Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL THE QUESTIONS Consifer the data contained in the tabie below, which lists 30 menthly excoss returns to two different actively manajod stock

PLEASE ANSWER ALL THE QUESTIONS

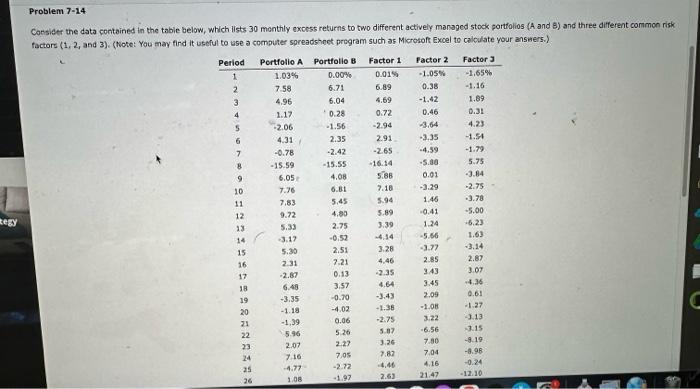

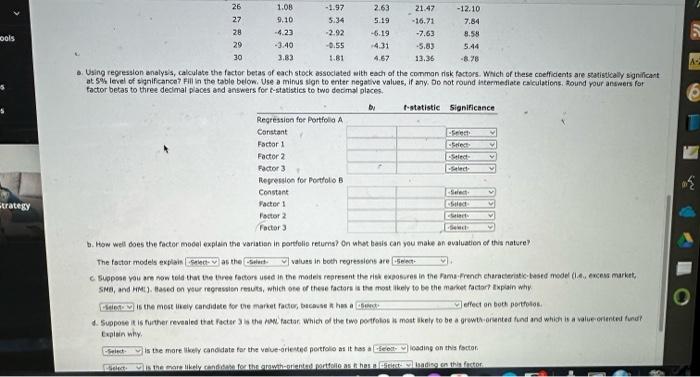

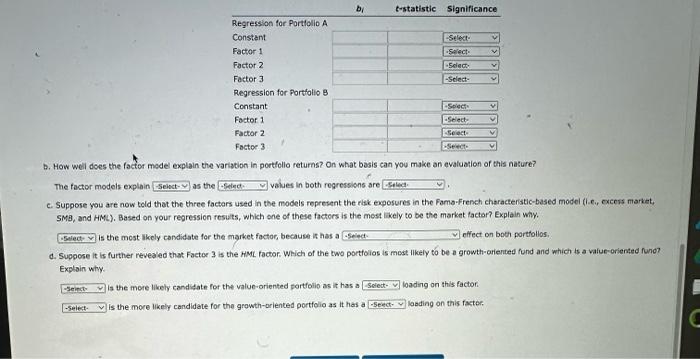

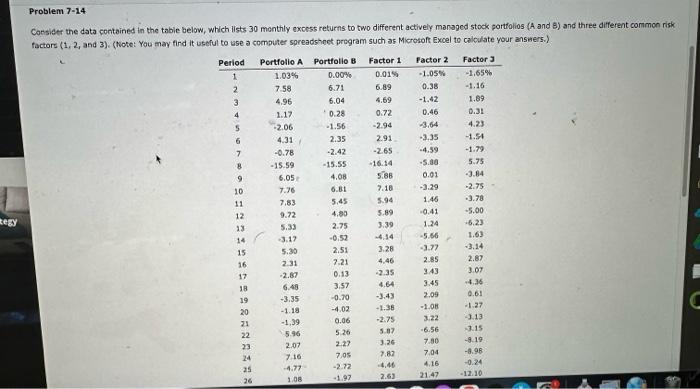

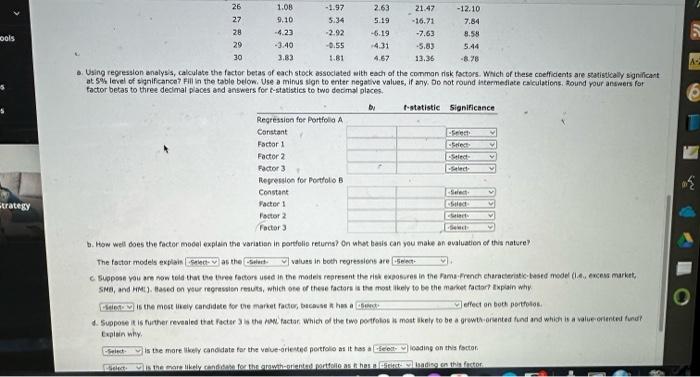

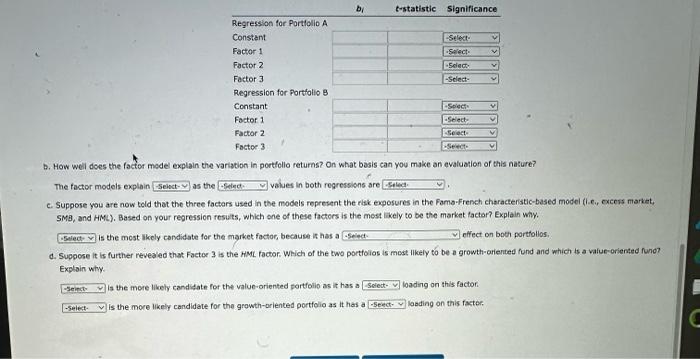

Consifer the data contained in the tabie below, which lists 30 menthly excoss returns to two different actively manajod stock portfolios (A and B) and three different common risk factors (1,2, and 3). (Notet You may find it useful to use a computer spreadshect program such as Microsoft Excel to calculate your ansuers.) Using regression analyss, calculate the fector betas of each stock associated with each of the comman risk factors. Wich of these coefficients are statistcaly signilicant at 5% level of significance?. Fili in the table belon. Use a minus sign to enter negative valuec, if any. Do not round thtermedlate caiculations, hound rour answeis for tactor betas to three decimal places and answers for e-statistics to two decimal places. b. How weil does the fector mooal explain the variatian in portiolio returns? On what bedis can you maie an ovaluatien of this nature? The foctor models explain as the values in both regressions are SMA, and kiMt]. Hased on your recresien resuts, which ote of these factars it the most thely to be the market factart topiain why. is the most liely cardidete for the market facter, bucasse in hes a leffect on both portfolas. Expiein why. is the mare likeriy candidate far the velue-orieteed portolo at it has at losding on this foctor. Madise cen thin fuctor. b. How weil does the factor medel explain the variation in portfollo returns? On what basis can you make an evaluation of this nature? The factor models explain as the values in both regressions are c. Suppose you are now told that the three factars used in the models represent the risk exposures in the Foma.French characteristic-based model (i.e., excers market, SM3, and HML). Based on your regression resuits, which one of these factors is the mest likely to be the market factor? Explain wiy. is the most likely candidate for the market factor, because is has a effect on both porthollos, d. Suppose it is further revealed that Factor 3 is the HML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund Explain why. is the more likely candidate for the value-oriented portfolio as it has a loading on this factori. is the more likely candidate for the growth-oriented portfolio as it has a lasding on this facter. Consifer the data contained in the tabie below, which lists 30 menthly excoss returns to two different actively manajod stock portfolios (A and B) and three different common risk factors (1,2, and 3). (Notet You may find it useful to use a computer spreadshect program such as Microsoft Excel to calculate your ansuers.) Using regression analyss, calculate the fector betas of each stock associated with each of the comman risk factors. Wich of these coefficients are statistcaly signilicant at 5% level of significance?. Fili in the table belon. Use a minus sign to enter negative valuec, if any. Do not round thtermedlate caiculations, hound rour answeis for tactor betas to three decimal places and answers for e-statistics to two decimal places. b. How weil does the fector mooal explain the variatian in portiolio returns? On what bedis can you maie an ovaluatien of this nature? The foctor models explain as the values in both regressions are SMA, and kiMt]. Hased on your recresien resuts, which ote of these factars it the most thely to be the market factart topiain why. is the most liely cardidete for the market facter, bucasse in hes a leffect on both portfolas. Expiein why. is the mare likeriy candidate far the velue-orieteed portolo at it has at losding on this foctor. Madise cen thin fuctor. b. How weil does the factor medel explain the variation in portfollo returns? On what basis can you make an evaluation of this nature? The factor models explain as the values in both regressions are c. Suppose you are now told that the three factars used in the models represent the risk exposures in the Foma.French characteristic-based model (i.e., excers market, SM3, and HML). Based on your regression resuits, which one of these factors is the mest likely to be the market factor? Explain wiy. is the most likely candidate for the market factor, because is has a effect on both porthollos, d. Suppose it is further revealed that Factor 3 is the HML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund Explain why. is the more likely candidate for the value-oriented portfolio as it has a loading on this factori. is the more likely candidate for the growth-oriented portfolio as it has a lasding on this facter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started