Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all thanks Based on the segmented market hypothesis, the interest rate in each segment is determined by the supply and demand in the

please answer all thanks

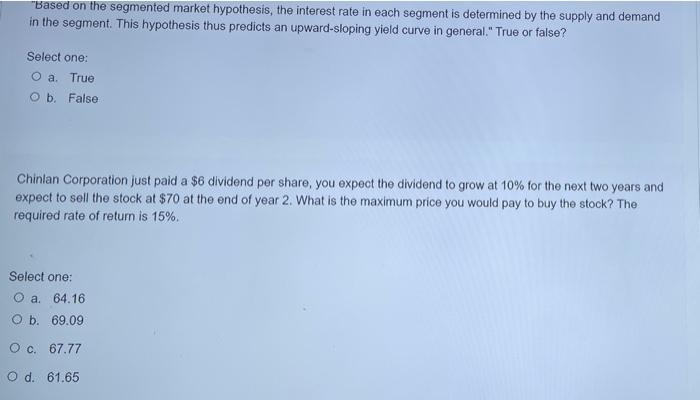

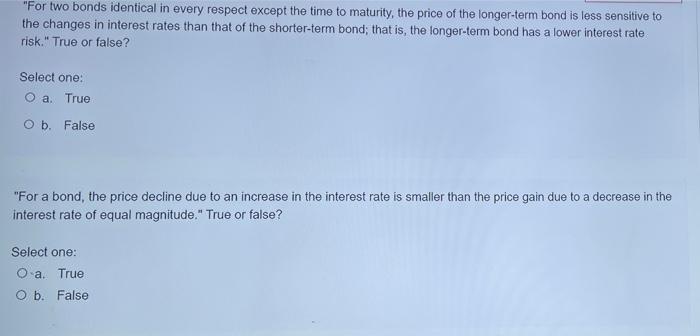

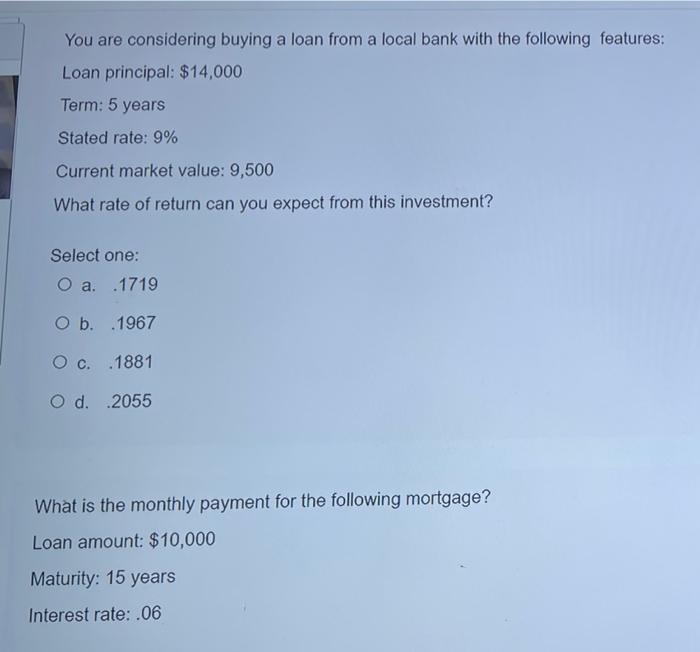

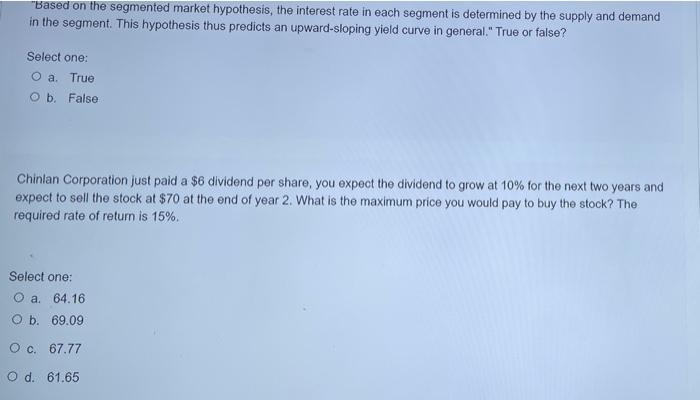

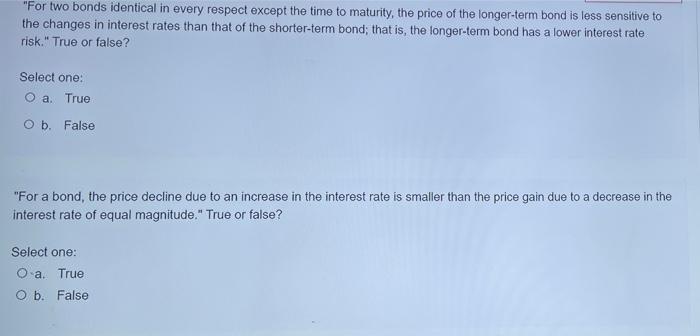

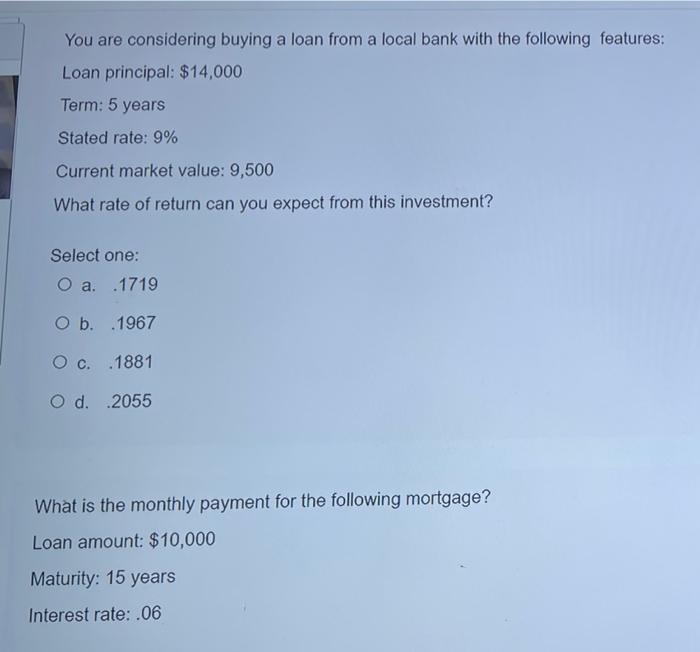

Based on the segmented market hypothesis, the interest rate in each segment is determined by the supply and demand in the segment. This hypothesis thus predicts an upward-sloping yield curve in general." True or false? Select one: O a. True Ob. False Chinian Corporation just paid a $6 dividend per share, you expect the dividend to grow at 10% for the next two years and expect to sell the stock at $70 at the end of year 2. What is the maximum price you would pay to buy the stock? The required rate of retum is 15%. Select one: O a. 64.16 O b. 69.09 O c. 67.77 Od. 61.65 "For two bonds identical in every respect except the time to maturity, the price of the longer-term bond is less sensitive to the changes in interest rates than that of the shorter-term bond; that is, the longer-term bond has a lower interest rate risk." True or false? Select one: O a. True Ob False a "For a bond, the price decline due to an increase in the interest rate is smaller than the price gain due to a decrease in the interest rate of equal magnitude." True or false? Select one: O a. True O b. False You are considering buying a loan from a local bank with the following features: Loan principal: $14,000 Term: 5 years Stated rate: 9% Current market value: 9,500 What rate of return can