Answered step by step

Verified Expert Solution

Question

1 Approved Answer

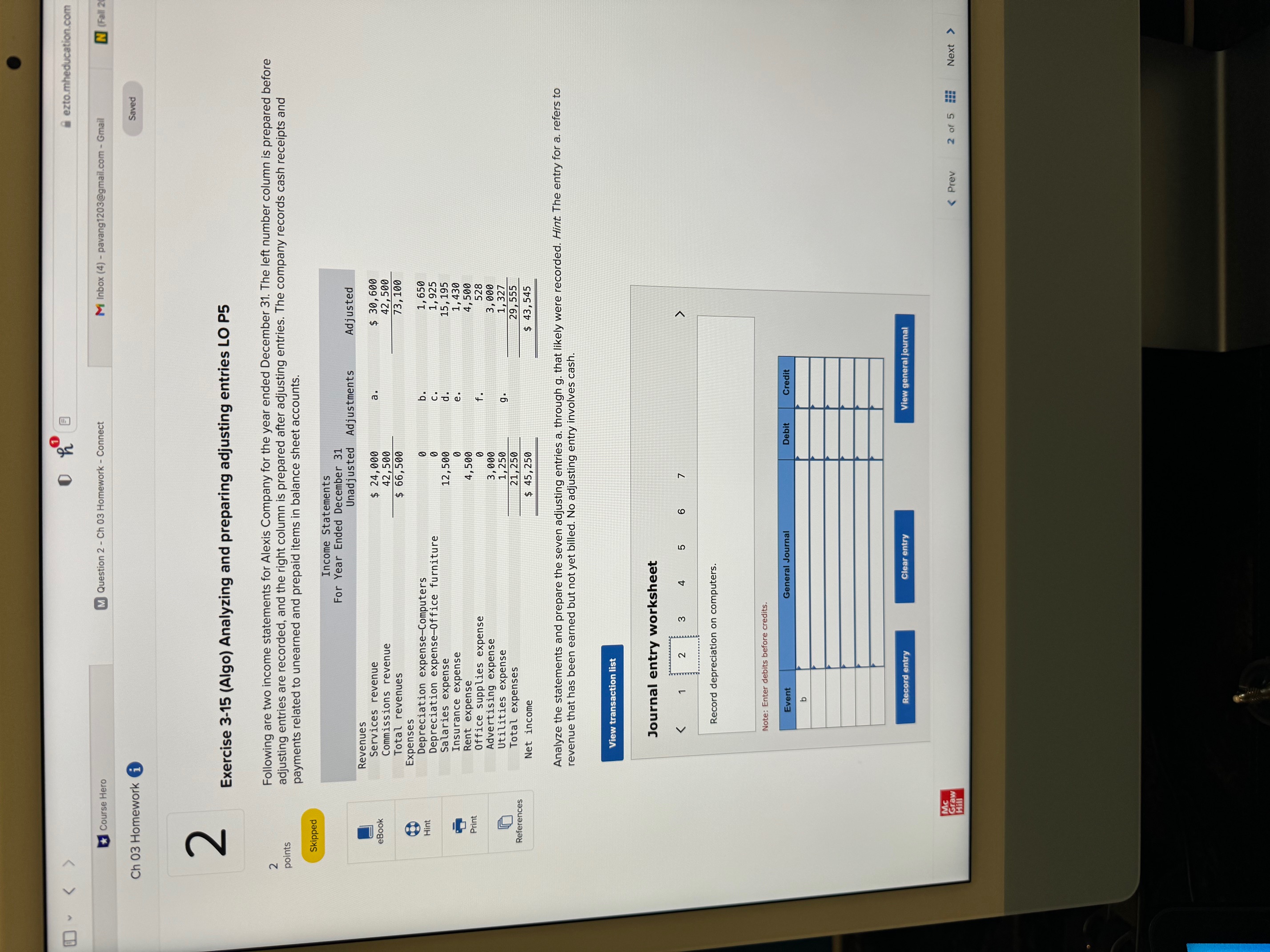

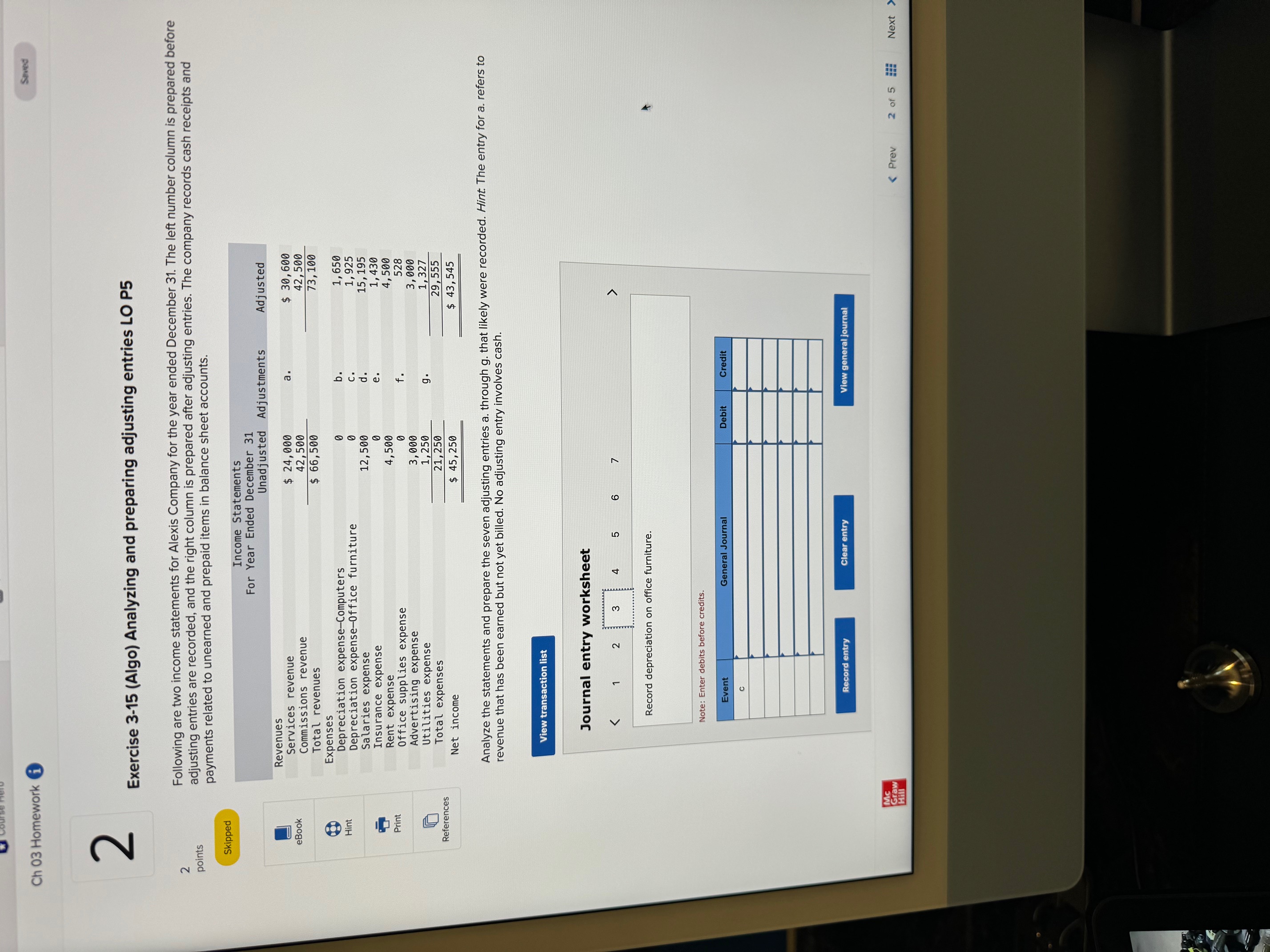

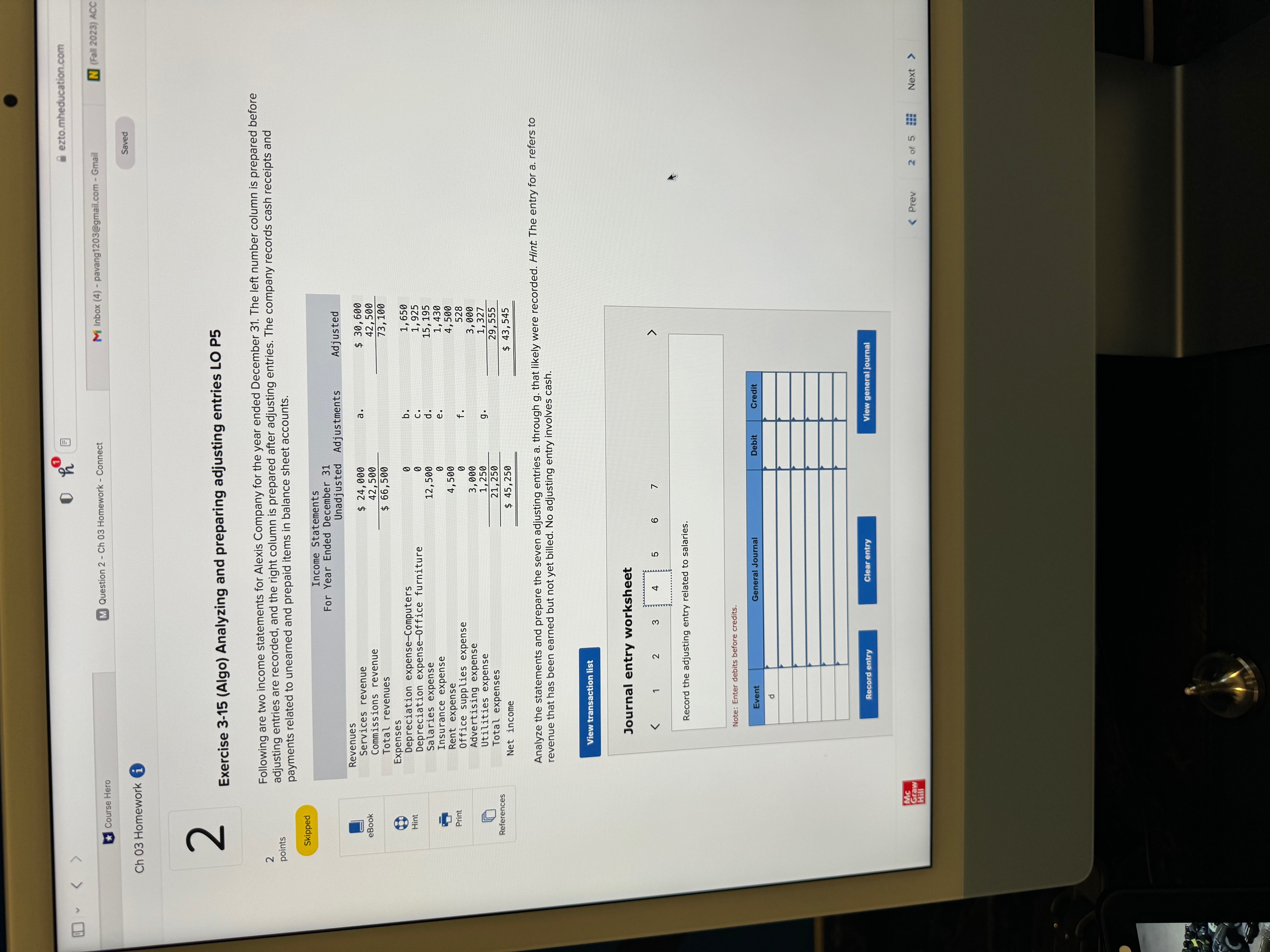

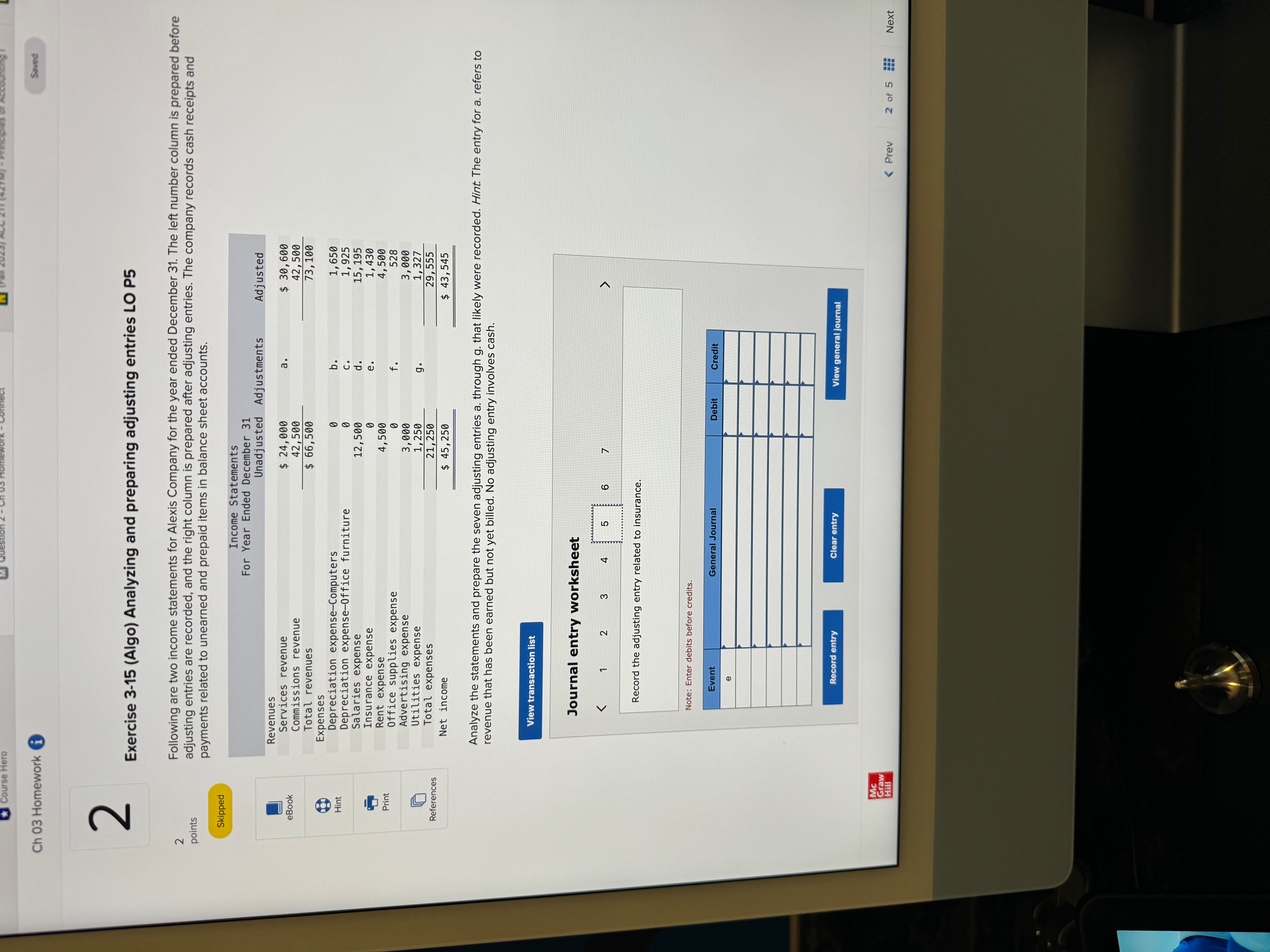

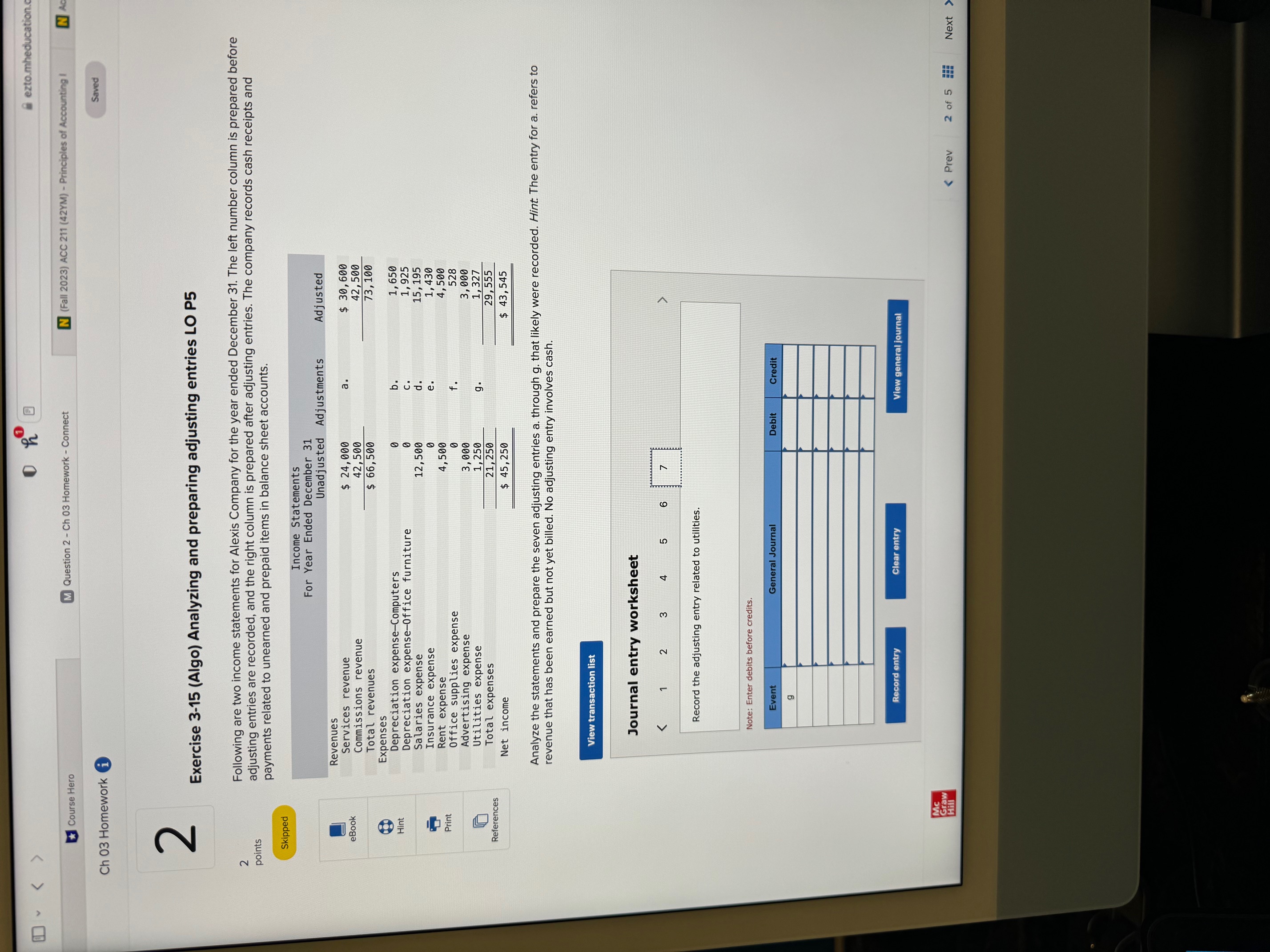

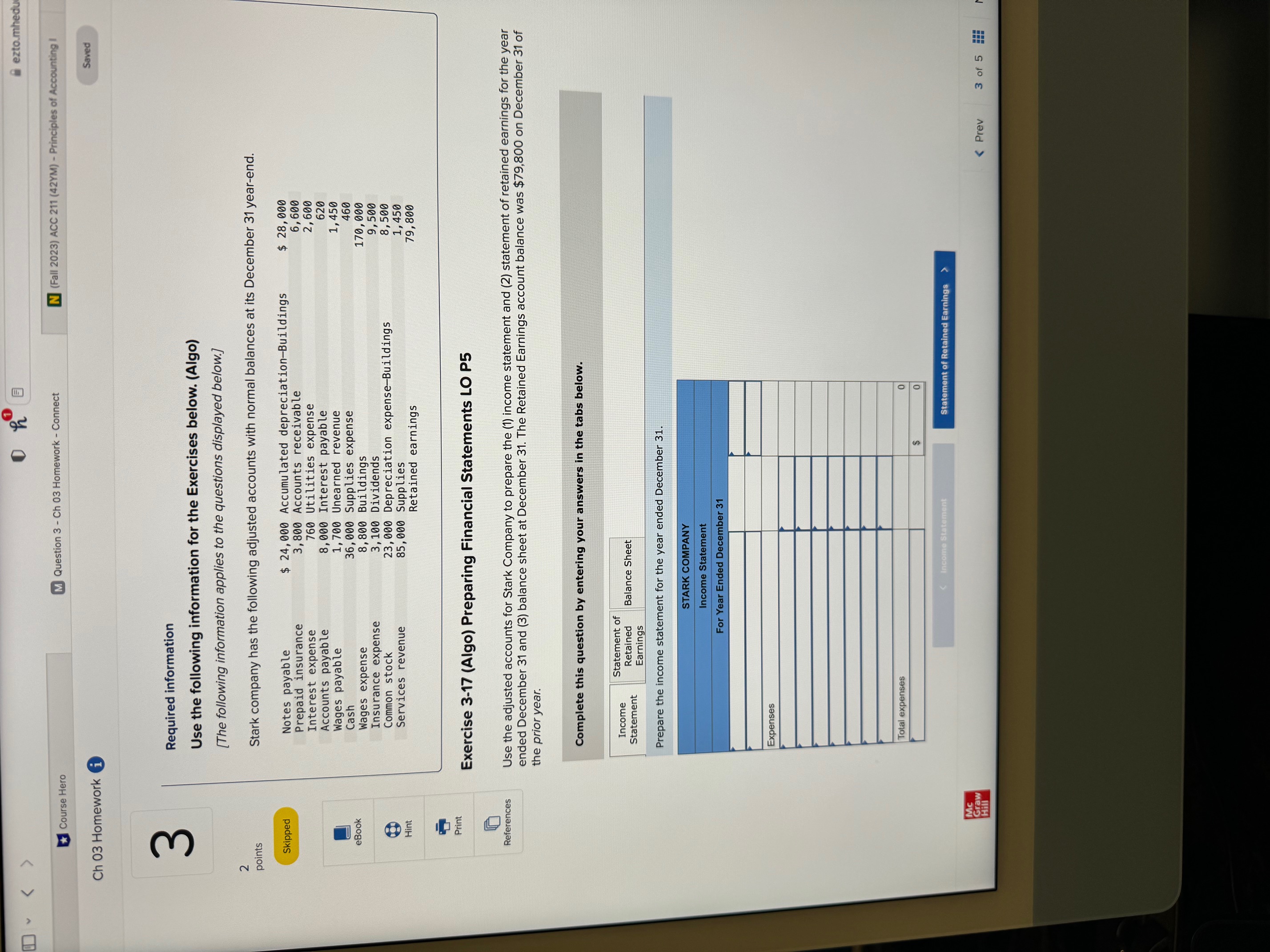

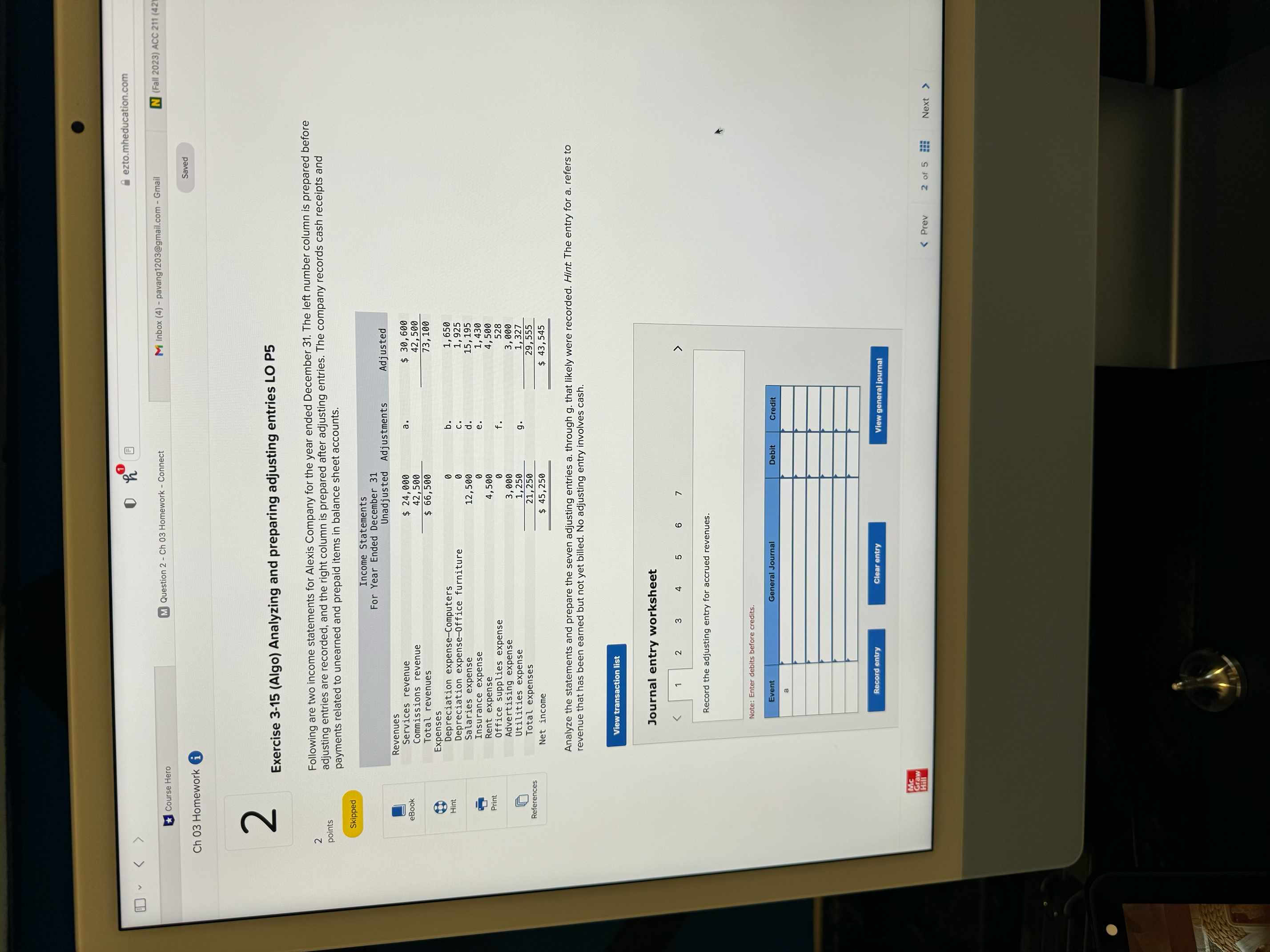

Course Hero Ch 03 Homework 2 2 points Skipped eBook 01 Hint Print References Mc Graw Hill Revenues Services revenue Commissions revenue Total revenues

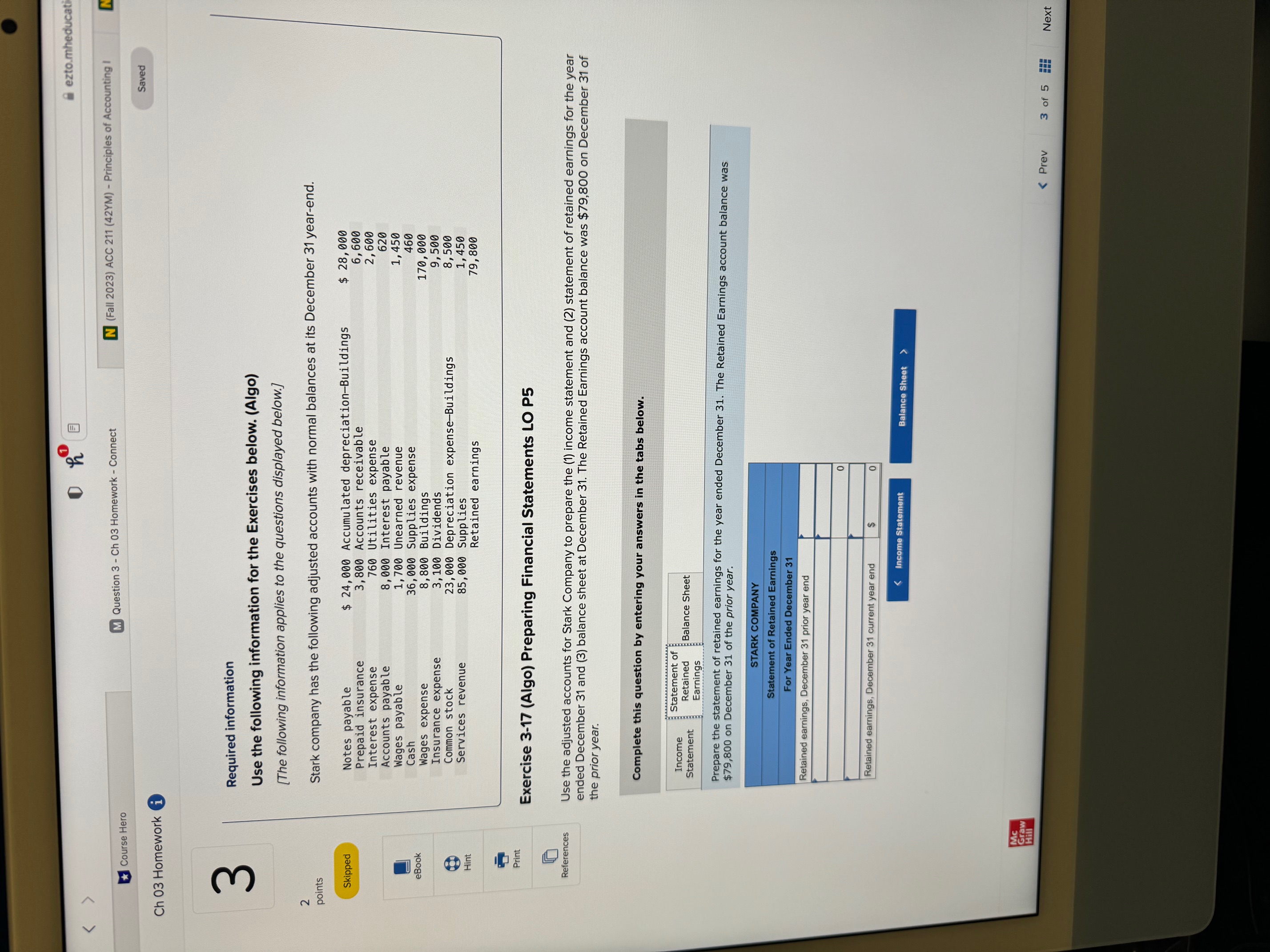

Course Hero Ch 03 Homework 2 2 points Skipped eBook 01 Hint Print References Mc Graw Hill Revenues Services revenue Commissions revenue Total revenues Expenses Exercise 3-15 (Algo) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Company for the year ended December 31. The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Salaries expense Insurance expense Depreciation expense-Computers Depreciation expense-Office furniture Rent expense Office supplies expense Advertising expense Utilities expense Total expenses Net income View transaction list 1 Journal entry worksheet M Question 2 - Ch 03 Homework- Connect 2 Event b Income Statements For Year Ended December 31 3 Record entry Record depreciation on computers. Note: Enter debits before credits. 