Please answer all the questions.

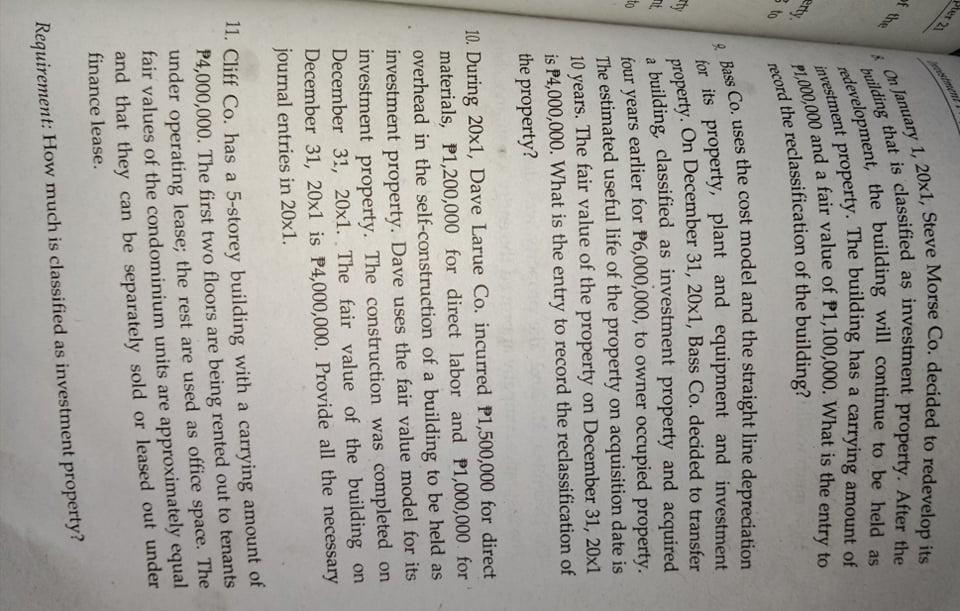

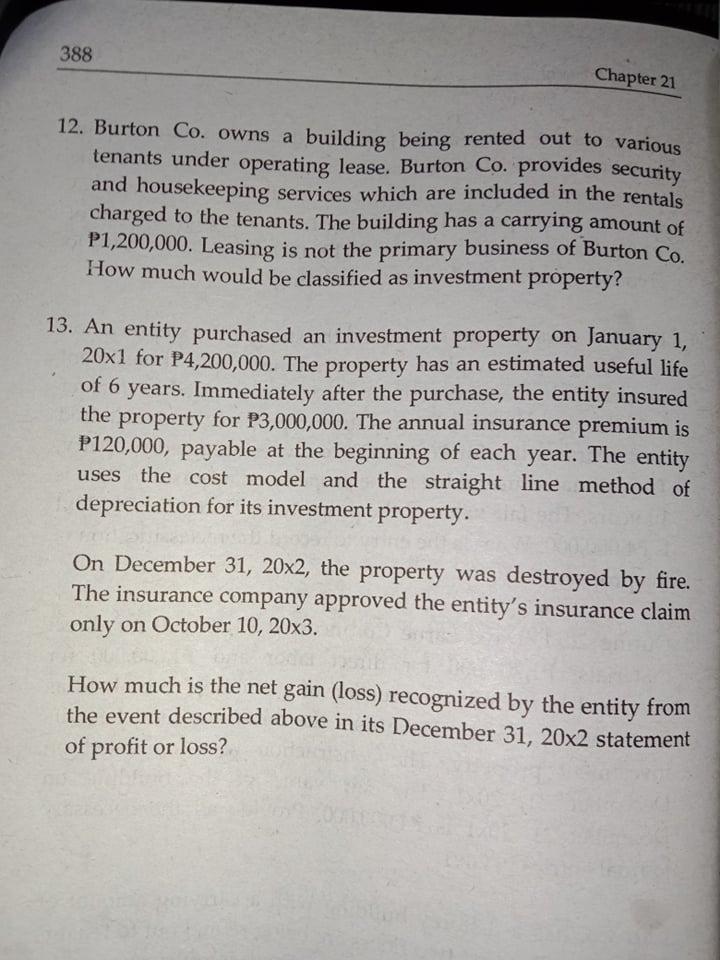

7. On January 1, 20x1, Dream Theater Co., a real estate company, decided not to lease out anymore its building but rather sell it. The building will be sold in its current state and that no redevelopment will be necessary. The building has a carrying amount of P1,000,000 and a fair value of P1,100,000. What is the entry to record the reclassification of the building? Het On January 1, 20x1, Steve Morse Co. decided to redevelop its building that is classified as investment property. After the redevelopment, the building will continue to be held as investment property. The building has a carrying amount of P1,000,000 and a fair value of P1,100,000. What is the entry to record the reclassification of the building? erty. sto . Bass Co. uses the cost model and the straight line depreciation for its property, plant and equipment and investment property. On December 31, 20x1, Bass Co. decided to transfer ty nt to a building, classified as investment property and acquired four years earlier for P6,000,000, to owner occupied property. The estimated useful life of the property on acquisition date is 10 years. The fair value of the property on December 31, 20x1 is P4,000,000. What is the entry to record the reclassification of the property? 10. During 20x1, Dave Larue Co. incurred P1,500,000 for direct materials, P1,200,000 for direct labor and P1,000,000 for overhead in the self-construction of a building to be held as investment property. Dave uses the fair value model for its investment property. The construction was completed on December 31, 20x1. The fair value of the building on December 31, 20x1 is P4,000,000. Provide all the necessary journal entries in 20x1. 11. Cliff Co. has a 5-storey building with a carrying amount of P4,000,000. The first two floors are being rented out to tenants under operating lease; the rest are used as office space. The fair values of the condominium units are approximately equal and that they can be separately sold or leased out under finance lease. Requirement: How much is classified as investment property? 388 Chapter 21 12. Burton Co. owns a building being rented out to various tenants under operating lease. Burton Co. provides security and housekeeping services which are included in the rentals charged to the tenants. The building has a carrying amount of P1,200,000. Leasing is not the primary business of Burton Co. How much would be classified as investment property? 13. An entity purchased an investment property on January 1, 20x1 for P4,200,000. The property has an estimated useful life of 6 years. Immediately after the purchase, the entity insured the property for P3,000,000. The annual insurance premium is P120,000, payable at the beginning of each year. The entity uses the cost model and the straight line method of depreciation for its investment property. On December 31, 20x2, the property was destroyed by fire. The insurance company approved the entity's insurance claim only on October 10, 20x3. How much is the net gain (loss) recognized by the entity from the event described above in its December 31, 20x2 statement of profit or loss