Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all. Thank you Question 1 3.34 pts ChexPro Corporation is considering an expansion project that requires an initial fixed asset investment of $2,750,000.

please answer all. Thank you

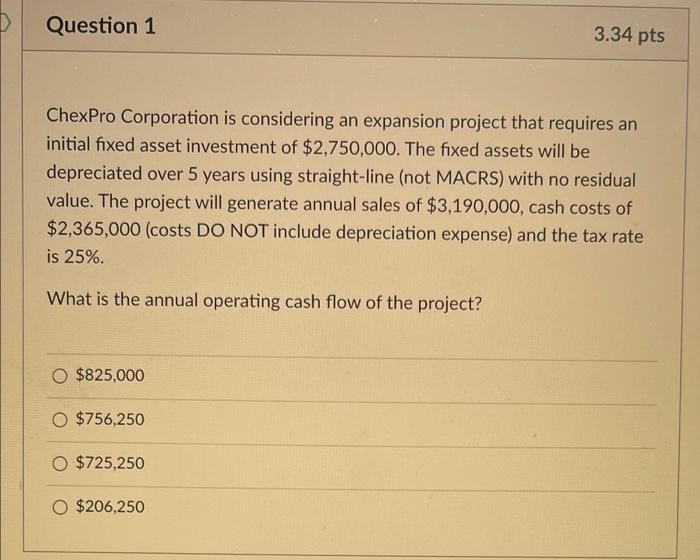

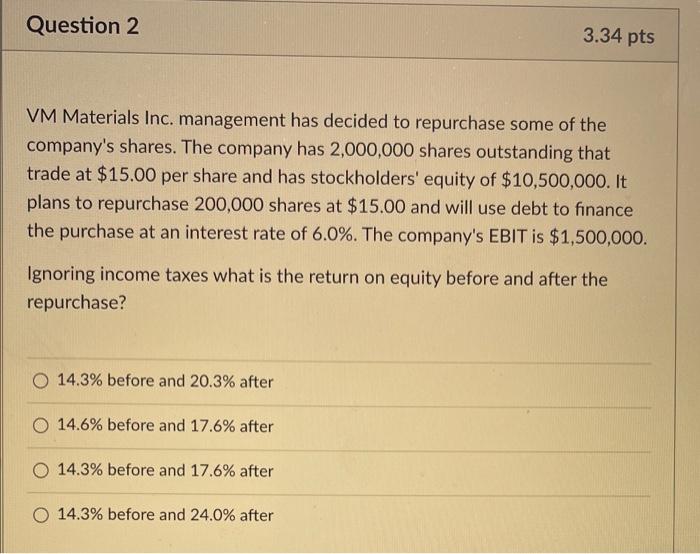

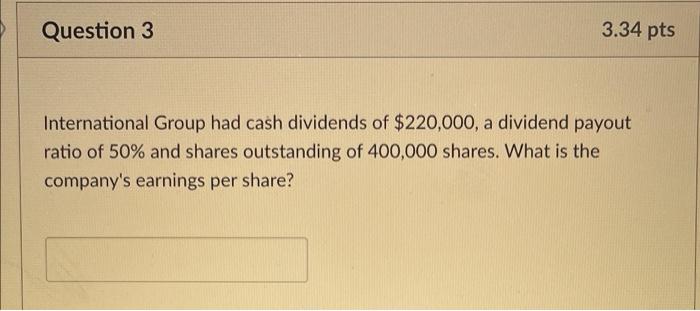

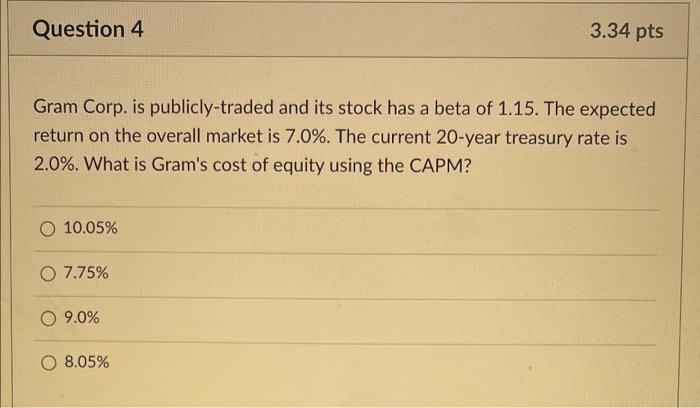

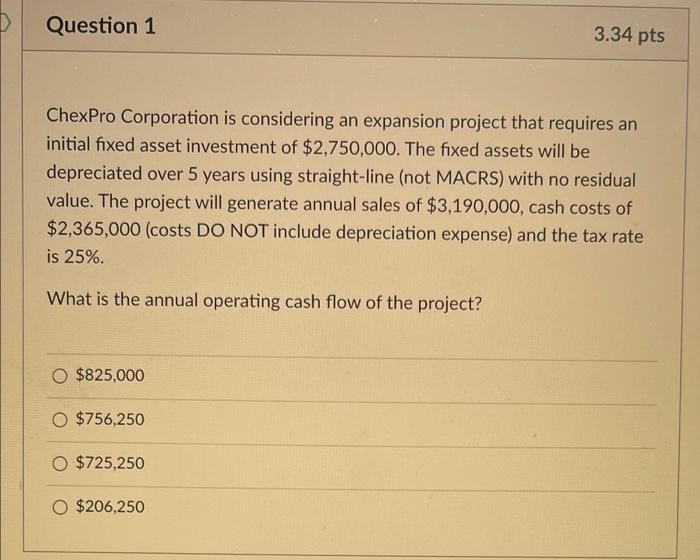

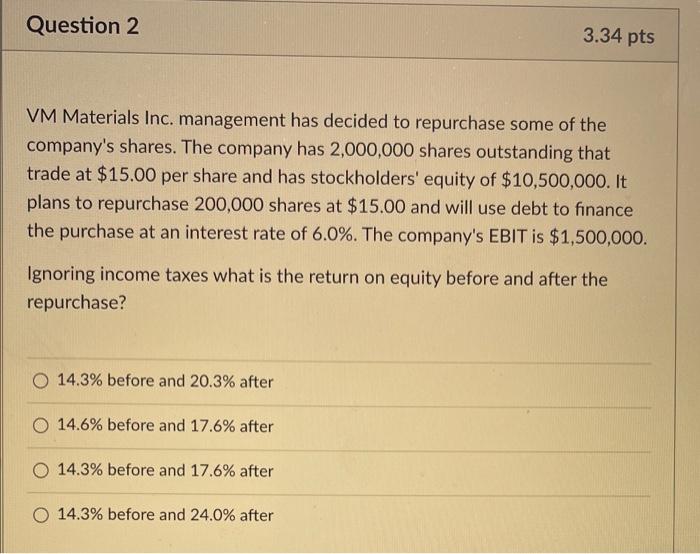

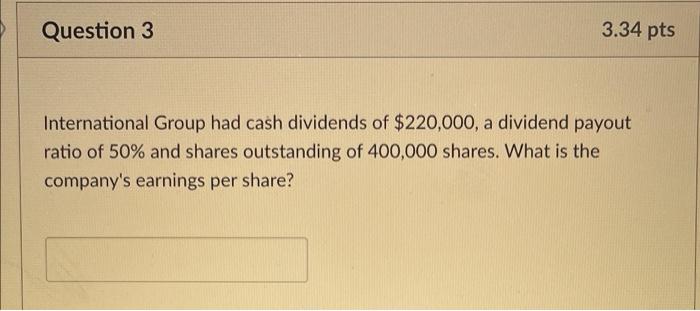

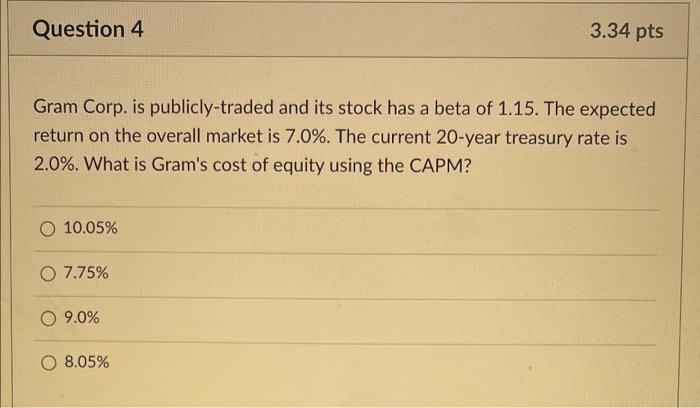

Question 1 3.34 pts ChexPro Corporation is considering an expansion project that requires an initial fixed asset investment of $2,750,000. The fixed assets will be depreciated over 5 years using straight-line (not MACRS) with no residual value. The project will generate annual sales of $3,190,000, cash costs of $2,365,000 (costs DO NOT include depreciation expense) and the tax rate is 25%. What is the annual operating cash flow of the project? O $825.000 O $756,250 O $725,250 O $206,250 Question 2 3.34 pts VM Materials Inc. management has decided to repurchase some of the company's shares. The company has 2,000,000 shares outstanding that trade at $15.00 per share and has stockholders' equity of $10,500,000. It plans to repurchase 200,000 shares at $15.00 and will use debt to finance the purchase at an interest rate of 6.0%. The company's EBIT is $1,500,000. Ignoring income taxes what is the return on equity before and after the repurchase? O 14.3% before and 20.3% after O 14.6% before and 17.6% after O 14.3% before and 17.6% after 14.3% before and 24.0% after Question 3 3.34 pts International Group had cash dividends of $220,000, a dividend payout ratio of 50% and shares outstanding of 400,000 shares. What is the company's earnings per share? Question 4 3.34 pts Gram Corp. is publicly-traded and its stock has a beta of 1.15. The expected return on the overall market is 7.0%. The current 20-year treasury rate is 2.0%. What is Gram's cost of equity using the CAPM? 10.05% O 7.75% 9.0% 8.05%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started