4 0 5 General Journal Clear entry 6 Unadjusted Adjustments $ 24,000 42,500 $ 66,500 Analyze the statements and prepare the seven adjusting entries a. through g. that likely were recorded. Hint. The entry for a. refers to that has been earned but not yet billed. No adjusting entry involves cash. reve 0 0 12,500 0 4,500 0 3,000 1,250 21,250 $ 45,250 7 a. Debit b. C. d. e. f. g. M Inbox (4)- pavang1203@gmail.com - Gmail Credit Adjusted $ 30,600 42,500 73,100 View general journal 1,650 1,925 15,195 1,430 4,500 528 3,000 1,327 29,555 $ 43,545 ezto.mheducation.com Saved < Prev 2 of 5 ___ - N (Fall 20 Next > Ch 03 Homework i 2 2 points Skipped eBook 101 Hint Print References Exercise 3-15 (Algo) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Company for the year ended December 31. The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Mc Graw Hill Revenues Services revenue Commissions revenue Total revenues Expenses Depreciation expense-Computers Depreciation expense-Office furniture Salaries expense Insurance expense 282 Rent expense Office supplies expense Advertising expense Utilities expense Total expenses Net income View transaction list Journal entry worksheet < 1 2 Income Statements For Year Ended December 31 Event 3 Note: Enter debits before credits. Record depreciation on office furniture. Record entry 4 5 Analyze the statements and prepare the seven adjusting entries a. through g. that likely were recorded. Hint. The entry for a. refers to revenue that has been earned but not yet billed. No adjusting entry involves cash. General Journal Clear entry Unadjusted Adjustments 6 $ 24,000 42,500 $ 66,500 0 0 12,500 0 4,500 0 3,000 1,250 21,250 $ 45,250 