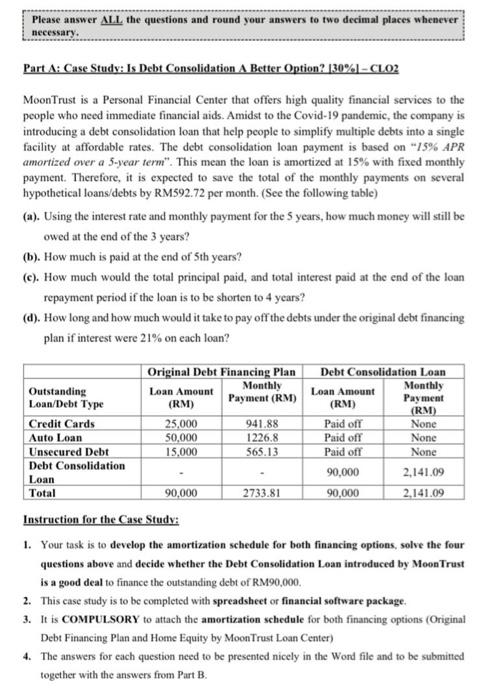

Please answer ALL the questions and round your answers to two decimal places whenever necessary. Part A: Case Study: Is Debt Consolidation A Better Option? (30%- CLOZ Moon Trust is a Personal Financial Center that offers high quality financial services to the people who need immediate financial aids. Amidst to the Covid-19 pandemic, the company is introducing a debt consolidation loan that help people to simplify multipic debts into a single facility at affordable rates. The debt consolidation loan payment is based on "15% APR amortized over a 5-year termi". This mean the loan is amortized at 15% with fixed monthly payment. Therefore, it is expected to save the total of the monthly payments on several hypothetical loans/debts by RM592.72 per month. (See the following table) (a). Using the interest rate and monthly payment for the 5 years, how much money will still be owed at the end of the 3 years? (b). How much is paid at the end of Sth years? (c). How much would the total principal paid, and total interest paid at the end of the loan repayment period if the loan is to be shorten to 4 years? (d). How long and how much would it take to pay off the debts under the original debt financing plan if interest were 21% on each loan? 90,000 2733.81 90,000 Original Debt Financing Plan Debt Consolidation Loan Outstanding Loan Amount Monthly Monthly Loan Amount Loan/Debt Type (RM) Payment (RM) Payment (RM) (RM) Credit Cards 25,000 941.88 Paid ofr None Auto Loan 50.000 1226.8 aid off None Unsecured Debt 15,000 565.13 Paid off None Debt Consolidation Loan 90,000 2,141.09 Total 2,141.09 Instruction for the Case Study: 1. Your task is to develop the amortization schedule for both financing options, solve the four questions above and decide whether the Debt Consolidation Loan introduced by Moon Trust is a good deal to finance the outstanding debt of RM90,000. 2. This case study is to be completed with spreadsheet or financial software package. 3. It is COMPULSORY to attach the amortization schedule for both financing options (Original Debt Financing Plan and Home Equity by Moon Trust Loan Center) 4. The answers for each question need to be presented nicely in the Word file and to be submitted together with the answers from Part B