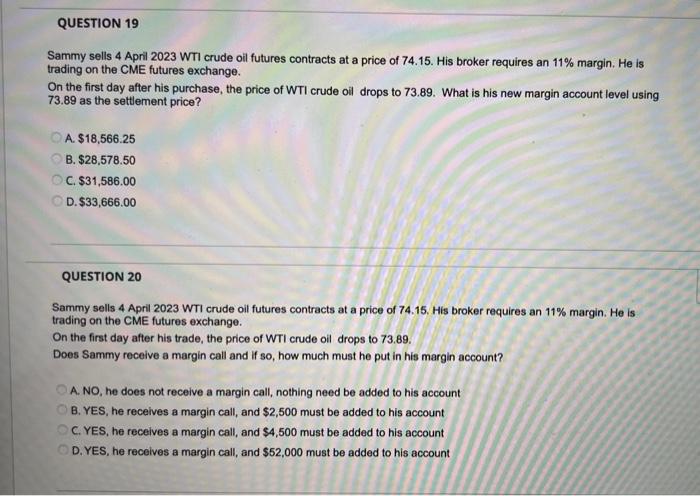

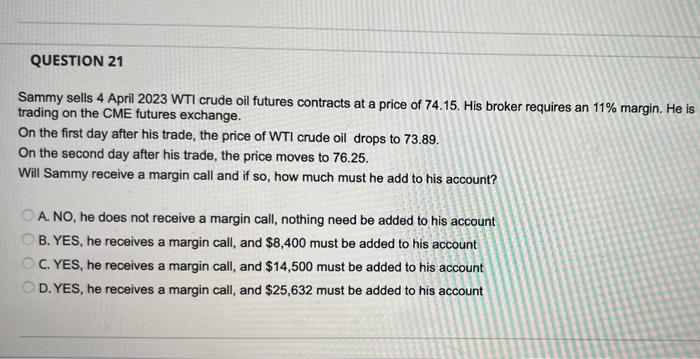

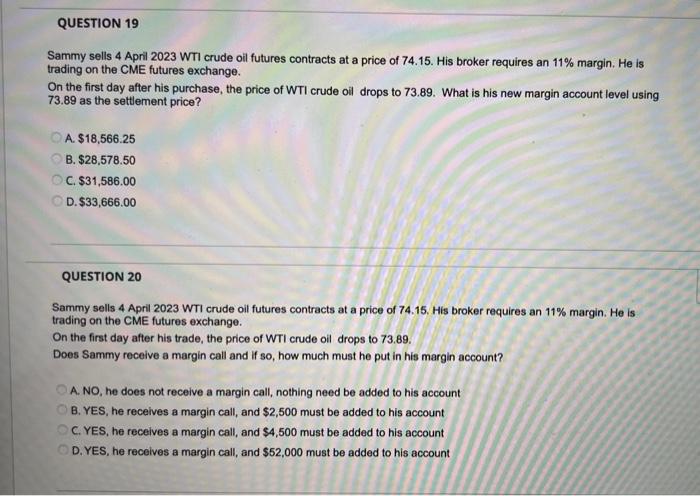

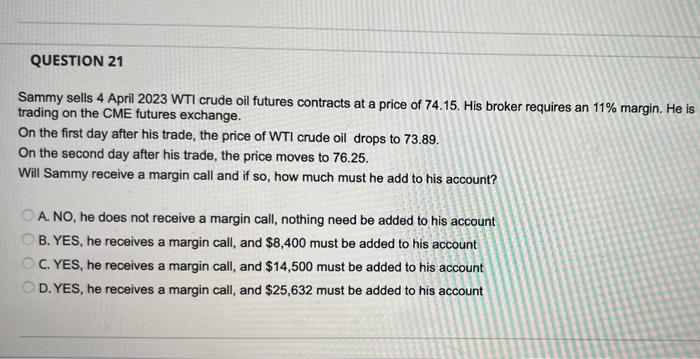

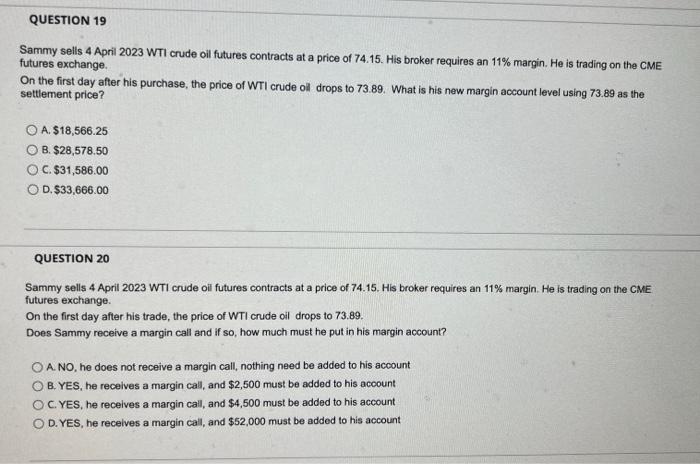

Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his purchase, the price of WTI crude oil drops to 73.89. What is his new margin account level using 73.89 as the settlement price? A. $18,566.25 B. $28,578.50 C. $31,586.00 D. $33,666.00 QUESTION 20 Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his trade, the price of WTI crude oil drops to 73.89. Does Sammy receive a margin call and if so, how much must he put in his margin account? A. NO, he does not recelve a margin call, nothing need be added to his account B. YES, he receives a margin call, and $2,500 must be added to his account C. YES, he recelves a margin call, and $4,500 must be added to his account D. YES, he recelves a margin call, and $52,000 must be added to his account Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his trade, the price of WTI crude oil drops to 73.89. On the second day after his trade, the price moves to 76.25. Will Sammy receive a margin call and if so, how much must he add to his account? A. NO, he does not receive a margin call, nothing need be added to his account B. YES, he receives a margin call, and $8,400 must be added to his account C. YES, he receives a margin call, and $14,500 must be added to his account D. YES, he receives a margin call, and $25,632 must be added to his account Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his purchase, the price of WTI crude oll drops to 73.89. What is his new margin account level using 73.89 as the settlement price? A. $18,566.25 B. $28,578.50 C. $31,586.00 D. $33,666.00 QUESTION 20 Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his trade, the price of WTI crude oil drops to 73.89. Does Sammy receive a margin call and if so, how much must he put in his margin account? A. NO, he does not receive a margin call, nothing need be added to his account B. YES, he receives a margin call, and $2,500 must be added to his acoount C. YES, he receives a margin call, and $4,500 must be added to his account D. YES, he recelves a margin