7 a. Debit C. f. Adjusted Credit $ 30,600 42,500 73,100 1,650 1,925 15,195 1,430 4,500 528 3,000 1,327 29,555 $ 43,545 View general journal Seved < Prev 2 of 5 www *** Next > v Course Hero Ch 03 Homework i 2 2 points Skipped eBook 101 Hint Print References Mc Graw Hill Revenues Services revenue Commissions revenue Exercise 3-15 (Algo) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Company for the year ended December 31. The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Total revenues Expenses Salaries expense Insurance expense Depreciation expense-Computers Depreciation expense-Office furniture Rent expense Office supplies expense Advertising expense Utilities expense Total expenses Net income View transaction list < Journal entry worksheet 1 M Question 2 - Ch 03 Homework - Connect 2 Income Statements For Year Ended December 31 Event d 3 Record entry Note: Enter debits before credits. Record the adjusting entry related to salaries. 4 Unadjusted Adjustments General Journal $ 24,000 42,500 $ 66,500 5 6 7 Clear entry 0 0 12,500 0 4,500 0 3,000 1,250 21,250 $ 45,250 Analyze the statements and prepare the seven adjusting entries a. through g. that likely were recorded. Hint. The entry for a. refers to revenue that has been earned but not yet billed. No adjusting entry involves cash. a. Debit b. C. d. e. f. M Inbox (4)- pavang1203@gmail.com - Gmail Credit Adjusted $ 30,600 42,500 73,100 1,650 1,925 15,195 1,430 4,500 528 3,000 1,327 29,555 $ 43,545 ezto.mheducation.com View