please answer all, same question different parts (1, 1b, 1c)

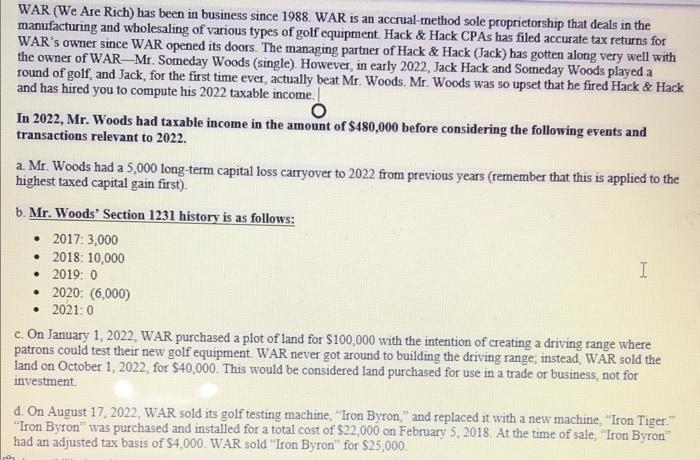

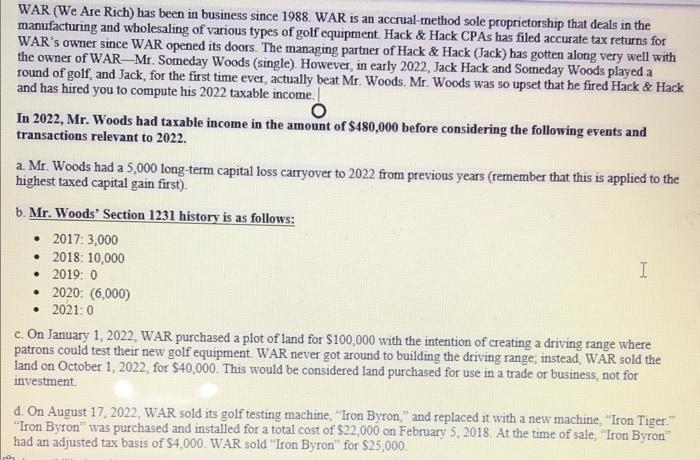

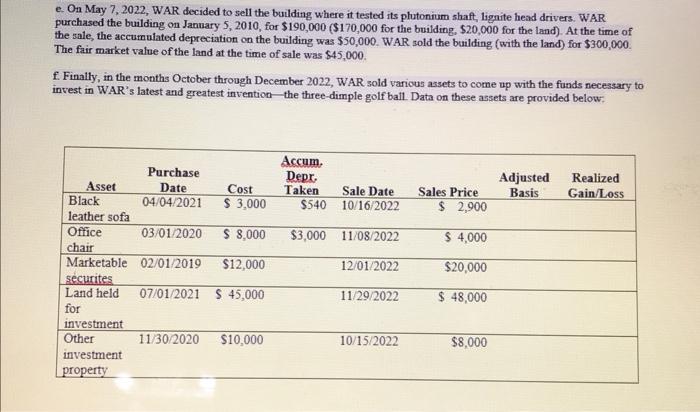

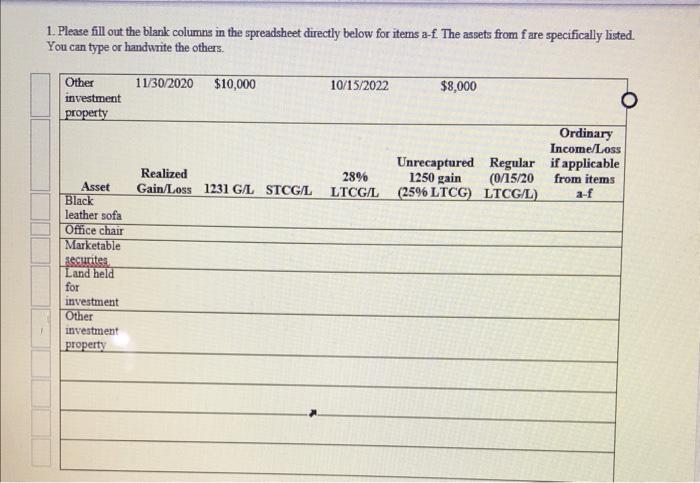

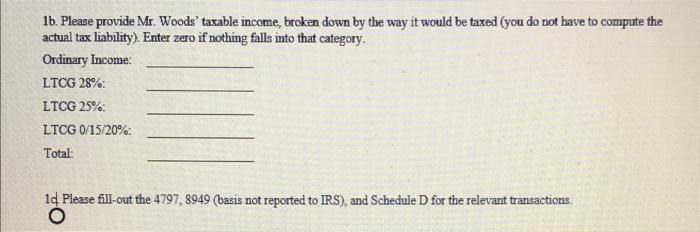

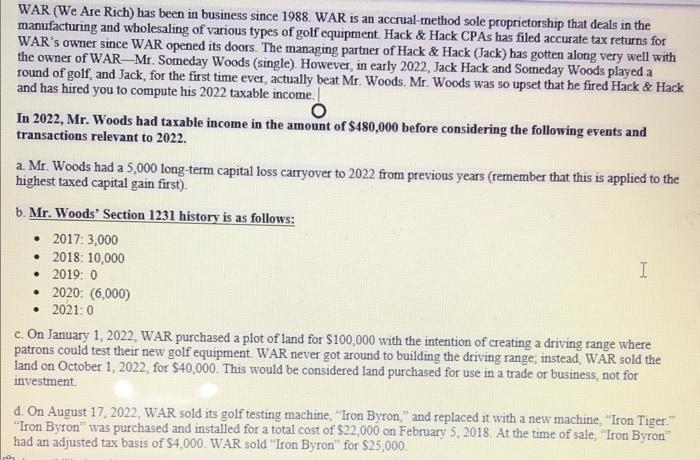

WAR (We Are Rich) has been in business since 1988. WAR is an accrual-method sole proprietorship that deals in the manufacturing and wholesaling of various types of golf equipment. Hack \& Hack CPAs has filed accurate tax returns for WAR's owner since WAR opened its doors. The managing partner of Hack \& Hack (Jack) has gotten along very well with the owner of WAR - Mr. Someday Woods (single). However, in early 2022, Jack Hack and Someday Woods played a round of golf, and Jack, for the first time ever, actually beat Mr. Woods. Mr. Woods was so upset that he fired Hack \& Hack and has hired you to compute his 2022 taxable income. In 2022, Mr. Woods had taxable income in the amount of $480,000 before considering the following events and transactions relevant to 2022 . a. Mr. Woods had a 5,000 long-term capital loss carryover to 2022 from previous years (remember that this is applied to the highest taxed capital gain first). b. Mr. Woods' Section 1231 history is as follows: - 2017:3,000 - 2018:10,000 - 2019:0 - 2020: (6,000) - 2021:0 c. On January 1, 2022, WAR purchased a plot of land for $100,000 with the intention of creating a driving range where patrons could test their new golf equipment. WAR never got around to building the driving range; instead, WAR sold the land on October 1, 2022, for $40,000. This would be considered land purchased for use in a trade or business, not for investment d. On August 17, 2022, WAR sold its golf testing machine, "Iron Byron," and replaced it with a new machine, "Iron Tiger." "Iron Byron" was purchased and installed for a total cost of $22,000 on February 5,2018 . At the time of sale, "Iron Byron" had an adjusted tax basis of $4,000. WAR sold "Iron Byron" for $25,000. e. On May 7,2022 , WAR decided to sell the building where it tested its plutonium shaft, lignite head drivers. WAR purchased the building on January 5,2010 , for $190,000($170,000 for the building, $20,000 for the land). At the time of the sale, the accumulated depreciation on the building was $50,000. WAR sold the building (with the land) for $300,000. The fair market value of the land at the time of sale was $45,000. f. Finally, in the months October through December 2022 , WAR sold various assets to come up with the funds necessary to invest in WAR's latest and greatest invention-the three-dimple golf ball. Data on these assets are provided below: Please fill out the blank columns in the spreadsheet directly below for items a-f. The assets from f are specifically listed. You can type or handwrite the others. 