call, and $52,000 must be added to his account Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his purchase, the price of WTI crude oil drops to 73.89. What is his new margin account level using 73.89 as the settlement price? A. $18,566.25 B. $28,578.50 C. $31,586.00 D. $33,666.00 QUESTION 20 Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his trade, the price of WTI crude oil drops to 73.89. Does Sammy receive a margin call and if so, how much must he put in his margin account? A. NO, he does not recelve a margin call, nothing need be added to his account B. YES, he receives a margin call, and $2,500 must be added to his account C. YES, he recelves a margin call, and $4,500 must be added to his account D. YES, he recelves a margin call, and $52,000 must be added to his account Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his trade, the price of WTI crude oil drops to 73.89. On the second day after his trade, the price moves to 76.25. Will Sammy receive a margin call and if so, how much must he add to his account? A. NO, he does not receive a margin call, nothing need be added to his account B. YES, he receives a margin call, and $8,400 must be added to his account C. YES, he receives a margin call, and $14,500 must be added to his account D. YES, he receives a margin call, and $25,632 must be added to his account Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his purchase, the price of WTI crude oll drops to 73.89. What is his new margin account level using 73.89 as the settlement price? A. $18,566.25 B. $28,578.50 C. $31,586.00 D. $33,666.00 QUESTION 20 Sammy sells 4 April 2023 WTI crude oil futures contracts at a price of 74.15. His broker requires an 11% margin. He is trading on the CME futures exchange. On the first day after his trade, the price of WTI crude oil drops to 73.89. Does Sammy receive a margin call and if so, how much must he put in his margin account? A. NO, he does not receive a margin call, nothing need be added to his account B. YES, he receives a margin call, and $2,500 must be added to his acoount C. YES, he receives a margin call, and $4,500 must be added to his account D. YES, he recelves a margin call, and $52,000 must be added to his account