Question

PLEASE ANSWER ALL THE PARTS . DO NOT POST INCOMPLETE SOLUTIONS. I WANT COMPLETE REASONS AND EXPLANATIONS FOR EACH ANSWER . PLEASE EXPLAIN IN A

PLEASE ANSWER ALL THE PARTS . DO NOT POST INCOMPLETE SOLUTIONS. I WANT COMPLETE REASONS AND EXPLANATIONS FOR EACH ANSWER. PLEASE EXPLAIN IN A BETTER WAY.

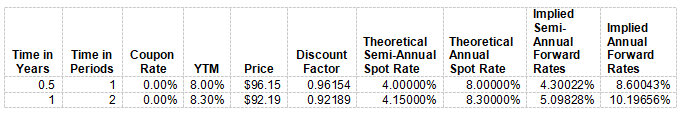

Assume the following Treasury yield curve is in existence.

Assume that there is a 6-month Treasury bill futures contract in existence. Assume that it is priced to yield 8.70% (BEY). Assume the face value of the contract is $100,000.

a. Based on the above curve, what should the BEY and PRICE of the 6-month Treasury bill futures contract be?

b. Show that this futures price is incorrect using a zero-cost investment strategy involving the spot market and the futures market. (Of course, if the futures price is correct, this zero cost strategy will also have zero profit.) Show the actual dollar cash flows at time 0 and at the expiration of the futures contract.

c. This strategy will have a loss which means that the investor taking the other side of this strategy would have a profit. In a few sentences, describe the other side of this strategy (no calculations necessary).

Implied Semi Implied Theoretical Theoretical Annua Annual Forward Forward Time inTime in Coupon Years Periods Rate YTM Price Factor Spot Rate Spot Rate Rates Discount Semi-Annual Annual Rates 0.00% 8.00% $96.15 0.96154 4.00000% 8.00000% 430022% 860043% 0.00% 8.30% $92.19 0.92189 4.15000% 8.30000% 5.09828% 10.19656% 0.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started