general journal Saved < Prev 2 of 5 www N (Fall 2023) ACC Next > Course Hero Ch 03 Homework 2 2 points Skipped eBook 101 Hint Print References Mc Graw Hill Revenues Exercise 3-15 (Algo) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Company for the year ended December 31. The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Services revenue Commissions revenue Total revenues Expenses Depreciation expense-Computers Depreciation expense-Office furniture Salaries expense Insurance expense Rent expense Office supplies expense Advertising expense Utilities expense Total expenses Net income View transaction list Journal entry worksheet < 1 2 Event e Income Statements For Year Ended December 31 Note: Enter debits before credits. 3 Record entry Record the adjusting entry related to insurance. 4 5 Analyze the statements and prepare the seven adjusting entries a. through g. that likely were recorded. Hint. The entry for a. refers to revenue that has been earned but not yet billed. No adjusting entry involves cash. General Journal 6 Clear entry Unadjusted Adjustments $ 24,000 42,500 $ 66,500 0 0 12,500 0 4,500 0 3,000 1,250 21,250 $ 45,250 7 a. Debit b. C. d. e. f. g. Adjusted Credit $ 30,600 42,500 73,100 View general journal 1,650 1,925 15,195 1,430 4,500 528 3,000 1,327 29,555 $ 43,545 J nang < Prev Saved 2 of 5 -- --- Next Course Hero Ch 03 Homework i 2 2 points Skipped eBook Hint Print References Mc Graw Hill Revenues Services revenue Commissions revenue Total revenues Expenses