Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all Sammy buys 3 March 2023 com contracts when the quote is 6726. His broker requires a 12% margin. He is trading on

please answer all

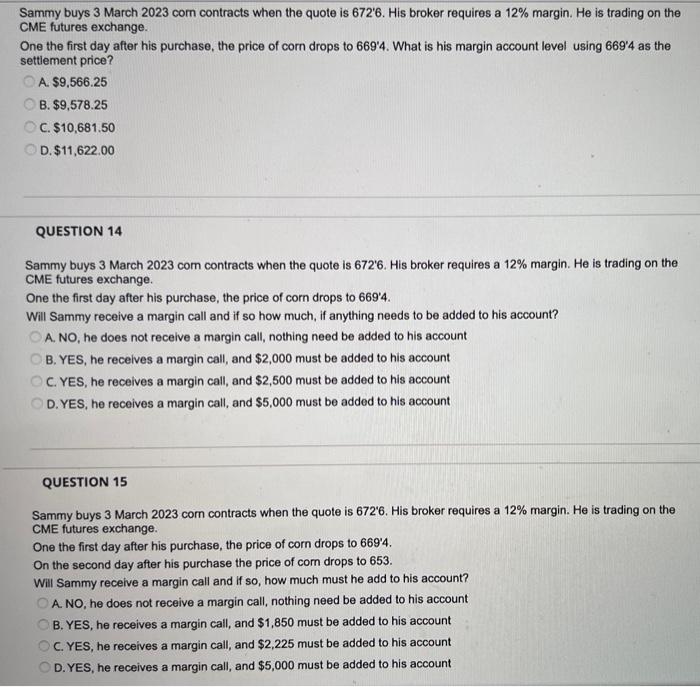

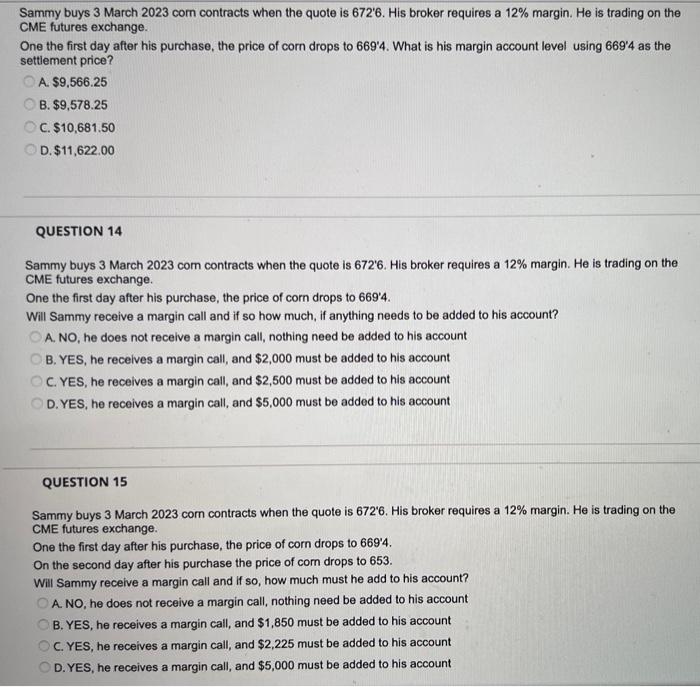

Sammy buys 3 March 2023 com contracts when the quote is 6726. His broker requires a 12% margin. He is trading on the CME futures exchange. One the first day after his purchase, the price of corn drops to 6694. What is his margin account level using 669 ' 4 as the settlement price? A. $9,566.25 B. $9,578.25 C. $10,681.50 D. $11,622.00 QUESTION 14 Sammy buys 3 March 2023 com contracts when the quote is 672 ' 6 . His broker requires a 12% margin. He is trading on the CME futures exchange. One the first day after his purchase, the price of corn drops to 669'4. Will Sammy receive a margin call and if so how much, if anything needs to be added to his account? A. NO, he does not recelve a margin call, nothing need be added to his account B. YES, he recelves a margin call, and $2,000 must be added to his account C. YES, he receives a margin call, and $2,500 must be added to his account D. YES, he receives a margin call, and $5,000 must be added to his account QUESTION 15 Sammy buys 3 March 2023 com contracts when the quote is 6726. His broker requires a 12% margin. He is trading on the CME futures exchange. One the first day after his purchase, the price of corn drops to 6694. On the second day after his purchase the price of com drops to 653. Wil Sammy recelve a margin call and if so, how much must he add to his account? A. NO, he does not receive a margin call, nothing need be added to his account B. YES, he receives a margin call, and $1,850 must be added to his account C. YES, he receives a margin call, and $2,225 must be added to his account D. YES, he receives a margin call, and $5,000 must be added to his account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started