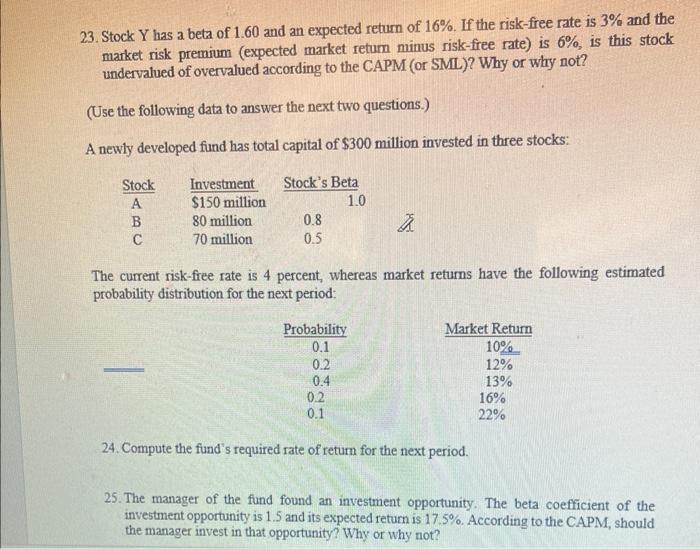

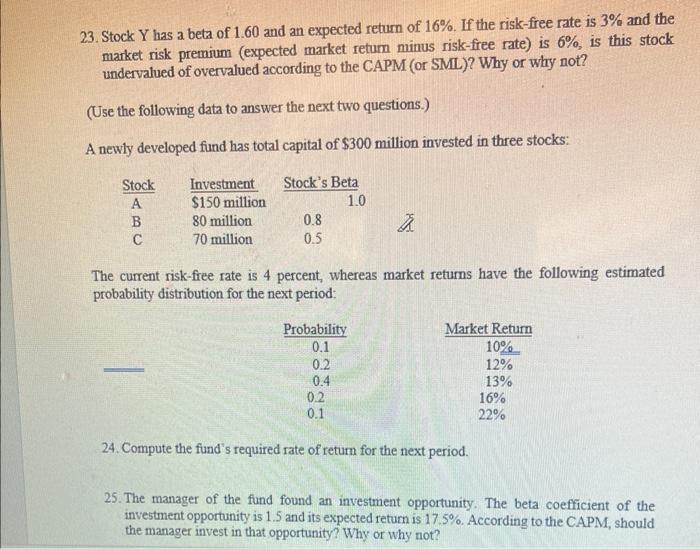

please answer all questions thank you! 23. Stock Y has a beta of 1.60 and an expected return of 16%. If the risk-free rate is

please answer all questions thank you!

23. Stock Y has a beta of 1.60 and an expected return of 16%. If the risk-free rate is 3% and the market risk premium (expected market retum minus risk-free rate) is 6%, is this stock undervalued of overvalued according to the CAPM (or SML)? Why or why not? (Use the following data to answer the next two questions.) A newly developed fund has total capital of $300 million invested in three stocks: The current risk-free rate is 4 percent, whereas market returns have the following estimated probability distribution for the next period: 24. Compute the fund's required rate of return for the next period. 25. The manager of the fund found an investment opportunity. The beta coefficient of the investment opportunity is 1.5 and its expected return is 17.5%. According to the CAPM, should the manager invest in that opportunity? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started