Exercise 3-15 (Algo) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Company for the year ended December 31. The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Salaries expense Insurance expense Depreciation expense-Computers Depreciation expense-Office furniture Rent expense Office supplies expense Advertising expense Utilities expense Total expenses Net income View transaction list < Journal entry worksheet 1 2 M Question 2 - Ch 03 Homework - Connect Event g 3 Income Statements For Year Ended December 31 Record entry Note: Enter debits before credits. 4 Record the adjusting entry related to utilities. 5 0 General Journal h 6 Clear entry Analyze the statements and prepare the seven adjusting entries a. through g. that likely were recorded. Hint. The entry for a. refers to revenue that has been earned but not yet billed. No adjusting entry involves cash. Unadjusted Adjustments $ 24,000 42,500 $ 66,500 0 0 12,500 0 4,500 0 3,000 1,250 21,250 $ 45,250 7 a. Debit b. C. d. e. f. g. Credit (Fall 2023) ACC 211 (42YM) - Principles of Accounting Adjusted $ 30,600 42,500 73,100 1,650 1,925 15,195 1,430 4,500 528 3,000 1,327 29,555 $ 43,545 View general journal ezto.mheducation.c Saved < Prev 2 of 5 --- HI - N Ac Next > < > Course Hero Ch 03 Homework i 3 2 points Skipped eBook BO Hint 1 Print References Mc Graw Hill Notes payable Prepaid insurance Interest expense Accounts payable Wages payable Cash Wages expense Insurance expense Commo stock Services