1b. Please provide Mr. Woods' taxable income, broken down by the way it would be taxed (you do not have to compute the actual tax liability). Enter zero if nothing falls into that category. Ordinary Income: LTCG 28\%: LTCG 25\%: LTCG 0/15/20\%: Total: 1d. Please fill-out the 4797, 8949 (basis not reported to IRS), and Schedule D for the relevant transactions. WAR (We Are Rich) has been in business since 1988. WAR is an accrual-method sole proprietorship that deals in the manufacturing and wholesaling of various types of golf equipment. Hack \& Hack CPAs has filed accurate tax returns for WAR's owner since WAR opened its doors. The managing partner of Hack \& Hack (Jack) has gotten along very well with the owner of WAR - Mr. Someday Woods (single). However, in early 2022, Jack Hack and Someday Woods played a round of golf, and Jack, for the first time ever, actually beat Mr. Woods. Mr. Woods was so upset that he fired Hack \& Hack and has hired you to compute his 2022 taxable income. In 2022, Mr. Woods had taxable income in the amount of $480,000 before considering the following events and transactions relevant to 2022 . a. Mr. Woods had a 5,000 long-term capital loss carryover to 2022 from previous years (remember that this is applied to the highest taxed capital gain first). b. Mr. Woods' Section 1231 history is as follows: - 2017:3,000 - 2018:10,000 - 2019:0 - 2020: (6,000) - 2021:0 c. On January 1, 2022, WAR purchased a plot of land for $100,000 with the intention of creating a driving range where patrons could test their new golf equipment. WAR never got around to building the driving range; instead, WAR sold the land on October 1, 2022, for $40,000. This would be considered land purchased for use in a trade or business, not for investment d. On August 17, 2022, WAR sold its golf testing machine, "Iron Byron," and replaced it with a new machine, "Iron Tiger." "Iron Byron" was purchased and installed for a total cost of $22,000 on February 5,2018 . At the time of sale, "Iron Byron" had an adjusted tax basis of $4,000. WAR sold "Iron Byron" for $25,000. e. On May 7,2022 , WAR decided to sell the building where it tested its plutonium shaft, lignite head drivers. WAR purchased the building on January 5,2010 , for $190,000($170,000 for the building, $20,000 for the land). At the time of the sale, the accumulated depreciation on the building was $50,000. WAR sold the building (with the land) for $300,000. The fair market value of the land at the time of sale was $45,000. f. Finally, in the months October through December 2022 , WAR sold various assets to come up with the funds necessary to invest in WAR's latest and greatest invention-the three-dimple golf ball. Data on these assets are provided below: Please fill out the blank columns in the spreadsheet directly below for items a-f. The assets from f are specifically listed. You can type or handwrite the others. 1b. Please provide Mr. Woods' taxable income, broken down by the way it would be taxed (you do not have to compute the actual tax liability). Enter zero if nothing falls into that category. Ordinary Income: LTCG 28\%: LTCG 25\%: LTCG 0/15/20\%: Total: 1d. Please fill-out the 4797, 8949 (basis not reported to IRS), and Schedule D for the relevant transactions