Answered step by step

Verified Expert Solution

Question

1 Approved Answer

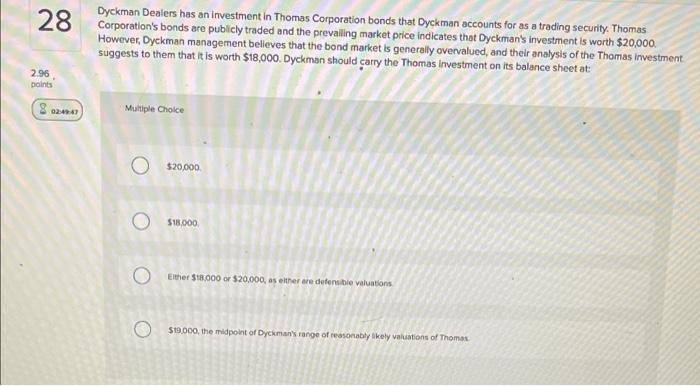

Please answer all the questions correctly. Thank you in advance. 28 Dyckman Dealers has an investment in Thomas Corporation bonds that Dyckman accounts for as

Please answer all the questions correctly. Thank you in advance.

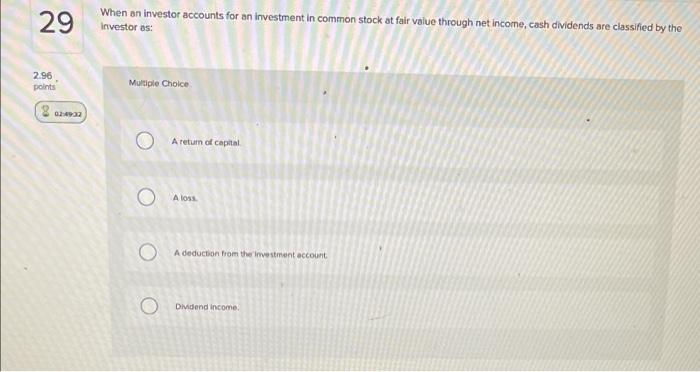

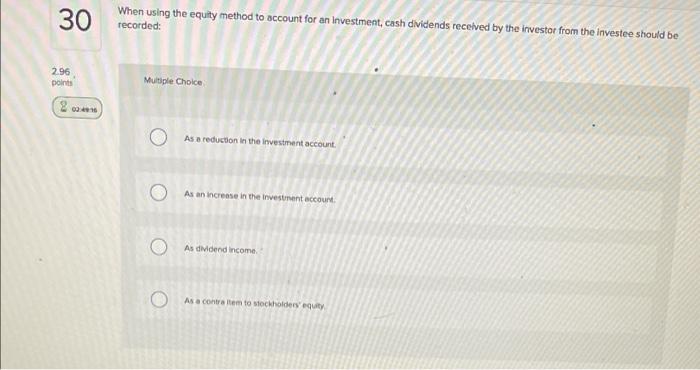

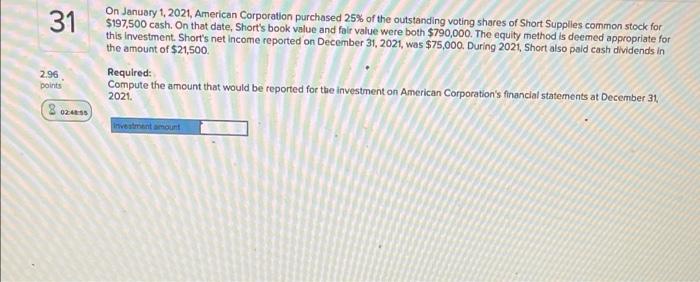

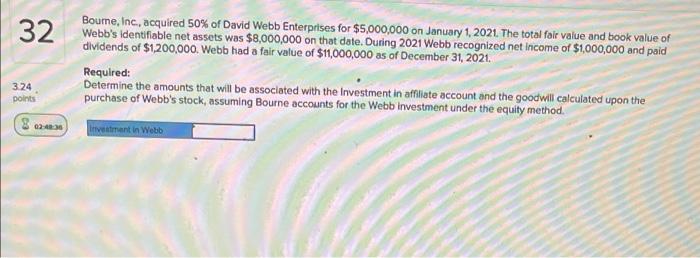

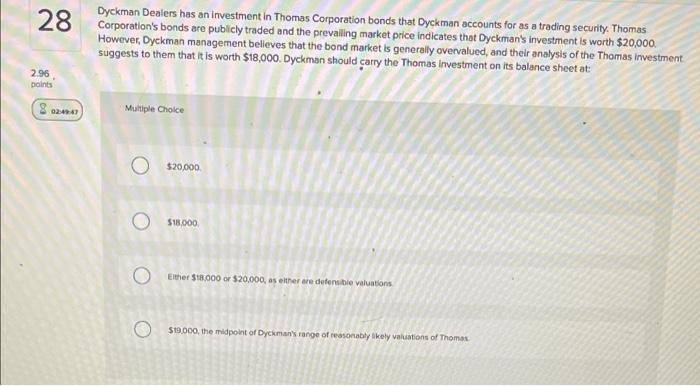

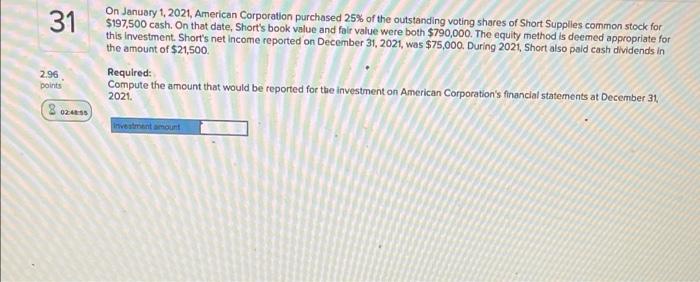

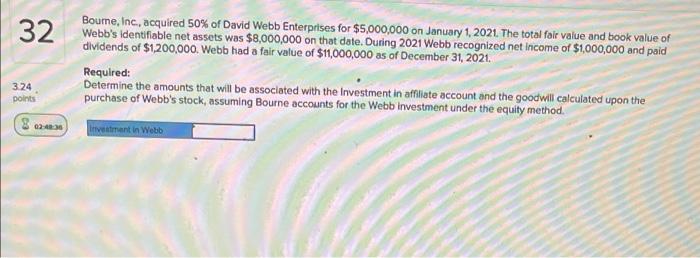

28 Dyckman Dealers has an investment in Thomas Corporation bonds that Dyckman accounts for as a trading security. Thomas Corporation's bonds are publicly traded and the prevailing market price indicates that Dyckman's investment is worth $20,000 However, Dyckman management believes that the bond market is generally overvalued, and their analysis of the Thomas investment suggests to them that it is worth $18,000. Dyckman should carry the Thomas investment on its balance sheet at 2.96 points 8 034733 Multiple Choice O $20,000 O $18.000 Omer $10,000 or $20,000, as emner are detenibile valuations O $19.000, the midpoint of Dyckman/tange of reasonably ikety valuations of Thomas When an investor accounts for an investment in common stock at fair value through net income.cash dividends are classified by the 29 Investor as: 2.96 points Multiple Choice 802002 O A return of capital O A los A deduction from the lowestment account