you expect from this investment? Select one: O a. 1719 O b. .1967 O c. 1881 O d. 2055 What is the monthly payment for the following mortgage? Loan amount: $10,000 Maturity: 15 years Interest rate: .06 Based on the segmented market hypothesis, the interest rate in each segment is determined by the supply and demand in the segment. This hypothesis thus predicts an upward-sloping yield curve in general." True or false? Select one: O a. True Ob. False Chinian Corporation just paid a $6 dividend per share, you expect the dividend to grow at 10% for the next two years and expect to sell the stock at $70 at the end of year 2. What is the maximum price you would pay to buy the stock? The required rate of retum is 15%. Select one: O a. 64.16 O b. 69.09 O c. 67.77 Od. 61.65 "For two bonds identical in every respect except the time to maturity, the price of the longer-term bond is less sensitive to the changes in interest rates than that of the shorter-term bond; that is, the longer-term bond has a lower interest rate risk." True or false? Select one: O a. True Ob False a "For a bond, the price decline due to an increase in the interest rate is smaller than the price gain due to a decrease in the interest rate of equal magnitude." True or false? Select one: O a. True O b. False You are considering buying a loan from a local bank with the following features: Loan principal: $14,000 Term: 5 years Stated rate: 9% Current market value: 9,500 What rate of return can you expect from this investment? Select one: O a. 1719 O b. .1967 O c. 1881 O d. 2055 What is the monthly payment for the following mortgage? Loan amount: $10,000 Maturity: 15 years Interest rate: .06

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started