Please answer all questions

Thanks!

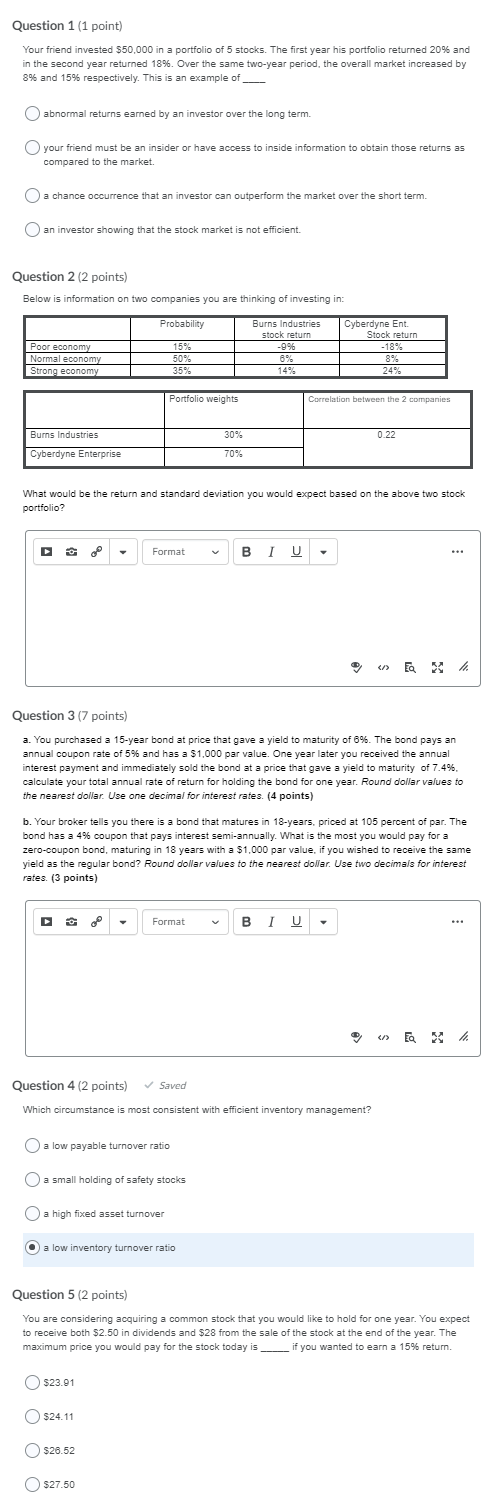

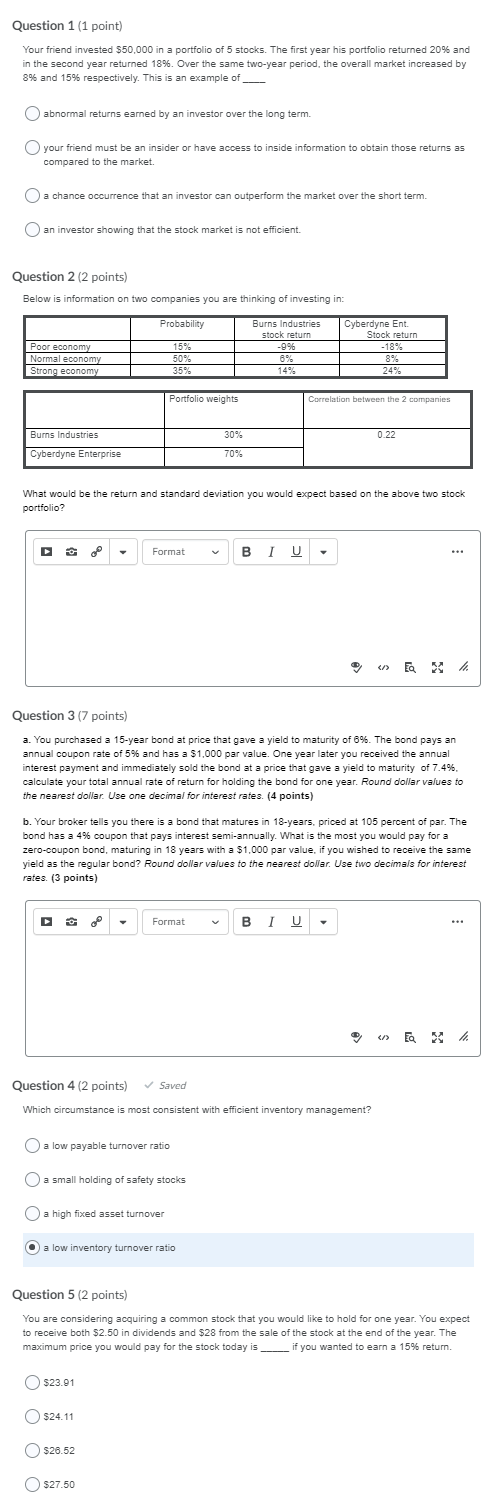

Question 1 (1 point) Your friend invested $50,000 in a portfolio of 5 stocks. The first year his portfolio returned 20% and in the second year returned 18%. Over the same two-year period, the overall market increased by 8% and 15% respectively. This is an example of abnormal returns earned by an investor over the long term. your friend must be an insider or have access to inside information to obtain those returns as compared to the market. a chance occurrence that an investor can outperform the market over the short term. an investor showing that the stock market is not efficient. Question 2 (2 points) Below is information on two companies you are thinking of investing in: Probability Burns Industries stock return Poor economy Normal economy Strong economy 15% 50% 35% Cyberdyne Ent. Stock return -18% 8% 24% 14% Portfolio weights Correlation between the 2 companies Burns Industries 30% 0.22 Cyberdyne Enterprise 70% What would be the return and standard deviation you would expect based on the above two stock portfolio? Format BIU Question 3 (7 points) a. You purchased a 15-year bond at price that gave a yield to maturity of 8%. The bond pays an annual coupon rate of 5% and has a $1,000 par value. One year later you received the annual interest payment and immediately sold the bond at a price that gave a yield to maturity of 7.4% calculate your total annual rate of return for holding the bond for one year. Round dollar values to the nearest dollar. Use one decimal for interest rates. (4 points) b. Your broker tells you there is a bond that matures in 18-years, priced at 105 percent of par. The bond has a 4% coupon that pays interest semi-annually. What is the most you would pay for a zero-coupon bond, maturing in 18 years with a $1,000 par value, if you wished to receive the same yield as the regular bond? Round dollar values to the nearest dollar. Use two decimals for interest rates (3 points) Format BIU h Question 4 (2 points) Saved Which circumstance is most consistent with efficient inventory management? a low payable turnover ratio O a small holding of safety stocks O a high fixed asset turnover a O a low inventory turnover ratio Question 5 (2 points) You are considering acquiring a common stock that you would like to hold for one year. You expect to receive both $2.50 in dividends and $28 from the sale of the stock at the end of the year. The maximum price you would pay for the stock today is if