Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou always 26. An equipment was purchased on Jan. 1, 2015 for P 600,000 less a 10% trade discount.

please answer all the questions immediately thankyou always

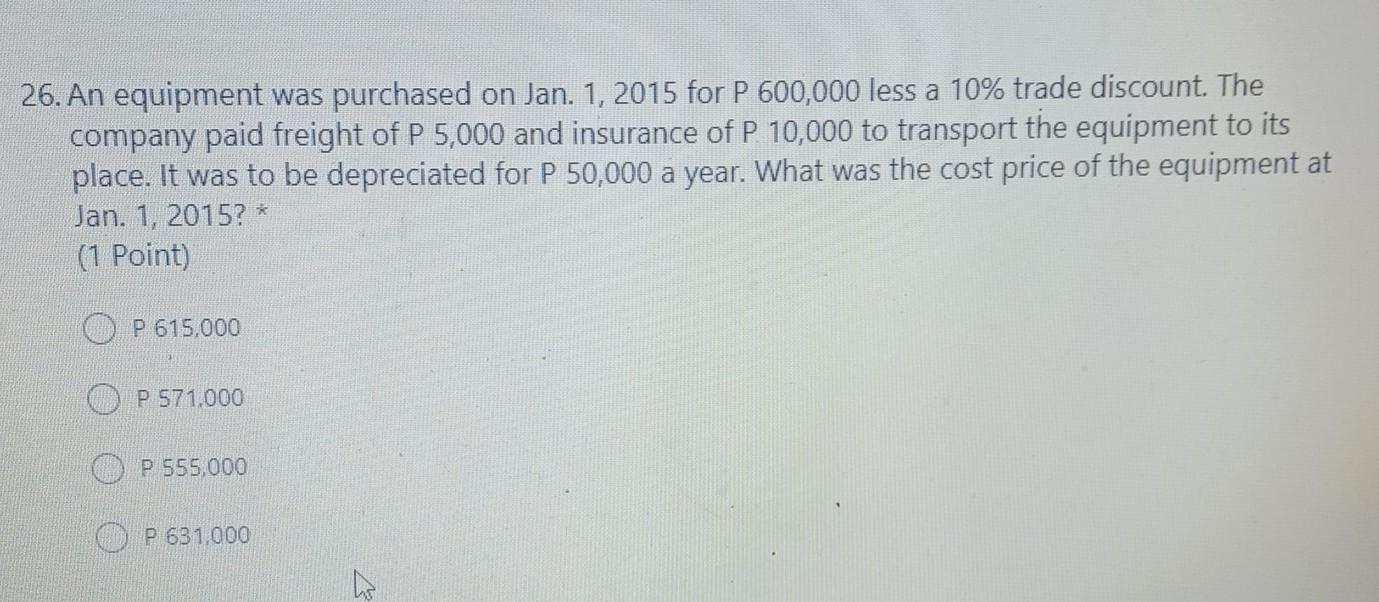

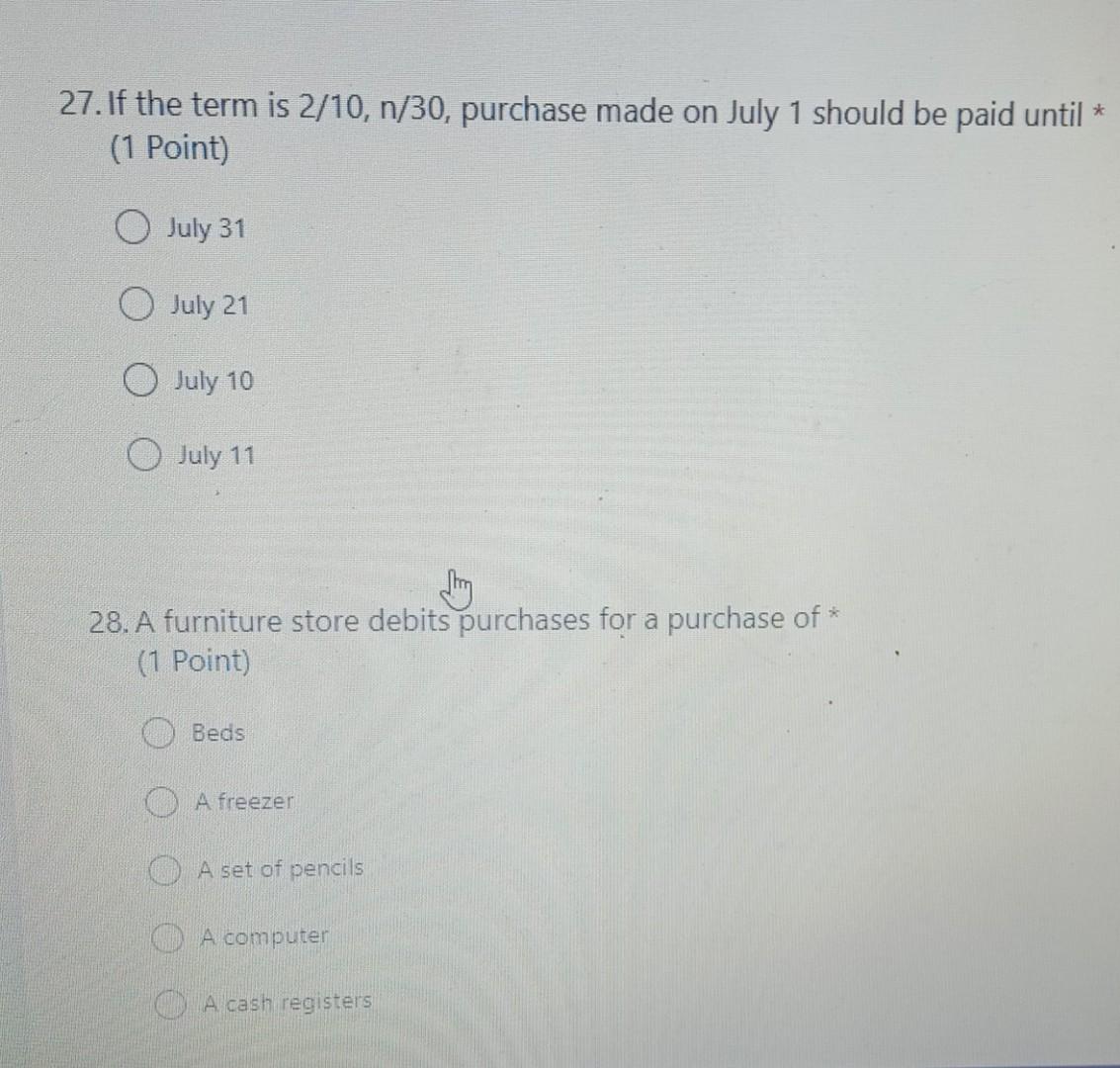

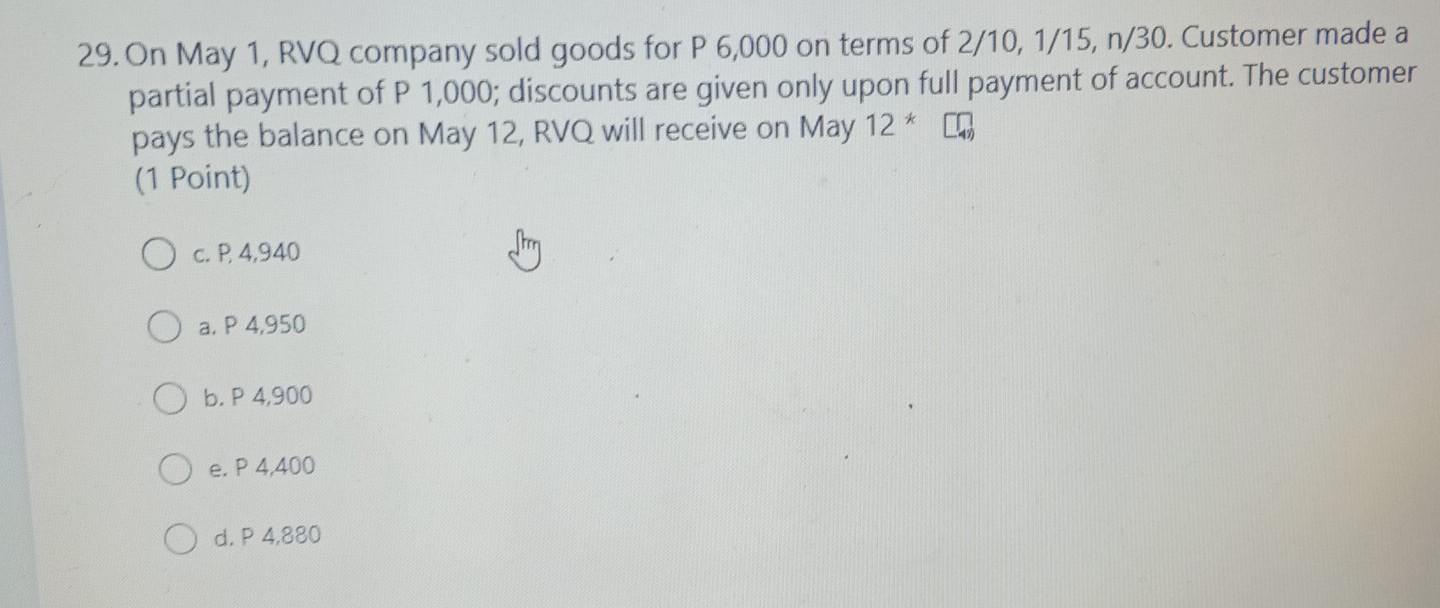

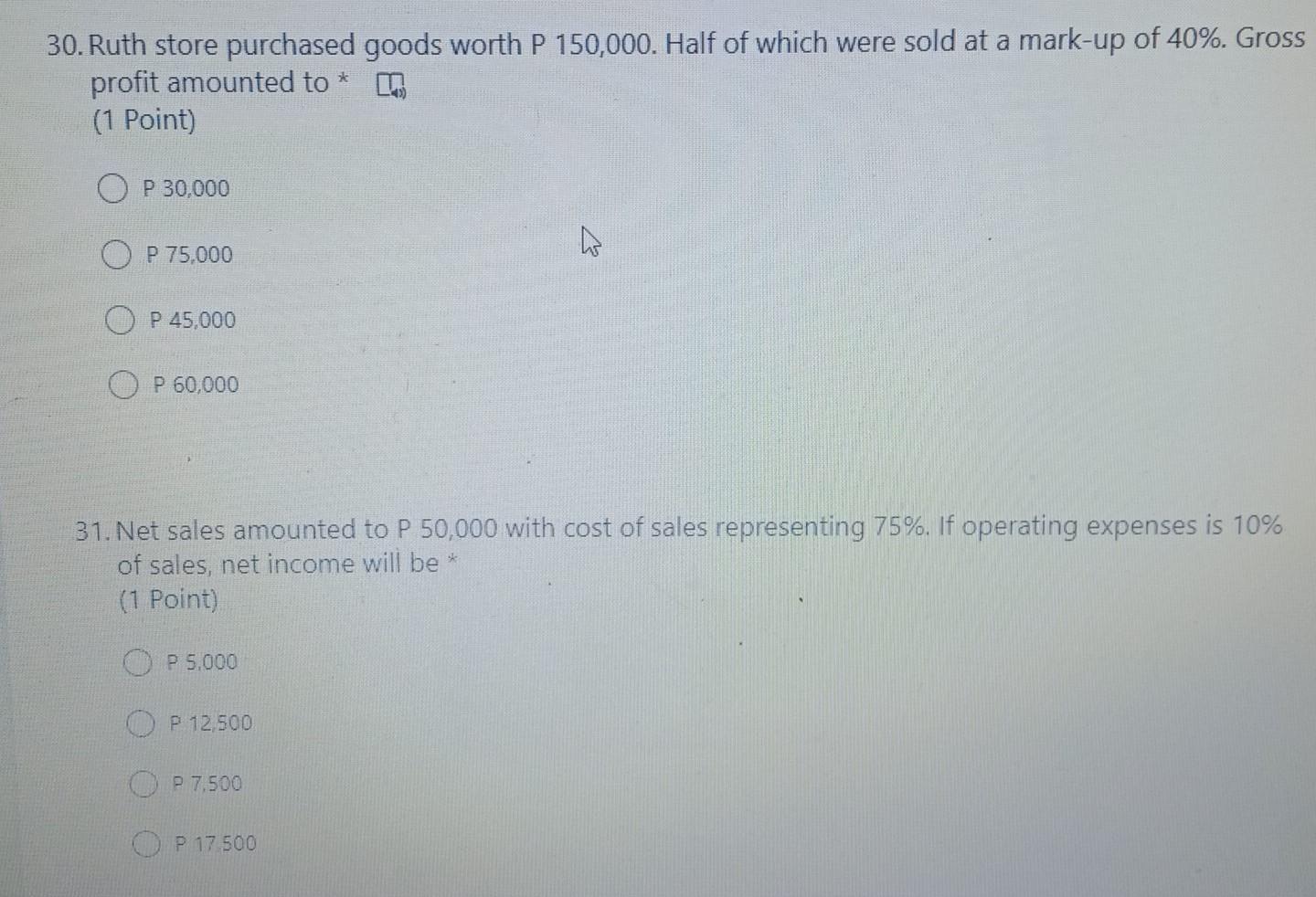

26. An equipment was purchased on Jan. 1, 2015 for P 600,000 less a 10% trade discount. The company paid freight of P 5,000 and insurance of P 10,000 to transport the equipment to its place. It was to be depreciated for p 50,000 a year. What was the cost price of the equipment at Jan. 1, 2015? * (1 Point) P 615,000 P 571.000 P 555,000 P 631.000 27. If the term is 2/10, n/30, purchase made on July 1 should be paid until * (1 Point) July 31 0 July 21 July 10 O July 11 hing 28. A furniture store debits purchases for a purchase of * (1 Point) Beds O A freezer A set of pencils O A computer O A cash registers 29. On May 1, RVQ company sold goods for P 6,000 on terms of 2/10, 1/15, n/30. Customer made a partial payment of P 1,000; discounts are given only upon full payment of account. The customer pays the balance on May 12, RVQ will receive on May 12* (1 Point) O C.P.4,940 - a. P 4.950 O b.P 4,900 O e. P 4.400 d. P 4,880 sk 30. Ruth store purchased goods worth P 150,000. Half of which were sold at a mark-up of 40%. Gross profit amounted to (1 Point) OP 30,000 O P 75.000 O P 45,000 P 60,000 31. Net sales amounted to P 50,000 with cost of sales representing 75%. If operating expenses is 10% of sales, net income will be (1 Point) P5.000 O P 12500 O P7.500 P 17 500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started