revenue Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Stark company has the following adjusted accounts with normal balances at its December 31 year-end. $ 28,000 6,600 $ 24,000 Accumulated depreciation-Buildings 3,800 Accounts receivable 760 Utilities expense 8,000 Interest payable 1,700 Unearned revenue 36,000 Supplies expense 8,800 Buildings 2,600 620 1,450 460 170,000 9,500 3,100 Dividends 23,000 Depre 85,000 Supplies 8,500 1,450 79,800 Income Statement Statement of Retained Earnings Expenses M Question 3 - Ch 03 Homework- Connect 0 Complete this question by entering your answers in the tabs below. Total expenses Balance Sheet h Exercise 3-17 (Algo) Preparing Financial Statements LO P5 Use the adjusted accounts for Stark Company to prepare the (1) income statement and (2) statement of retained earnings for the year ended December 31 and (3) balance sheet at December 31. The Retained Earnings account balance was $79,800 on December 31 of the prior year. Retained earnings tion expense-Buildings Prepare the income statement for the year ended December 31. STARK COMPANY Income Statement For Year Ended December 31 Income Statement $ N (Fall 2023) ACC 211 (42YM) - Principles of Accounting I 0 0 ezto.mhedu Statement of Retained Earnings > < Prev Saved 3 of 5 --- M Course Hero Ch 03 Homework 3 2 points Skipped eBook 0 Hint Print References Mc Graw Hill Question 3 - Ch 03 Homework- Connect Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Stark company has the following adjusted accounts with normal balances