Dividend income 30 When using the equity method to account for an investment, cash dividends received by the investor from the investee should be recorded: 2.96 points Multiple Choice 22:42 o As a reduction in the Investment account o As an increase in the investment account O As didend income o As a contra lem to stockholders que 31 On January 1, 2021, American Corporation purchased 25% of the outstanding voting shares of Short Supplies common stock for $197,500 cash. On that date, Short's book value and fair value were both $790,000. The equity method is deemed appropriate for this investment. Short's net Income reported on December 31, 2021, was $75,000. During 2021 Short also paid cash dividends in the amount of $21,500 Required: Compute the amount that would be reported for the investment on American Corporation's financial statements at December 31 2021 2.96 points 8 2256 Investment amount 32 Boume, Inc., acquired 50% of David Webb Enterprises for $5,000,000 on January 1, 2021. The total fair value and book value of Webb's identifiable net assets was $8,000,000 on that date. During 2021 Webb recognized net income of $1,000,000 and paid dividends of $1,200,000. Webb had a fair value of $11,000,000 as of December 31, 2021. Required: Determine the amounts that will be associated with the Investment in affiliate account and the goodwill calculated upon the purchase of Webb's stock, assuming Bourne accounts for the Webb investment under the equity method. 324 points 8 02:42 Investment in Webb

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started