Question: Please answer all the questions QUESTIONS AND APPLICATIONS 1. Exchange Rate Systems Compare and contrast the fixed, freely floating, and managed float exchange rate systems.

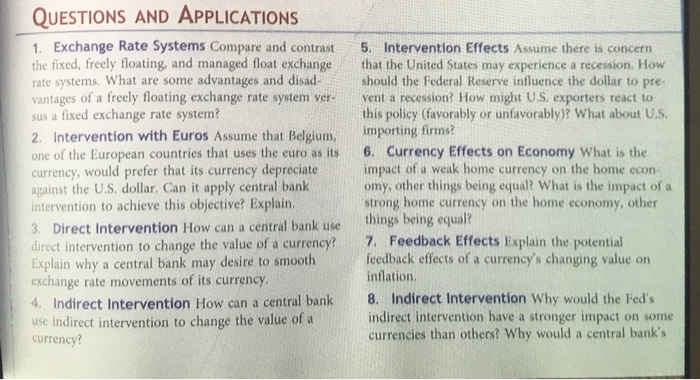

QUESTIONS AND APPLICATIONS 1. Exchange Rate Systems Compare and contrast the fixed, freely floating, and managed float exchange rate systems. What are some advantages and disadvantages of a freely floating exchange rate system versa; a fixed exchange rate system? 2. Intervention with Euros Assume that Belgium, one of the European countries that uses the euro as its currency, would prefer that its currency depreciate against the U.S. dollar. Can it apply central bank intervention to achieve this objective? Explain. 3. Direct Intervention How can a central bank use ilium intervention to change the value of a currency? Explain why a central bank may desire to smooth exchange rate movements or its currency. 4. Indirect Intervention How can a central bank use indirect intervention to change the value of a currency? 5. Intervention Effects Assume there is concern that the United State, may experience a recession. How should the Federal Reserve influence the dollar to prevent a recession? How ought U.S. exporters react to this policy (favorably or unfavorably? What about U.S. importing Firms? 6. Currency Effects on Economy What is the impact of a weak home currency on the home economy, other things being equal? What is the impact of a strong home currency on the home economy, other things being equal? 7. Feedback Effects Explain the potential feedback effects of a currency's changing value on inflation. 8. Indirect Intervention Why would the Fed's indirect intervention have a stronger impact on some currencies than others? Why would a central bank's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts