Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**PLEASE ANSWER ALL SUB-QUESTIONS AND EXPLAIN STEP BY STEP, PLEASE INCLUDE FORMULAE IN CORRECT FORMAT NOT COMPUTED VERSIONS, PLEASE INCLUDE NOMENCLATURE FOR ALL FORMULAE USED.

**PLEASE ANSWER ALL SUB-QUESTIONS AND EXPLAIN STEP BY STEP, PLEASE INCLUDE FORMULAE IN CORRECT FORMAT NOT COMPUTED VERSIONS, PLEASE INCLUDE NOMENCLATURE FOR ALL FORMULAE USED. THANK YOU FOR THE ASSISTANCE! ** PLEASE ANSWER THE ENTIRE QUESTION UNTIL THE END**

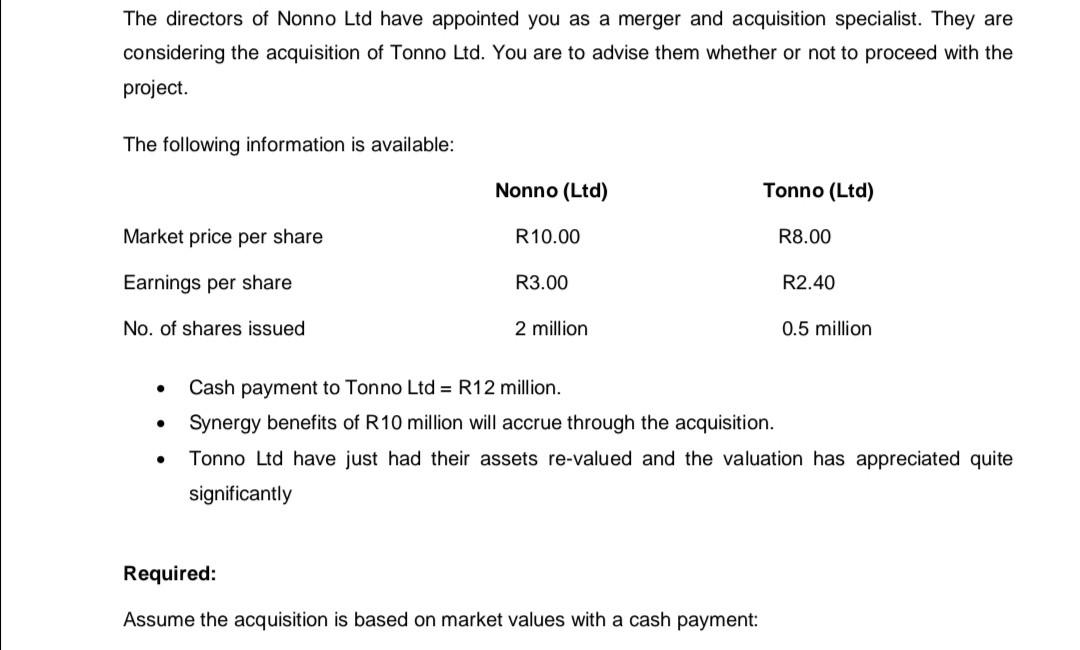

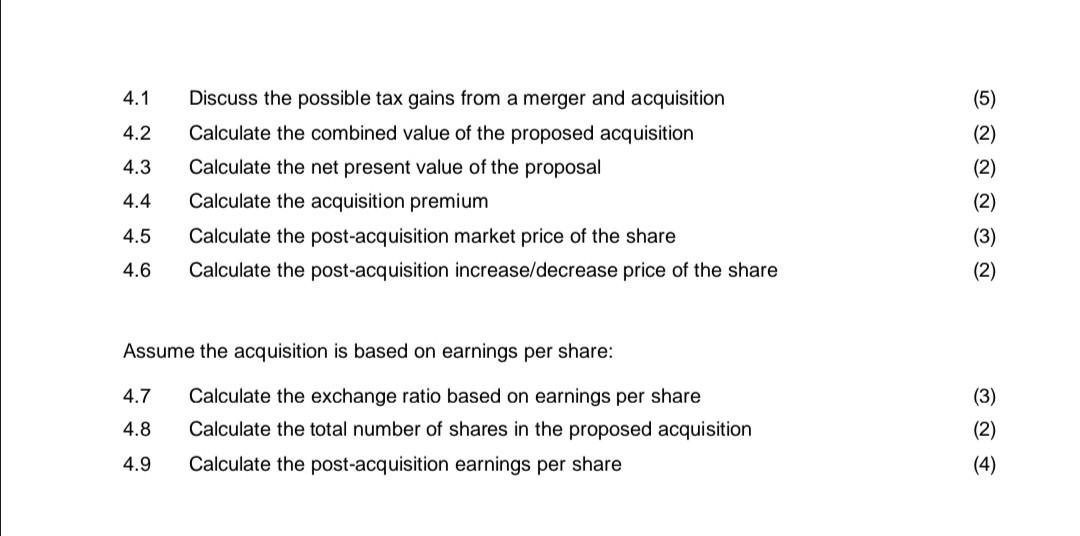

The directors of Nonno Ltd have appointed you as a merger and acquisition specialist. They are considering the acquisition of Tonno Ltd. You are to advise them whether or not to proceed with the project. The following information is available: Nonno (Ltd) Tonno (Ltd) Market price per share R10.00 R8.00 Earnings per share R3.00 R2.40 No. of shares issued 2 million 0.5 million . Cash payment to Tonno Ltd = R12 million. Synergy benefits of R10 million will accrue through the acquisition. Tonno Ltd have just had their assets re-valued and the valuation has appreciated quite significantly Required: Assume the acquisition is based on market values with a cash payment: 4.1 4.2 Discuss the possible tax gains from a merger and acquisition Calculate the combined value of the proposed acquisition Calculate the net present value of the proposal Calculate the acquisition premium Calculate the post-acquisition market price of the share Calculate the post-acquisition increase/decrease price of the share (5) (2) (2) (2) 4.3 4.4 4.5 (3) (2) 4.6 Assume the acquisition is based on earnings per share: 4.7 4.8 Calculate the exchange ratio based on earnings per share Calculate the total number of shares in the proposed acquisition Calculate the post-acquisition earnings per share (3) (2) (4) 4.9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started