Please answer all requirements.

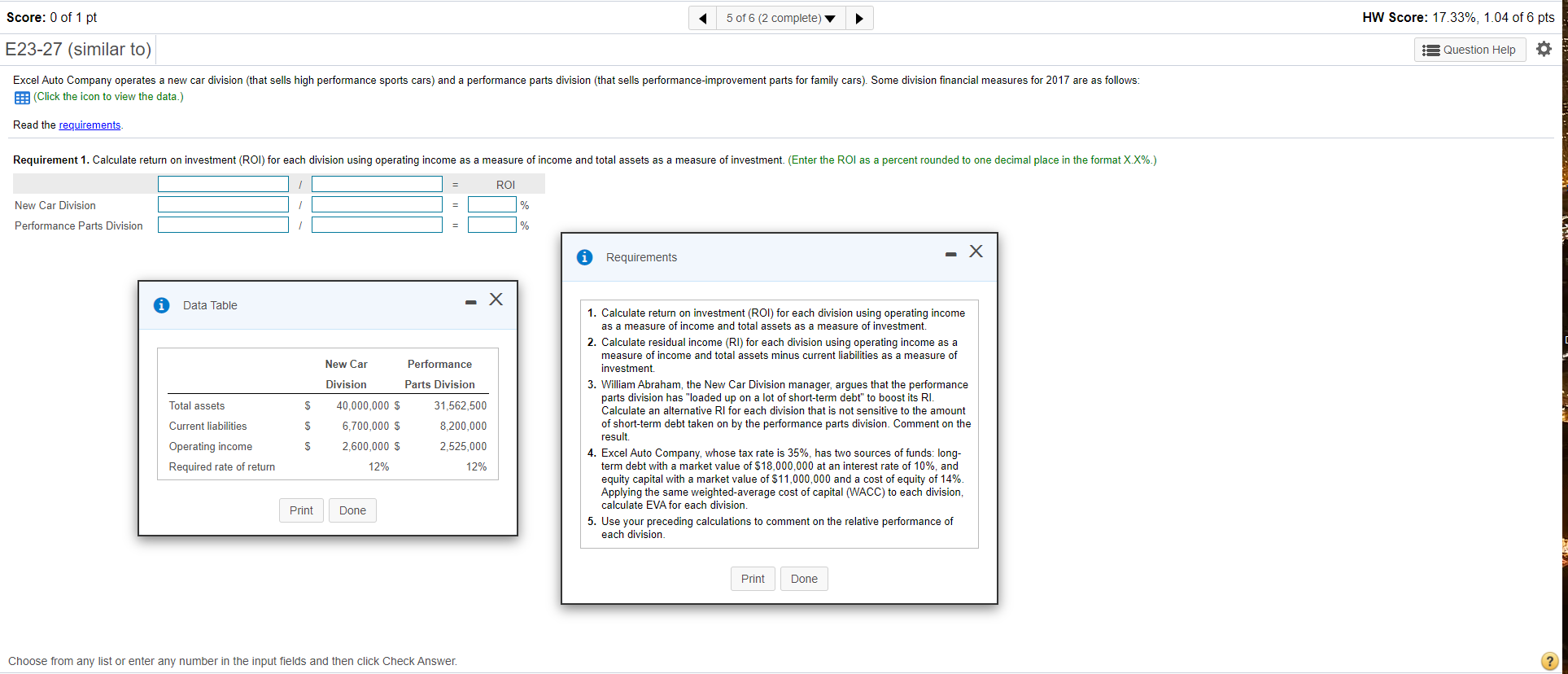

Score: 0 of 1 pt 5 of 6 (2 complete) HW Score: 17.33%, 1.04 of 6 pts E23-27 (similar to) A Question Help Excel Auto Company operates a new car division (that sells high performance sports cars) and a performance parts division (that sells performance-improvement parts for family cars). Some division financial measures for 2017 are as follows: Click the icon to view the data.) Read the requirements Requirement 1. Calculate return on investment (ROI) for each division using operating income as a measure of income and total assets as a measure of investment. (Enter the ROI as a percent rounded to one decimal place in the format XX%.) = ROI % New Car Division Performance Parts Division % 24 Requirements - X Data Table New Car Performance Division Parts Division Total assets $ 31,562,500 Current liabilities $ 40,000,000 $ 6,700,000 $ 2,600,000 $ 12% 1. Calculate return on investment (ROI) for each division using operating income as a measure of income and total assets as a measure of investment. 2. Calculate residual income (RI) for each division using operating income as a measure of income and total assets minus current liabilities as a measure of investment 3. William Abraham, the New Car Division manager, argues that the performance parts division has "loaded up on a lot of short-term debt" to boost its RI. Calculate an alternative RI for each division that is not sensitive to the amount of short-term debt taken on by the performance parts division. Comment on the result. 4. Excel Auto Company, whose tax rate is 35%, has two sources of funds: long- term debt with a market value of $18,000,000 at an interest rate of 10%, and equity capital with a market value of $11,000,000 and a cost of equity of 14% Applying the same weighted average cost of capital (WACC) to each division, calculate EVA for each division. 5. Use your preceding calculations to comment on the relative performance of each division $ 8,200,000 2,525,000 12% Operating income Required rate of return Print Done Print Done Choose from any list or enter any number in the input fields and then click Check