at its December 31 year-end. Notes payable $ 28,000 24,000 Accumulated depreciation-Buildings 3,800 Accounts receivable Prepaid insurance Interest expense Accounts payable Wages payable Cash 760 Utilities expense 8,000 Interest payable 6,600 2,600 620 1,450 460 170,000 1,700 Unearned revenue Wages expense Insurance expense Common stock 9,500 8,500 Services revenue 1,450 79,800 Income Statement 36,000 Supplies expense 8,800 Buildings 3,100 Dividends 23,000 Depreciation expense-Buildings 85,000 Supplies 0 h Complete this question by entering your answers in the tabs below. Statement of Retained Balance Sheet Earnings Exercise 3-17 (Algo) Preparing Financial Statements LO P5 Use the adjusted accounts for Stark Company to prepare the (1) income statement and (2) statement of retained earnings for the year ended December 31 and (3) balance sheet at December 31. The Retained Earnings account balance was $79,800 on December 31 of the prior year. STARK COMPANY Statement of Retained Earnings For Year Ended December 31 Retained earnings, December 31 prior year end Retained earnings Prepare the statement of retained earnings for the year ended December 31. The Retained Earnings account balance was $79,800 on December 31 of the prior year. Retained earnings, December 31 current year end < $ Income Statement 0 (Fall 2023) ACC 211 (42YM) - Principles of Accounting I 0 Balance Sheet ezto.mheducati < Prev Saved 3 of 5 N Next Course Hero Ch 03 Homework i 2 2 points Skipped eBook Hint Print References