Answered step by step

Verified Expert Solution

Question

1 Approved Answer

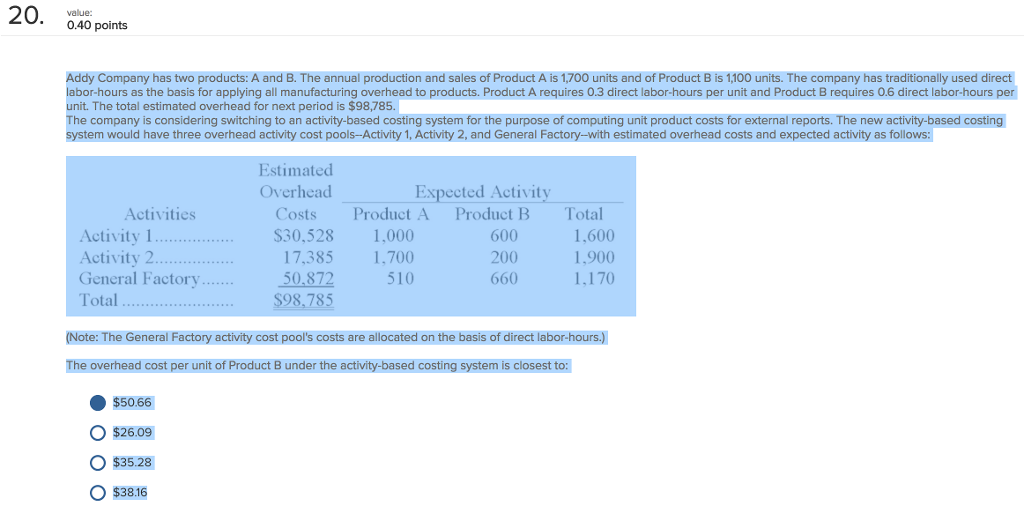

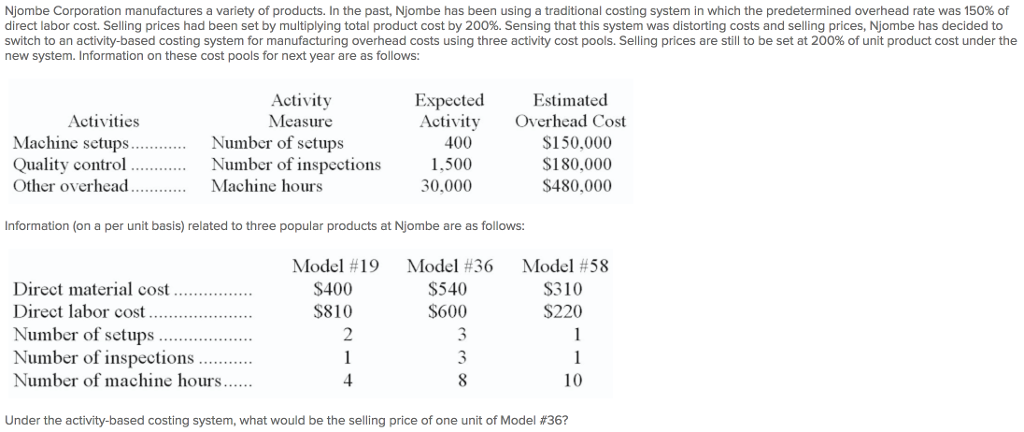

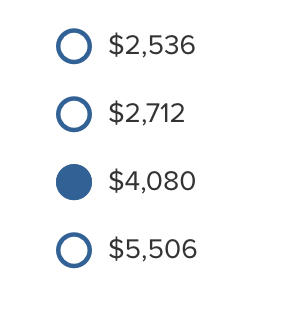

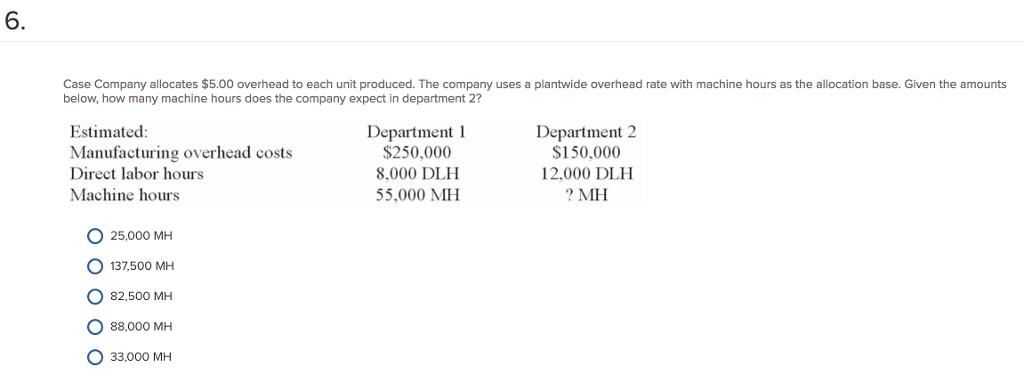

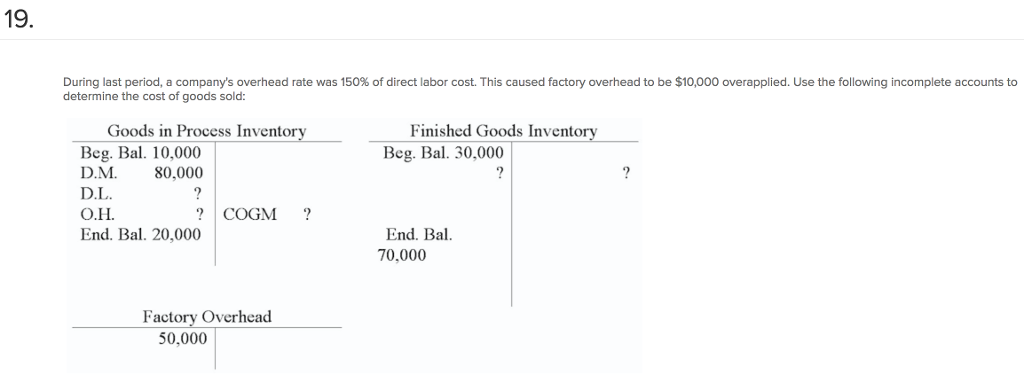

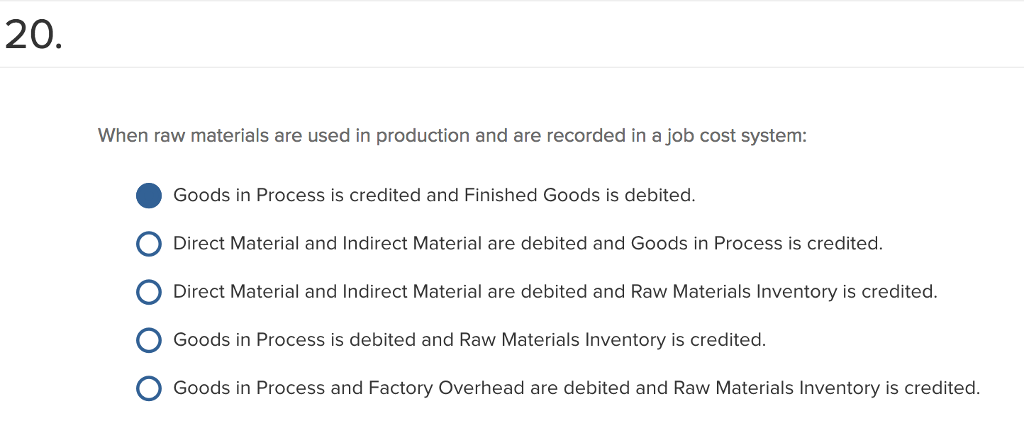

Please answer all. Thank you so much in advance:)! 20 0.40 points Addy Company has two products: A and B. The annual production and sales

Please answer all. Thank you so much in advance:)!

Please answer all. Thank you so much in advance:)!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started