you wanted to earn a 15% return. $23.91 $24.11 $26.52 $27.50 Question 1 (1 point) Your friend invested $50,000 in a portfolio of 5 stocks. The first year his portfolio returned 20% and in the second year returned 18%. Over the same two-year period, the overall market increased by 8% and 15% respectively. This is an example of abnormal returns earned by an investor over the long term. your friend must be an insider or have access to inside information to obtain those returns as compared to the market. a chance occurrence that an investor can outperform the market over the short term. an investor showing that the stock market is not efficient. Question 2 (2 points) Below is information on two companies you are thinking of investing in: Probability Burns Industries stock return Poor economy Normal economy Strong economy 15% 50% 35% Cyberdyne Ent. Stock return -18% 8% 24% 14% Portfolio weights Correlation between the 2 companies Burns Industries 30% 0.22 Cyberdyne Enterprise 70% What would be the return and standard deviation you would expect based on the above two stock portfolio? Format BIU Question 3 (7 points) a. You purchased a 15-year bond at price that gave a yield to maturity of 8%. The bond pays an annual coupon rate of 5% and has a $1,000 par value. One year later you received the annual interest payment and immediately sold the bond at a price that gave a yield to maturity of 7.4% calculate your total annual rate of return for holding the bond for one year. Round dollar values to the nearest dollar. Use one decimal for interest rates. (4 points) b. Your broker tells you there is a bond that matures in 18-years, priced at 105 percent of par. The bond has a 4% coupon that pays interest semi-annually. What is the most you would pay for a zero-coupon bond, maturing in 18 years with a $1,000 par value, if you wished to receive the same yield as the regular bond? Round dollar values to the nearest dollar. Use two decimals for interest rates (3 points) Format BIU h Question 4 (2 points) Saved Which circumstance is most consistent with efficient inventory management? a low payable turnover ratio O a small holding of safety stocks O a high fixed asset turnover a O a low inventory turnover ratio Question 5 (2 points) You are considering acquiring a common stock that you would like to hold for one year. You expect to receive both $2.50 in dividends and $28 from the sale of the stock at the end of the year. The maximum price you would pay for the stock today is if you wanted to earn a 15% return. $23.91 $24.11 $26.52 $27.50