Mc Graw Hill Revenues Services revenue Commissions revenue Exercise 3-15 (Algo) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Company for the year ended December 31. The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Total revenues Expenses Salaries expense Insurance expense Depreciation expense-Computers Depreciation expense-Office furniture Rent expense Office supplies expense Advertising expense Utilities expense Total expenses Net income View transaction list Journal entry worksheet 1 M Question 2 - Ch 03 Homework- Connect 2 Event a Income Statements For Year Ended December 31 3 Note: Enter debits before credits. Record entry 4 5 Record the adjusting entry for accrued revenues. Unadjusted Adjustments General Journal Analyze the statements and prepare the seven adjusting entries a. through g. that likely were recorded. Hint. The entry for a. refers to revenue that has been earned but not yet billed. No adjusting entry involves cash. Clear entry $ 24,000 42,500 $ 66,500 6 0 0 12,500 0 4,500 0 3,000 1,250 21,250 $ 45,250 7 a. Debit b. C. d. e. f. g. M Inbox (4) - pavang1203@gmail.com - Gmail Credit Adjusted $ 30,600 42,500 73,100 1,650 1,925 15,195 1,430 4,500 528 3,000 1,327 29,555 $ 43,545 View general journal ezto.mheducation.com Saved < Prev 2 of 5 N (Fall 2023) ACC 211 (42 Next >

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets solve this stepbystep The income statement shows an adjustment of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started