Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 45 If the partnership agreements states that profit and losses are divided by allowing 15% interest on beginning

please answer all the questions immediately thankyou

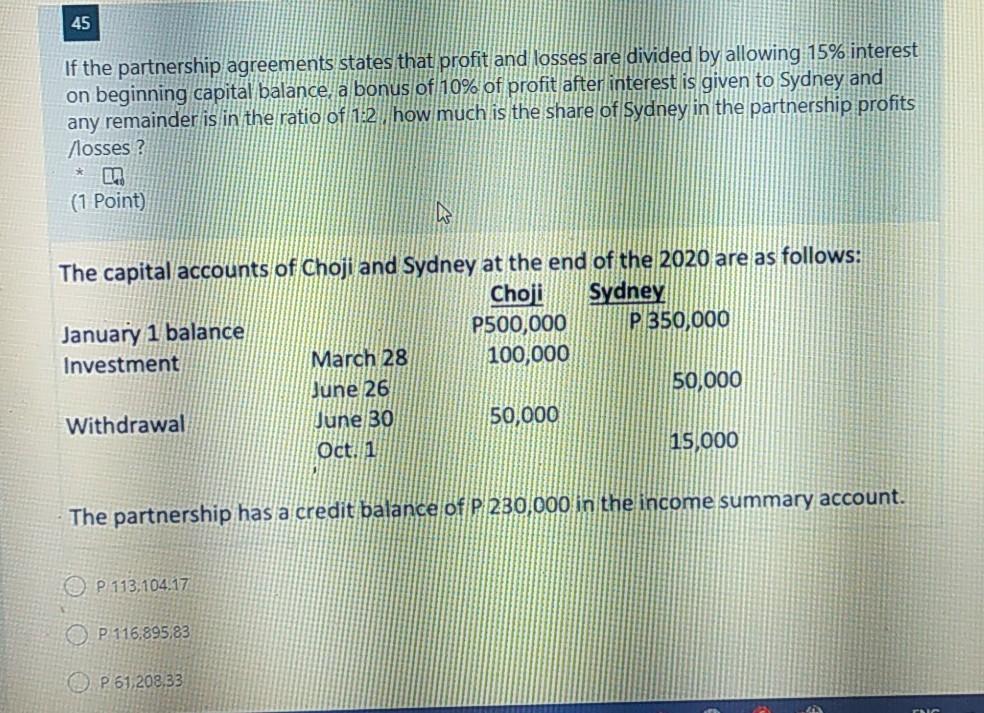

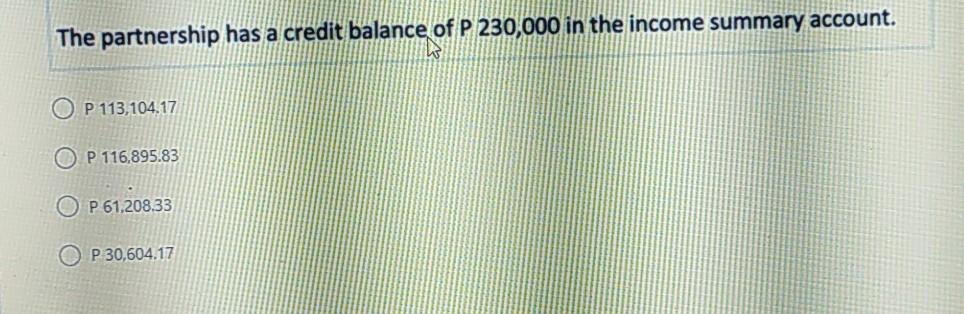

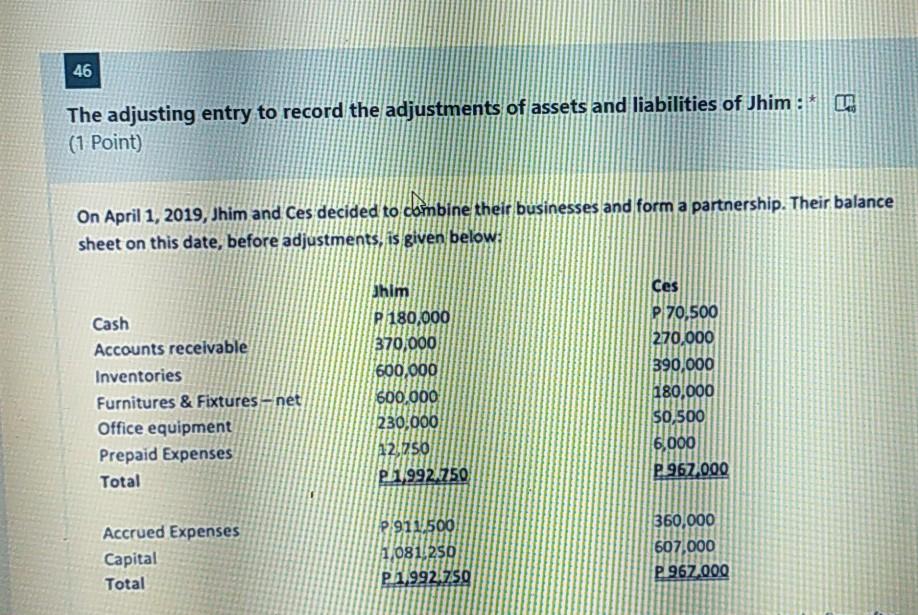

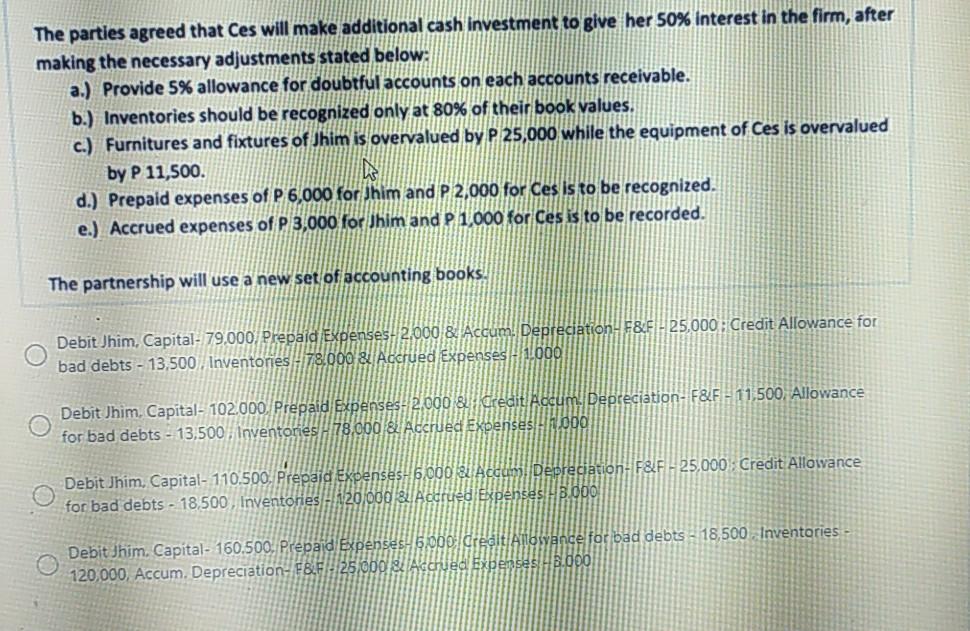

45 If the partnership agreements states that profit and losses are divided by allowing 15% interest on beginning capital balance, a bonus of 10% of profit after interest is given to Sydney and any remainder is in the ratio of 1:2 how much is the share of Sydney in the partnership profits losses ? * (1 Point) The capital accounts of Choji and Sydney at the end of the 2020 are as follows: Choji Sydney January 1 balance P500,000 P 350,000 Investment March 28 100,000 June 26 50,000 Withdrawal June 30 50,000 Oct. 1 15,000 The partnership has a credit balance of P 230.000 in the income summary account. O P 113,104.17 O P 116,895,83 O P 61,208,33 The partnership has a credit balance of P 230,000 in the income summary account. P 113,104.17 OP 116.895.83 O P 61,208.33 OP 30,604.17 46 The adjusting entry to record the adjustments of assets and liabilities of Jhim : (1 Point) On April 1, 2019, Jhim and Ces decided to combine their businesses and form a partnership . Their balance sheet on this date, before adjustments, is given below: Cash Accounts receivable Inventories Furnitures & Fixtures - net Office equipment Prepaid Expenses Total ahim P 180,000 370,000 600,000 600.000 230,000 12.256 P.1992.750 Ces P 70,500 270,000 390,000 180,000 50,500 6,000 P1967.000 Accrued Expenses Capital Total P 911500 1,081250 P.1,992759 360,000 607,000 P.967.000 The parties agreed that Ces will make additional cash investment to give her 50% Interest in the firm, after making the necessary adjustments stated below: a.) Provide 5% allowance for doubtful accounts on each accounts receivable. b.) Inventories should be recognized only at 80% of their book values. c.) Furnitures and fixtures of Jhim is overvalued by P 25,000 while the equipment of Ces is overvalued by P 11,500. d.) Prepaid expenses of P 6,000 for Jhim and P 2,000 for Ces is to be recognized. e.) Accrued expenses of P 3,000 for Jhim and P 1,000 for Ces is to be recorded. The partnership will use a new set of accounting books. Debit Jhim, Capital- 79.000 Prepaid Expenses-2.000 & Accum. Depreciation: F&F-25,000 : Credit Allowance for bad debts - 13,500 Inventories -78.000 & Accrued Expenses 1000 Debit Jhim. Capital- 102.000. Prepaid Expenses: 2.000 8 Credit Accum. Depreciation- F&F - 11,500. Allowance for bad debts - 13,500 Inventories H78.000 & Accrued Expensest 000 Debit Jhim. Capital- 110.500. Prepaid Expenses 6.000 31 Acum Depreciation F&F - 25,000 Credit Allowance for bad debts - 18,500, Inventories H120 000 & Accrued Expenses HB000 Debit Jhim. Capital- 160.500. Prepaid Expenses- 5.000 drealtiAllowance for bad debts - 18,500 Inventories 120,000, Accum. Depreciation- F&F: 125.000 Expenses HE000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started