Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions , there are 7 questions the last pic which i have uploded , just answer those 2 questions , see the

Please answer all questions , there are 7 questions

the last pic which i have uploded , just answer those 2 questions , see the latest pic , that is question 4 and question 7

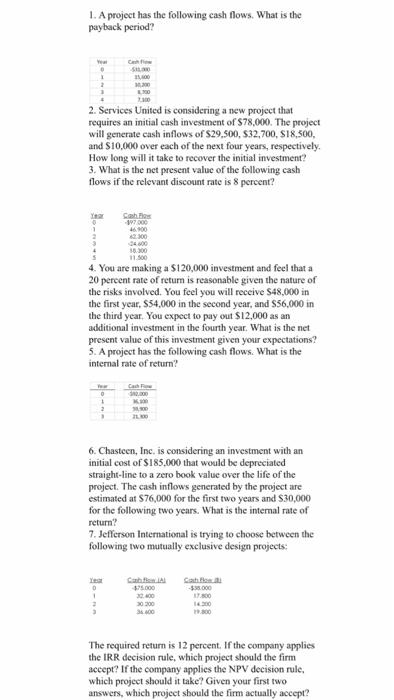

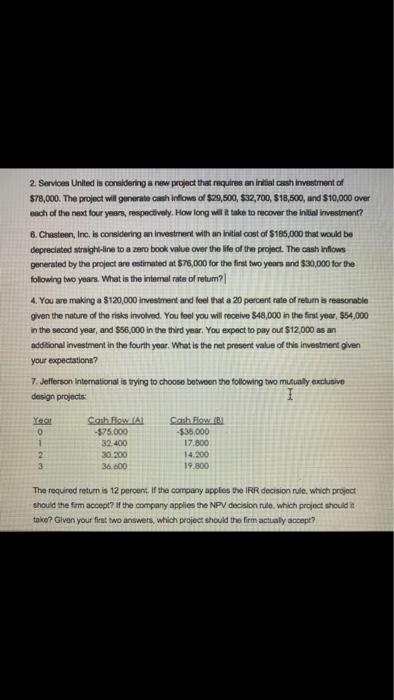

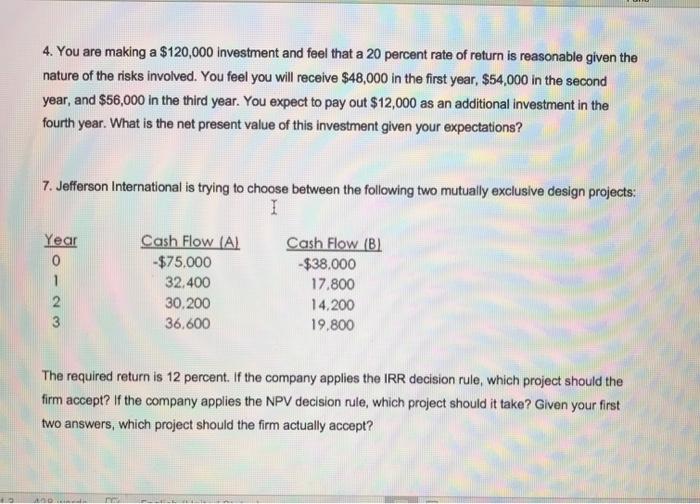

1. A project has the following cash flows. What is the payback period? 2300 2. Services United is considering a new project that requires an initial cash investment of $78,000. The project will generate cash inflows of S29,500,532,700, S18,500, and $10,000 over each of the next four years, respectively. How long will it take to recover the initial investment? 3. What is the net present value of the following cash flows if the relevant discount rate is 8 percent? Ya 1 Cash -197000 46.900 42300 18.30 11.500 4. You are making a $120,000 investment and feel that a 20 percent rate of return is reasonable given the nature of the risks involved. You feel you will receive $48.000 in the first year, S54,000 in the second year, and $56.000 in the third year. You expect to pay out $12,000 as an additional investment in the fourth year. What is the net present value of this investment given your expectations? 5. A project has the following cash flows. What is the internal rate of return? 2 3 6. Chasteen, Inc. is considering an investment with an initial cost of $185,000 that would be depreciated straight-line to a zero book value over the life of the project. The cash inflows generated by the project are estimated at $76,000 for the first two years and 30,000 for the following two years. What is the internal rate of return? 7. Jefferson International is trying to choose between the following two mutually exclusive design projects: -598.000 0 1 5:25.000 20.00 300 17.00 The required return is 12 percent. If the company applies the IRR decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm actually accept? 2 Services United is considering a new project that requires an initial cash investment of $78,000. The project will generate cash informs of $29,500,532,700, 318,500, and $10,000 over each of the next four years, respectively. How long will it take to recover the initial investment? 6. Chasteon, Inc. is considering an investment with an initial cost of $185,000 that would be depreciated straight-line to a zero book value over the life of the project. The cash flows generated by the project are estimated at $75,000 for the first two years and $30,000 for the following two years. What is the internal rate of retum?| 4. You are making a S120,000 investment and feel that a 20 percent rate of return is reasonable given the nature of the risks involved. You feel you will receive 348,000 in the first year $54,000 in the second year, and $56,000 in the third year. You expect to pay out $12,000 as an additional investment in the fourth year. What is the net present value of this investment given your expectations? 7. Jefferson International is trying to choose between the following two mutually exclusive design projects I Year 0 1 2 3 Cash Fow. Al -$75.000 32.400 30.200 36.600 Cash Flow. -$35.000 17.800 14.200 19.800 The required return is 12 percent. If the company applies the IRR decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should tako? Given your first two answers, which project should the firm actually accept? 4. You are making a $120,000 investment and feel that a 20 percent rate of return is reasonable given the nature of the risks involved. You feel you will receive $48,000 in the first year, $54,000 in the second year, and $56,000 in the third year. You expect to pay out $12,000 as an additional investment in the fourth year. What is the net present value of this investment given your expectations? 7. Jefferson International is trying to choose between the following two mutually exclusive design projects: I Year 0 1 2 3 Cash Flow (A) -$75.000 32,400 30.200 36,600 Cash Flow (B) -$38.000 17.800 14.200 19.800 The required return is 12 percent. If the company applies the IRR decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm actually accept? D Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started