Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions!! Thank you Complete the following equation that assists in the calculation of the firm's net investment (NINV) for the new

please answer all the questions!! Thank you

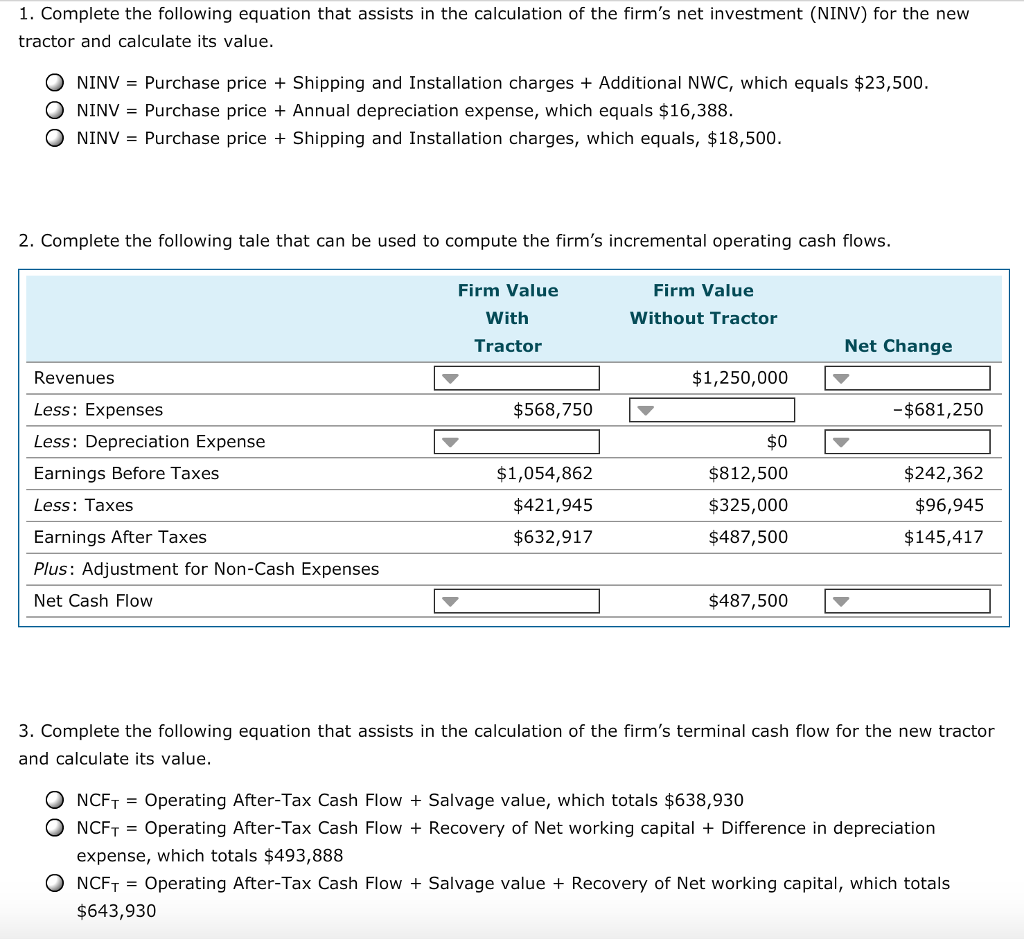

Complete the following equation that assists in the calculation of the firm's net investment (NINV) for the new tractor and calculate its value. NINV = Purchase price + Shipping and Installation charges + Additional NWC, which equals $23, 500. NINV = Purchase price + Annual depreciation expense, which equals $16, 388. NINV = Purchase price + Shipping and Installation charges, which equals, $18, 500. Complete the following tale that can be used to compute the firm's incremental operating cash flows. Complete the following equation that assists in the calculation of the firm's terminal cash flow for the new tractor and calculate its value. NCF_T = Operating After - Tax Cash Flow + Salvage value, which totals $638, 930 NCF_T = Operating After - Tax Cash Flow + Recovery of Net working capital + Difference in depreciation expense, which totals $493, 888 NCF_T = Operating After - Tax Cash Flow + Salvage value + Recovery of Net working capital, which totals $643, 930Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started