Please answer ALL sections. I will thumbs you up thank you!!!!

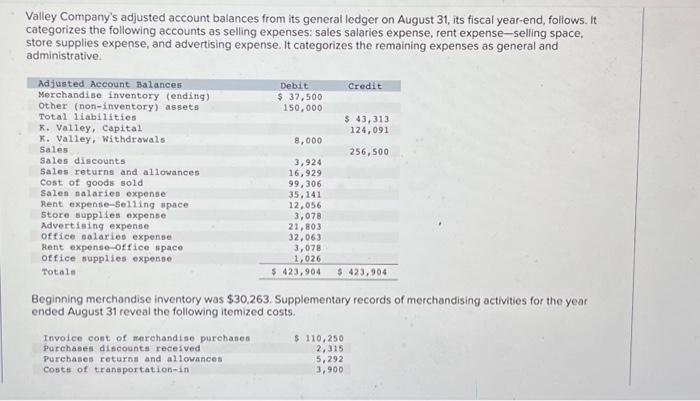

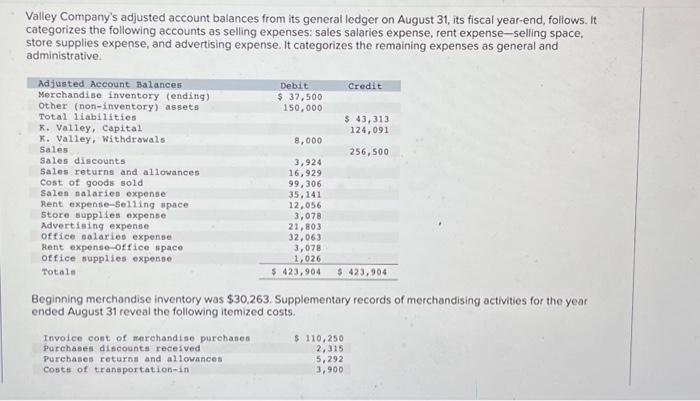

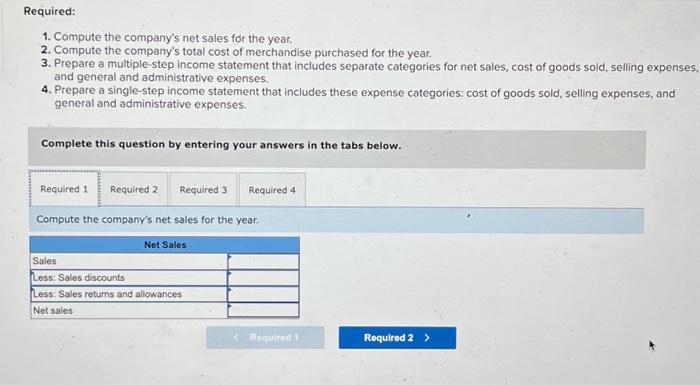

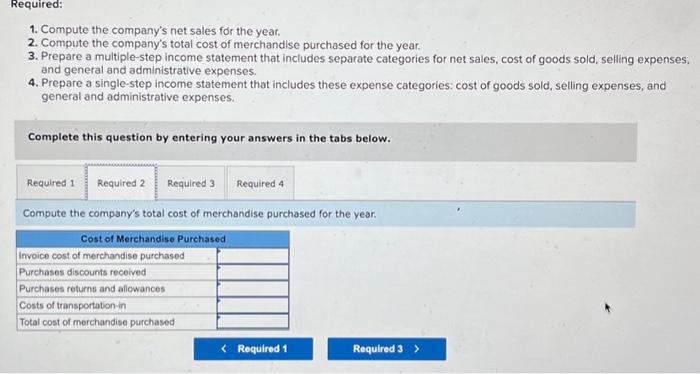

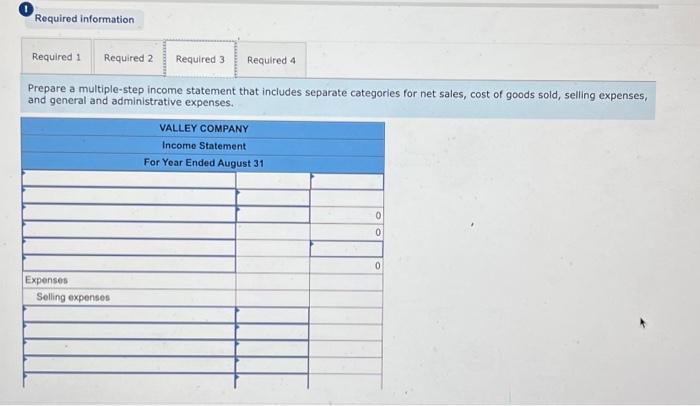

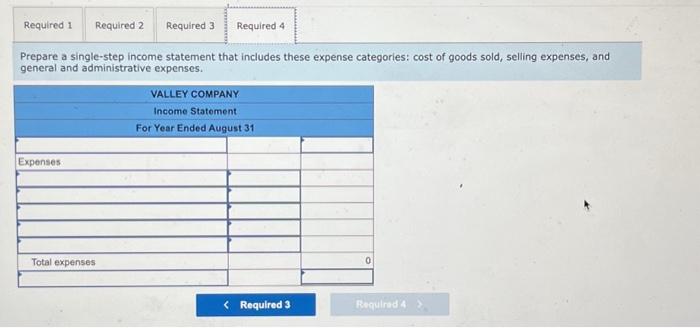

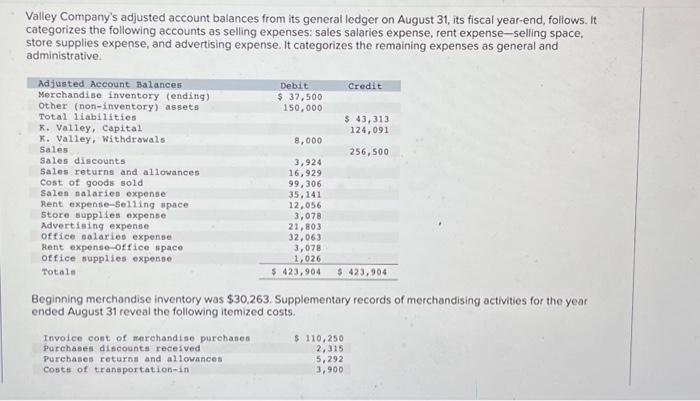

Valley Company's adjusted account balances from its general ledger on August 31 , its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was \$30,263. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expense and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Complete this question by entering your answers in the tabs below. Compute the company's net sales for the year. 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses. and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Complete this question by entering your answers in the tabs below. Compute the company's total cost of merchandise purchased for the year. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses and general and administrative expenses. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Valley Company's adjusted account balances from its general ledger on August 31 , its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was \$30,263. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expense and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Complete this question by entering your answers in the tabs below. Compute the company's net sales for the year. 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses. and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Complete this question by entering your answers in the tabs below. Compute the company's total cost of merchandise purchased for the year. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses and general and administrative expenses. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses