Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions in the pictures. ? An analyst with a leading investment bank tracks the stock of Mandalays Inc. According to her

please answer all the questions in the pictures.

?

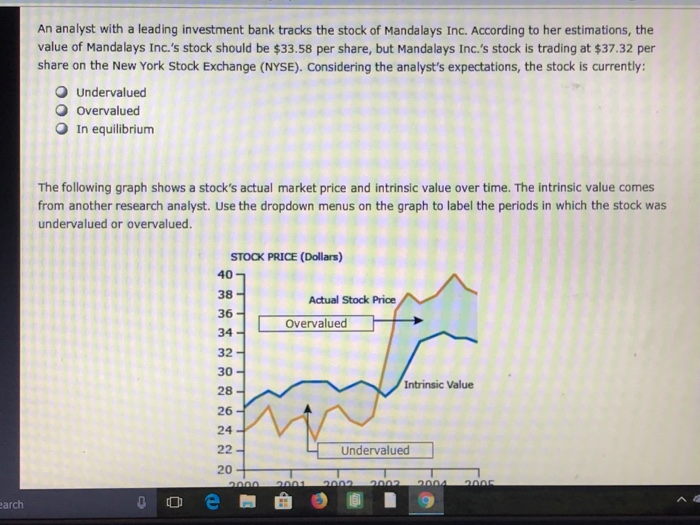

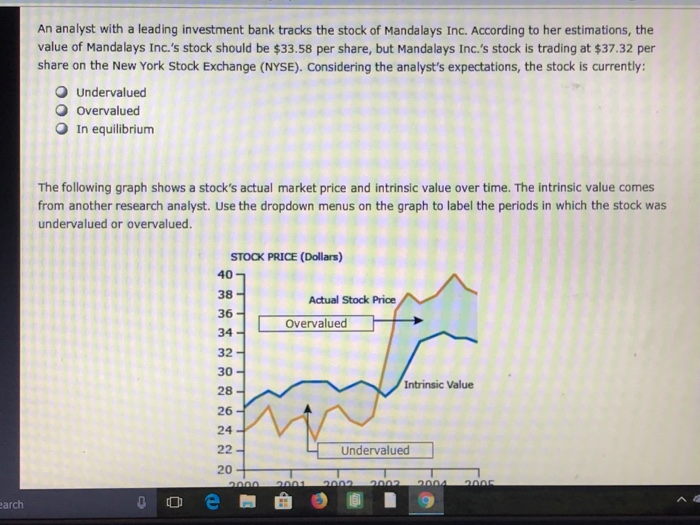

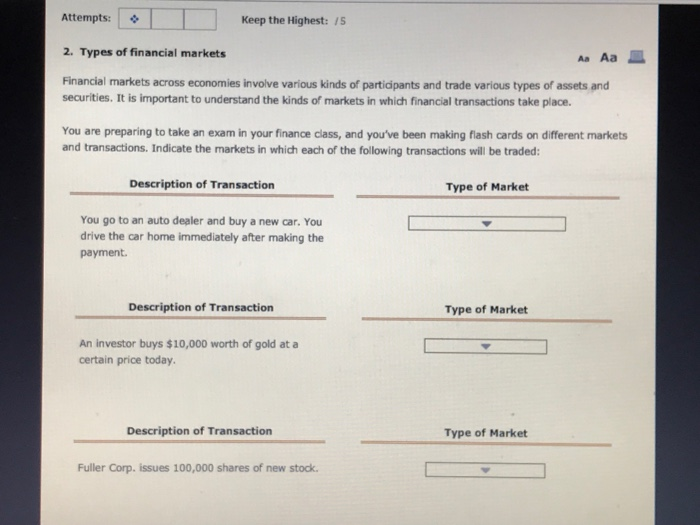

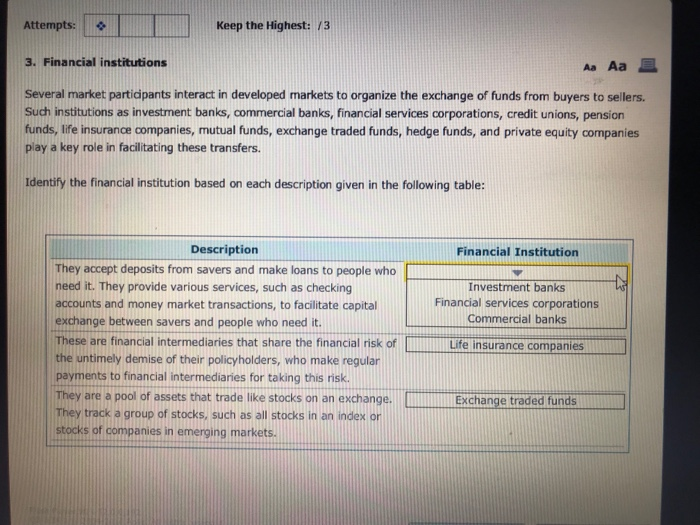

An analyst with a leading investment bank tracks the stock of Mandalays Inc. According to her estimations, the value of Mandalays Inc.'s stock should be $33.58 per share, but Mandalays Inc.'s stock is trading at $37.32 per share on the New York Stock Exchange (NYSE). Considering the analyst's expectations, the stock is currently: Undervalued overvalued O In equilibrium The following graph shows a stock's actual market price and intrinsic value over time. The intrinsic value comes from another research analyst. Use the dropdown menus on the graph to label the periods in which the stock was undervalued or overvalued. STOCK PRICE (Dollars) Actual Stock Price Overvalued 34- 32 30 Intrinsic Value 28- 26 24 Undervalued 20 arch Keep the Highest: 5 Attempts: 2. Types of financial markets Financial markets across economies involve various kinds of partidpants and trade various types of assets and securities. It is important to understand the kinds of markets in which financial transactions take place. You are preparing to take an exam in your finance class, and you've been making flash cards on different markets and transactions. Indicate the markets in which each of the following transactions will be traded: Description of Transaction Type of Market You go to an auto dealer and buy a new car. You drive the car home immediately after making the payment. Description of Transaction Type of Market An investor buys $10,000 worth of gold at a certain price today. Description of Transaction Type of Market Fuller Corp. issues 100,000 shares of new stock Keep the Highest: /3 Attempts: 3. Financial institutions Aa Aa Several market particdipants interact in developed markets to organize the exchange of funds from buyers to sellers. Such institutions as investment banks, commercial banks, financial services corporations, credit unions, pension funds, life insurance companies, mutual funds, exchange traded funds, hedge funds, and private equity companies play a key role in facilitating these transfers Identify the financial institution based on each description given in the following table: Description Financial Institution They accept deposits from savers and make loans to people who need it. They provide various services, such as checking Investment banks Financial services corporations Commercial banks accounts and money market transactions, to facilitate capital exchange between savers and people who need it. These are financial intermediaries that share the financial risk ofnuane companies the untimely demise of their policyholders, who make regular payments to financial intermediaries for taking this risk They are a pool of assets that trade like stocks on an exchange. They track a group of stocks, such as all stocks in an index or Exchange traded funds stocks of companies in emerging markets An analyst with a leading investment bank tracks the stock of Mandalays Inc. According to her estimations, the value of Mandalays Inc.'s stock should be $33.58 per share, but Mandalays Inc.'s stock is trading at $37.32 per share on the New York Stock Exchange (NYSE). Considering the analyst's expectations, the stock is currently: Undervalued overvalued O In equilibrium The following graph shows a stock's actual market price and intrinsic value over time. The intrinsic value comes from another research analyst. Use the dropdown menus on the graph to label the periods in which the stock was undervalued or overvalued. STOCK PRICE (Dollars) Actual Stock Price Overvalued 34- 32 30 Intrinsic Value 28- 26 24 Undervalued 20 arch Keep the Highest: 5 Attempts: 2. Types of financial markets Financial markets across economies involve various kinds of partidpants and trade various types of assets and securities. It is important to understand the kinds of markets in which financial transactions take place. You are preparing to take an exam in your finance class, and you've been making flash cards on different markets and transactions. Indicate the markets in which each of the following transactions will be traded: Description of Transaction Type of Market You go to an auto dealer and buy a new car. You drive the car home immediately after making the payment. Description of Transaction Type of Market An investor buys $10,000 worth of gold at a certain price today. Description of Transaction Type of Market Fuller Corp. issues 100,000 shares of new stock Keep the Highest: /3 Attempts: 3. Financial institutions Aa Aa Several market particdipants interact in developed markets to organize the exchange of funds from buyers to sellers. Such institutions as investment banks, commercial banks, financial services corporations, credit unions, pension funds, life insurance companies, mutual funds, exchange traded funds, hedge funds, and private equity companies play a key role in facilitating these transfers Identify the financial institution based on each description given in the following table: Description Financial Institution They accept deposits from savers and make loans to people who need it. They provide various services, such as checking Investment banks Financial services corporations Commercial banks accounts and money market transactions, to facilitate capital exchange between savers and people who need it. These are financial intermediaries that share the financial risk ofnuane companies the untimely demise of their policyholders, who make regular payments to financial intermediaries for taking this risk They are a pool of assets that trade like stocks on an exchange. They track a group of stocks, such as all stocks in an index or Exchange traded funds stocks of companies in emerging markets Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started